Maltese shares generated average annual return of 8.7%

In my article published two weeks ago, I made reference to a review published in the international media providing statistics on average returns for the Dow Jones Industrial Average and the S&P 500 for the past 100 years showing that they have generated returns to investors of about 10% annually. This is an annualised return over a very long period of time and naturally there were years when these indices surpassed a 10% gain (such as in 2019 when the Dow Jones rallied by over 22%) and others when the indices underperformed in a significant manner (such as in 2008 when the Dow Jones suffered a decline of 33.8%).

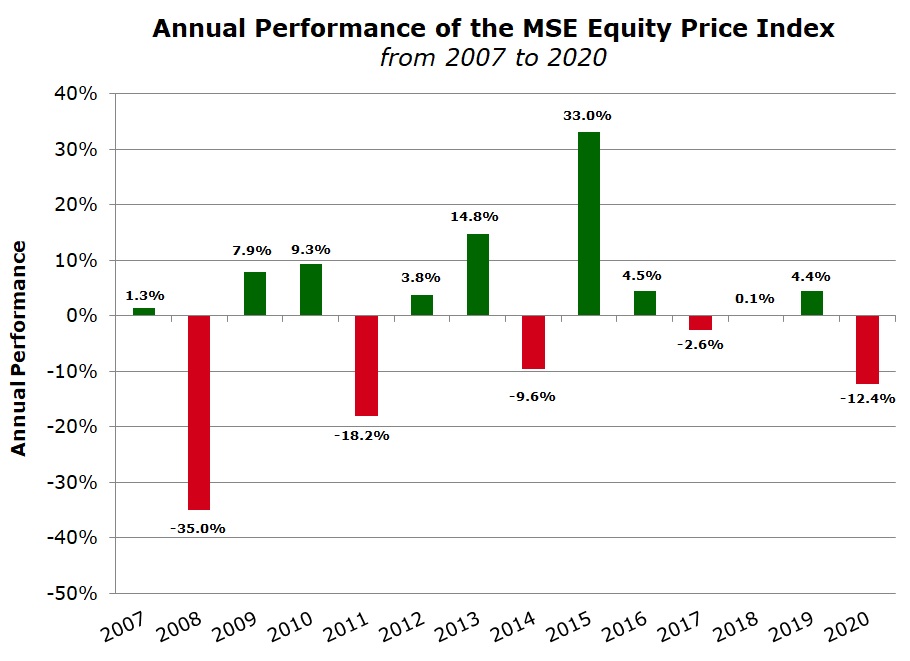

Since trading on the Malta Stock Exchange (MSE) commenced in January 1992 there isn’t as much data as that available across the US financial market to gauge returns over an extended period of time. Despite this, it is still interesting to review the performance of Maltese equities over the years. The Malta Stock Exchange produces two indices – the MSE Equity Price Index and the MSE Equity Total Return Index – and these were compiled from 1996.

The MSE Equity Price Index is a price return index such as the S&P500 which captures the changes in the prices of the index components. The MSE Equity Price Index ranks companies in terms of their market capitalisation and, as such, changes in the prices of the larger capitalised companies (currently made up of Bank of Valletta plc, Malta International Airport plc, International Hotel Investments plc, RS2 Software plc, GO plc and HSBC Bank Malta plc) have a much larger influence on the performance of the index than similar changes in the smaller companies.

The MSE Equity Total Return Index is also weighted according to the market capitalisation but it takes into consideration both the price fluctuations of the components of the index (namely all the shares on the Official List of the MSE) as well as dividends that these companies distribute to shareholders. The MSE Equity Total Return Index is based on the assumption that all dividends are reinvested into the respective company paying the dividend on the day it turns ex-dividend.

Since 1996, the MSE Equity Price Index generated a compound annual growth rate (CAGR) of 5.7% while the MSE Equity Total Return Index produced a CAGR of 8.7%.

