MIA announces record profits and significant uplift in passenger forecast

Last Thursday, Malta International Airport plc issued two separate company announcements. Early morning, the company published its 2017 interim financial statements and declared an interim dividend to shareholders following a Board of Directors meeting held the previous day. Meanwhile, late afternoon, the airport operator issued a further announcement wherein it upgraded its passenger and financial forecasts for 2017.

MIA is the only company currently publishing financial results on a quarterly basis. Moreover, the company also issues its traffic results on a monthly basis. Following the publication of the Q1 financial statements on 16 May 2017 coupled with the significant increase in passenger movements on a monthly basis, it should therefore not be a surprise that MIA reported revenue growth of +16.7% during the first six months of 2017 to a record €36.7 million.

Turnover from the ‘Airport’ segment increased by 19.1% to €25.9 million (H1 2016: €21.8 million) reflecting the 20.3% increase in passenger movements during the first six months of 2017 to nearly 2.64 million. Meanwhile, revenues from the ‘Retail and Property’ segment increased by 10.7% to €10.5 million (H1 2016: €9.5 million). As a result, the ‘Airport’ segment contributed 71.4% of total revenues (H1 2016: 69.6%) while the ‘Retail and Property’ segment accounted for 28.6% (H1 2016: 30.4%).

Despite the notable growth in business, operating costs increased by only 4.3% to €19.1 million, reflecting a marginal rise in staff costs (+1.7% to €3.84 million) and more meaningful increases in other operating costs (+6.9% to €11.9 million). As a result, earnings before interest, tax, depreciation and amortisation (“EBITDA”) surged by 26.7% to €20.9 million (H1 2016: €16.5 million) and the EBITDA margin improved to 57% from 52.5% in the first half of 2016. Depreciation charges dropped by 1.2% to €3.37 million resulting in an operating profit of €17.6 million (+33.8%).

After accounting for net finance costs of €0.51 million (H1 2016: €0.47 million), MIA reported a pre-tax profit of €17.1 million, representing a 34.6% increase over the previous comparable figure of €12.7 million. The tax charge for the period amounted to €6.11 million, leading to a net profit of €11 million which is 34.8% higher than the net profit registered during the previous comparable six months (€8.16 million).

The statement of financial position as at 30 June 2017 shows a 6.2% growth in total assets to €183.1 million while total shareholders’ funds edged 1.8% higher to €86.6 million. The most interesting aspects within the balance sheet are the cash balance of €36.6 million and the overall debt of €44.5 million. As such, the company’s net debt position stands at only €7.9 million.

Despite the significant growth in profits, the interim dividend was unchanged for the tenth consecutive year. It has been the company’s policy so far to declare a consistent interim dividend and then adjust the final dividend accordingly depending on various factors. As such, a net interim dividend of €0.03 per share was declared to all shareholders as at close of trading on Monday 21 August which will then be paid by not later than 22 September 2017.

MIA held a press conference on Thursday afternoon detailing the mid-year traffic results and providing an upgrade to the passenger and financial forecasts. The 20.3% growth in passenger numbers to a record of just under 2.64 million was as a result of a 19.3% increase in seat capacity as well as a 0.4 percentage point improvement in the seat load factor to 80.4%. MIA’s CEO Mr Alan Borg hailed the positive movement in the seat load factor which normally decreases once seat capacity increases by such a wide margin. However, Mr Borg explained that the positive development in the seat load factor is also evident across European airports.

The CEO also claimed that the double-digit passenger growth in each of the first six months of 2017 is a remarkable achievement.

Traffic from the UK increased by 10.3%, partly reflecting the start of the new cruise and fly programme operated by P&O. The UK market remains the largest source market with a share of 26% followed by Italy at 21%. The Italian market registered a 19.4% rise in traffic during the first half of 2017. Traffic from Germany improved by 21.7% whilst the French market also achieved a 19.4% increase in traffic. The Belgian market reported a significant increase of 204.6%, while growth rates of 63.7% and 26.5% were recorded from the Spanish and Polish markets respectively as new routes were introduced.

Following the 20.3% growth in passenger movements during the first half of 2017 and details of the upcoming airline winter schedule (November 2017 – March 2018), MIA now expects passenger movements to reach circa 5.8 million representing a growth rate of between 14% to 16% over last year’s record.

Mr Borg explained that during winter 2017/18, Ryanair and EasyJet will be introducing four new routes apart from increased frequencies of various existing routes. Meanwhile, Air Malta, Wizz Air and Aegean Airlines will extend a number of routes they operated during the summer months also into the winter season. Furthermore, SAS, Lufthansa, Vueling and Jet2 will also be increasing flight frequencies on some of their routes.

On 11 January 2017, MIA had forecasted a growth of between 2% to 3% in passenger numbers to 5.2 million for 2017 so last week’s announcement represents a significant upgrade for the company.

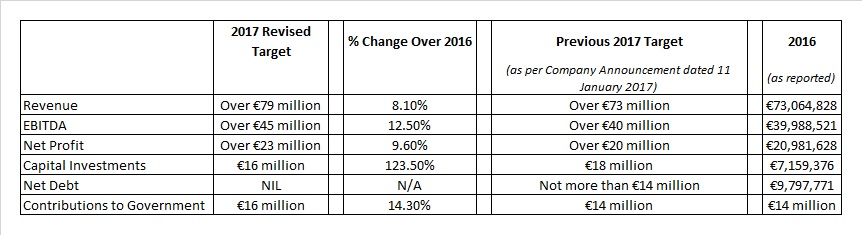

Moreover, last January the company had also presented a set of financial targets for 2017 showing expected revenues of €73 million, EBITDA of over €40 million and a net profit of over €20 million. Following the sizeable improvement to the forecasted passenger numbers, MIA also upgraded its financial targets. The company is now expecting its overall revenue to exceed €79 million which would represent an increase of at least 8.1% over the 2016 figures. EBITDA is expected to rise to over €45 million (+12.5%) with net profits amounting to over €23 million (+9.6%).

An interesting revelation last week is that the company expects that its net debt position will be nil by the end of 2017 compared to a previous expectation of not more than €14 million and a current level of €7.9 million. Is MIA correct in maintaining such a high cash balance ahead of its additional capital expenditure plans when it has such a low level of bank loans and generates EBITDA of well over €40 million per annum? This is one of the areas that financial analysts and shareholders should focus upon. Company directors should truly ensure that a company’s financial position is optimised to enhance shareholder returns further.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.