Malta’s retail banks in focus

The local banking sector captured a lot of media attention in recent weeks. Most of this focus revolved around the out-of-court settlement by Bank of Valletta plc (BOV) related to the very sizeable litigation in Italy which drew some sharp criticism from various quarters.

Today’s article will not delve into this matter following the wide coverage already provided across the media and ahead of the shareholders’ meeting on the subject matter due to take place on 15 June. Instead, with the annual reporting season for 2021 now concluded, and following the regulatory approval for the new share issue by APS Bank plc (APS), a comparison of some key figures and financial indicators together with a review of recent trends across the local banking sector may be useful for the investing public.

The Central Bank of Malta classifies APS, BOV, BNF Bank plc (BNF), HSBC Bank Malta plc (HSBC), Lombard Bank Malta plc (Lombard), and MeDirect Bank (Malta) plc (MeDirect) as Malta’s ‘core domestic banks’. However, in view of its distinctive business model which is not based on an extended retail network, coupled with the considerable exposure to business out of Malta, MeDirect is not directly comparable to the other five institutions which essentially have very similar operations and characteristics.

The performance of Malta’s banks during the past two financial years was largely impacted by the COVID-19 pandemic as the sharp economic downturn led to a contraction in income and an increase in expected credit losses (ECL’s) similar to what was reported by banking institutions across the world. Although the pandemic was still very much affecting the economic performance in 2021, all five banks reported an improved financial performance last year albeit still below the pre-pandemic figures in 2019.

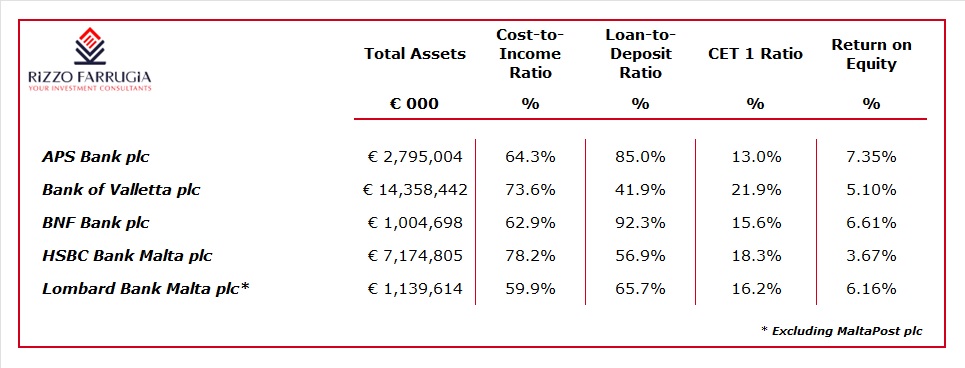

In absolute terms, BOV remains Malta’s largest bank with total assets exceeding €14 billion compared to €7.2 billion of HSBC, €2.8 billion of APS, and around €1 billion of Lombard (when excluding the Group’s investment in MaltaPost plc) and BNF. When analysing the asset composition of the balance sheet, the differences between the banks is very evident indeed.

While in BOV’s case only 35.5% of the total assets are represented by customer loans amounting to €5.1 billion, on the other hand customer loans represent 79% of the total assets of BNF and 73.9% for APS. This is an important determinant when analysing the banking sector especially in the light of the negative interest rate environment across the eurozone over recent years as idle funds hurt the performance of those banks that have excess levels of liquidity.

With circa one-third of assets making up customer loans, BOV has sizeable amounts in financial assets and investments amounting to €3.7 billion (25.8% of total assets) and short-term liquid funds amounting to over €5 billion (37.3% of total assets). On the other hand, short-term liquid funds only represent 9.2% of total assets for APS and 12% for BNF.

Another important metric when analysing banks is the level of loans compared to the deposit base. BOV has a particularly low loan-to-deposit ratio of 41.9% which implies that less than half of the customer deposits are loaned out to personal or business customers. Meanwhile, the highest loan-to-deposit ratio is that of BNF at 92.3% (customer loans of €0.79 billion compared to customer deposits of €0.86 billion) followed by APS Bank at just under 85% (customer loans of over €2 billion compared to customer deposits of €2.4 billion). The high ratios of BNF and APS portray the efficiency of deploying most deposits available into more productive use (customer loans as opposed to financial assets/liquid funds). Moreover, the high loan-to-deposit ratio also shows the abilities of these two banks to ensure that they attract the right amount of deposits rather than having far too many deposits which then negatively impacts shareholder returns also due to the costs associated with holding onto deposits such as the fees related to the Depositor Compensation Scheme.

Within this context, it is interesting to track the growth in the loan book by the five banks over recent years. APS recorded a compound annual growth rate (“CAGR”) of 20.7% in its loan book over the past 5 years, followed by BNF at 18.4% and Lombard at 13.3%. In contrast, BOV’s loan book over the same period grew by a CAGR of circa 5% whilst that of HSBC contracted by 0.8% per annum.

The cost-to-income ratio is another important key performance indicator regularly used across the banking sector. The two largest banks have suffered over recent years as their cost base either grew exponentially (in the case of BOV) or income contracted sharply also due to aggressive de-risking policies (in the case of HSBC). In fact, HSBC’s cost efficiency ratio spiked to 78.2% in 2021 compared to a level below 60% in 2016. Similarly, BOV’s ratio at 73.6% also shows a deterioration from the level of below 45% in 2016. While the cost-to-income ratio of both APS and Lombard also increased over the years, these remained within more acceptable levels of 64.3% for APS and 59.9% for Lombard. On a more positive note, it is interesting to highlight the progress by BNF which saw its cost-to-income ratio improve significantly during the past four years from almost 89% in 2017 to 62.9%.

Despite the recovery in profitability levels in 2021, all banks reported an average return on equity (“ROE”) below 10% as regulatory requirements remained particularly stringent with respect to capital ratios and risk-weighting. APS generated a ROE of 7.4% in 2021 followed by BNF at 6.6% while the ROE of HSBC was a paltry 3.7%. When analysing this key metric over a 5-year period, APS remains the top performer with an average ROE of 8.7% followed by Lombard at 6.7%. Meanwhile, BOV and HSBC recorded an average return on equity of 5.8% and 4.4% respectively.

Malta’s two largest banks were among the darling stocks for local investors as these produced spectacular returns for a period of more than 20 years since the Malta Stock Exchange commenced its trading operations in 1992. However, the negative interest rate environment since June 2014 coupled with the issues faced by these two banks (namely large litigation cases in the case of BOV as well as sizeable de-risking strategies adopted by both banks) led to very weak returns in more recent years coupled with very low dividend distribution.

Against this background and given the tough regulatory environment for the banking sector, it is very reassuring that APS already attracted €41.4 million from the investing public during the placement period shortly before the IPO. In the event of an overall successful issuance by APS of €66 million worth of new shares, this would be the largest share offering since the Maltacom (now GO plc) privatisation in 1998. This could be an important turning point for the domestic capital market following the recent difficult years endured by Maltese investors. A successful share offering by APS together with Malta’s removal from the FATF ‘grey list’ as well as the recovery in performance by many companies following the lifting of restrictions related to the pandemic, could lead to more positive returns which in turn would generate more active interest by retail and institutional investors.

Rizzo, Farrugia & Co. (Stockbrokers) Ltd is acting as Joint Sponsor and Manager to APS Bank plc.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.