In the earlier years the share prices of the two large retail banks, Bank of Valletta plc and HSBC Bank Malta plc, produced spectacular returns for investors. Between 1996 and March 2006, BOV’s share price jumped by 900% translating into a compound average annual gain of 23% apart from the dividends distributed to shareholders on a semi-annual basis every year without fail. Likewise, HSBC Malta’s share price had an incredible run between 1996 and April 2006 showing a remarkable upturn of 1646% equivalent to a CAGR of 29.3%.

However, sharp drops were recorded in the share prices of both banks since the record levels several years ago with the market capitalisation of HSBC shrinking to a current level of €342.3 million compared to a peak of €2.03 billion in April 2006. In more recent years, BOV and HSBC largely underperformed the index on account of various factors including the historically low interest rate environment and the hostile regulatory landscape leading to a marked shrinkage in the return on equity generated by both banks which is very much in line with that seen across all banks within the eurozone.

While the banks were the darlings of Maltese investors in the 1990’s and early 2000’s, other shares performed particularly well in more recent years providing returns far superior to the average annual gains of the entire market.

Malta International Airport plc shares debuted on the MSE in 2002 and since then the market capitalisation of the company surged by 611.6%. MIA distributed semi-annual dividends uninterruptedly since the company’s privatisation but these were then halted last year as COVID-19 wreaked havoc across the industry. Although the share price dropped over the past 12 months mainly due to the devastating impact of the pandemic, shareholders who purchased shares when these initially became available in 2002 saw their capital grow by a CAGR of 10.8%.

The extraordinary growth in passenger movements between 2006 and 2019 came to an abrupt halt in March 2020 as the pandemic significantly curtailed aircraft movements. As the COVID-19 vaccine rollout gathers momentum in the months ahead, it is envisaged that passenger movements will gradually start to recover before hopefully achieving over 7 million passenger movements once again in the years ahead.

RS2 Software plc was admitted to the MSE in mid-2008 and ranks as the best performing equity in Malta as the share price has climbed by over 1,100% since the initial share offering translating into a CAGR of over 21%. The company is possibly at a decisive juncture of its expansion and internationalisation strategy and as part of the issuance of up to €50 million worth of preference shares, it will be imminently announcing full details of its future business pipeline and financial projections. The company issued a detailed business update last month in which it explained that the proceeds of the new share issue are earmarked for further investment in North America and in the new acquiring business line, enhancements to the BankWORKS® platform, expanding the sales force across the various lines of businesses as well as selected M&A activities. The financial projections being published in the prospectus will prove to be very important to gauge the success of the company’s expansion strategy in the years ahead.

PG plc shares began trading on the MSE on 4 May 2017 following a share offering of 27 million shares at a price of €1.00 per share. In just under 4 years since listing, the share price has more than doubled resulting in CAGR of 18.9%. Apart from the strong capital growth in the share price, a total of €0.144 in dividends per share were also paid to shareholders over the past 4 years. This ranks PG as one of the more successful companies on the MSE in recent years. The company has proved to have moulded a highly profitable and cash generative business model in the supermarket and associated retail sector. Hopefully, this formula will be replicated in another location in the near future to enable the company to continue growing and providing strong returns to shareholders.

The very positive returns generated by RS2, PG and MIA in more recent years compared to the strong growth by the two large banks in earlier years shows the importance for investors to monitor the outlook and competitive landscape of the various companies within an investment portfolio.

Most international market commentators contend that as the COVID-19 vaccine rollout accelerates across the world, a strong economic upturn will materialise over the next few years as a result of the pent-up demand across various economic sectors. Many share prices across international markets are reflecting such an optimistic scenario with cyclical sectors also performing very positively in recent weeks. Hopefully, this positive sentiment will also spill over onto the Maltese capital market which performed weakly as from Q4 2019 due to the serious political developments in November 2019 followed by the COVID-19 pandemic in March 2020. The high levels of liquidity across the financial system, the low interest rate environment and the expected improvement in investor sentiment should also encourage other companies to obtain an equity listing on the MSE thereby providing further depth to the local capital market.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.