MIA’s 2019 EBITDA forecasted at just under €60 million

Regular followers of the Maltese capital market should have by now become accustomed to the financial calendar of Malta International Airport plc. Apart from the monthly traffic results and the obligatory issuance of semi-annual financial statements, the airport operator also publishes its traffic and financial forecasts in January and July as well as its financial highlights for the first quarter and the third quarter of their financial year.

Last week MIA held its customary press conference during which the company’s CEO Mr Alan Borg presented the company’s 2018 traffic results as well as their 2019 traffic and financial targets.

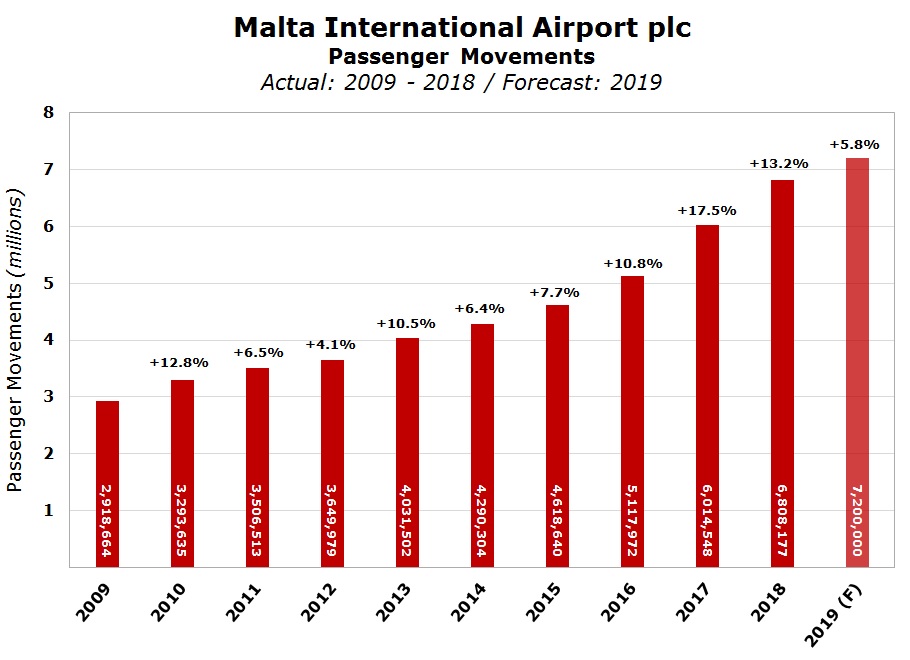

MIA reported that it registered a 13.2% growth in passenger movements to 6.8 million which is exactly in line with the company’s guidance in July 2018. This is the ninth consecutive annual record for the company.

The CEO presented the growth trajectory over the past 10 years and highlighted the faster pace of growth in the past 5 years when compared to the period between 2008 and 2013. In fact, over the past 5 years between 2014 and 2018, passenger movements climbed by an extraordinary 69% representing a compound annual growth rate (CAGR) of 11%.

A very important metric in the aviation sector is the seat load factor which measures the average seat occupancy of the airlines. Despite the 14% increase in seat capacity of the airlines travelling to and from Malta to 8.3 million seats in 2018 (an additional 1 million seats over the previous year), the seat load factor still surpassed the 80% level. The 2018 seat load factor of 81.8% represents a slight decline from the previous year of 82.4% and from the record level of 83.3% in 2016.

Another remarkable achievement was the continued strong growth in the ‘shoulder months’. While MIA registered a 12.2% growth in passengers in the peak summer months between June and September 2018, a higher rate of growth was recorded in the winter and shoulder months of 14%. This clearly demonstrates the success of the company, the government and the various tourism stakeholders in reducing seasonality by achieving a higher level of passenger traffic throughout the year.

The statistics published by the airport operator last week indicate that positive developments were registered in all core markets with the exception of Germany. In fact, while double-digit growth was achieved by the British market (+13.4%) and the Italian market (+14.1%), the German market only registered a growth of 2% due to the lower capacity of TUI Cruises which halved its schedule from the previous year. The French and Spanish markets also recorded remarkable growth rate of 14.5% and 37.8% respectively. The overall share of the British market amounted to 24.6% in 2018 followed by Italy at 20.6% and Germany at 12.1%.

Ryanair and AirMalta remain MIA’s most important airlines with a combined market share of 66%. During 2018, Ryanair accounted for 2.44 million passenger movements (+11.3%) with AirMalta at 2.03 million passenger movements (+22.5%).

MIA is expecting passenger movements to continue to rise during 2019. In fact, last week the airport operator announced that it expects to achieve a growth rate of 5.8% in 2019 to 7.2 million passenger movements. The company’s CEO explained that this forecast is based on the current airline schedule for both the ongoing winter season and also the upcoming summer season without giving details on the overall number of seats for 2019 and the estimated seat load factor.

The winter season currently underway features some new routes by AirMalta and also eight new routes of Ryanair which were carried forward from last year’s summer schedule to the winter schedule. The upcoming summer schedule shows more drastic changes with new routes by AirMalta as well as further expansion by Ryanair through an additional aircraft based in Malta (the sixth aircraft) in support of eleven new routes that will be operated. Moreover, Qatar Airways will commence a daily flight from June 2019 and Mr Alan Borg announced last week that TUI cruises will be extending their cruise and fly schedule which would represent more capacity compared to summer 2017 thereby promising good results from the German market.

Between September and November 2018 when Ryanair had announced their additional capacity to Malta for summer 2019, the low-cost carrier also said that they expected to register between 3 million and 3.1 million passenger movements to Malta.

Based on the current forecast of 7.2 million passenger movements for 2019, MIA also provided its financial targets. The company expects to achieve overall revenue of €96 million (representing an increase of 6.7% over the forecasted revenue for 2018 of €90 million), EBITDA of €59 million (representing an increase of 11.3% from the forecasted EBITDA for 2018 of €53 million), and net profit of €31 million (representing an increase of 6.9% from the forecasted net profit for 2018 of €29 million).

MIA had also announced that its 2018 financial statements will be published on 20 February 2019. Since the company only marginally exceeded the passenger target of 6.77 million that had been estimated in July 2018, its financial performance should not differ much from the indications also provided last July. As such, the main focus by the investing community will be on the final dividend that will be proposed by the directors for approval at the next Annual General Meeting. Despite the strong rate of growth in profits in recent years following the significant hike in passenger traffic, the company left its overall dividend distribution unchanged in view of the sizeable ongoing investment programme which will intensify in the years ahead. In fact, last week MIA’s CEO confirmed that works on the €40 million SkyParks 2 project (incorporating 22,000 sqm of office and commercial space together with a business hotel) will commence in 2021. Meanwhile, the company is carrying out a €20 million investment in a new multi-story car-park which is due for completion in 2020. Furthermore, Mr Borg confirmed that although the current terminal reconfiguration project will be finalised in the coming weeks, the company has already started planning for a terminal extension to incorporate additional check-in desks and gates. Further details on this sizeable new investment by MIA are expected to be disclosed during the course of the current financial year.

Although some shareholders might be disappointed at the lack of growth in dividends distributed by MIA in recent years, the overall return from MIA’s equity should not only be viewed from its dividend payout but should also be viewed in the context of the capital growth experienced by the share price reflecting the higher earnings generated by the company. In fact, MIA’s equity was once again among the positive performers in 2018 with an increase of 23.4% which is indeed a very positive return for shareholders.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.