MIA’s slow path to recovery

Last week, Malta International Airport plc issued a company announcement and held a press conference in which it disclosed its traffic results for 2021.

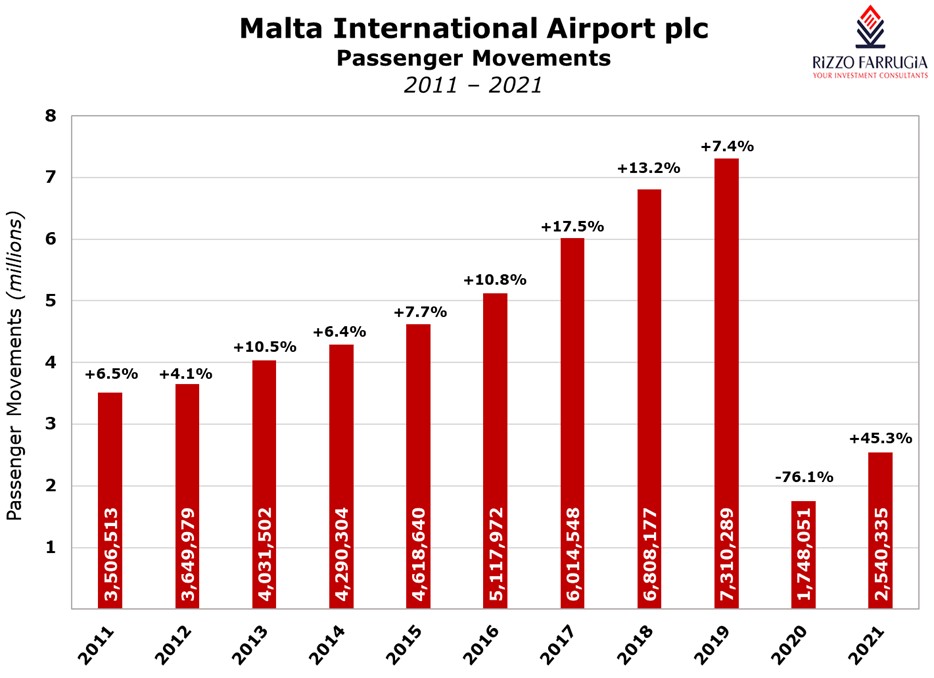

The airport operator reported passenger volumes of 2.54 million during 2021, representing a 45.3% rise from the 2020 levels but a decline of 65.2% from 2019 prior to the outbreak of the COVID-19 pandemic when over 7.3 million passenger movements were registered.

An analysis of the month-on-month passenger trajectory during 2021 reveals a very slow start to the year with virtually no traffic until June. However, passenger volumes began to recover strongly from June as travel requirements eased following the widespread vaccine roll-out. Passenger traffic exceeded 400,000 movements in August, September and also October. Unfortunately, the emergence of a new virus strain in November 2021 led to a renewed downturn in activity in the last few weeks of the year. However, it is still worth highlighting that MIA welcomed 2.14 million passengers between July 2021 and December 2021 which is three times higher than the passenger traffic of 0.73 million travellers recorded in H2 2020. This shows the considerable pent-up demand for leisure travel as restrictions are lifted and confidence is restored.

Prior to the outbreak of COVID-19 in early 2020, MIA used to publish traffic projections and financial forecasts at the start of each year. In view of the high level of uncertainty due to the ongoing pandemic, last week the airport operator failed to issue such guidance for the current financial year.

However, it is interesting to note that MIA’s parent company – Flughafen Wien AG (Vienna Airport) – also published its 2021 traffic results last week and also issued traffic and financial forecasts for this year. The Austrian company stated that they anticipate “a significant upturn in passenger traffic beginning when the summer flight schedule takes effect at the end of March 2022”. In this respect, they are forecasting a total of 21 million passengers for the Flughafen Wien Group which includes 17 million at Vienna Airport and the balance of 4 million passenger movements among its two other strategic investments namely Malta Airport and Kosice Airport. On this basis, one can assume that Flughafen Wien AG are expecting MIA to register overall traffic volumes of circa 3.5 million passenger movements in 2022. This would represent a further recovery of 38% from the 2.54 million in 2021. Should MIA manage to reach such a milestone however, it would only correspond to 48% of the passenger volume handled in 2019 prior to the onset of the pandemic. This shows the expectation of a gradual path to recovering the pre-COVID volumes given the continued fragility across the aviation sector.

At this point, it is also worth recalling that prior to the outbreak of COVID-19 in Q1 2020, passenger numbers passing through MIA increased at a compound annual growth rate (CAGR) of 9.62% in the prior 10 years reaching a record of 7.31 million travellers in 2019 from just 2.92 million in 2009. The year 2020 was also off to a very strong start with record figures in both January and February 2020 as passengers grew by 14.2% and 17.3% respectively over the comparative months in 2019. In both months, over 400,000 passenger movements were recorded. However, as all inbound commercial flights to and from Malta were temporarily banned from 21 March 2020 until 1 July 2020, traffic volumes were negligible and only saw a tepid recovery in summer 2020 before dropping sharply once again in Q4 2020.

In view of the high level of uncertainty on the one hand but the evident pent-up demand on the other hand as seen in the second half of 2021, expectations on the recovery path for the years ahead are mixed. While Flughafen Wien AG may be adopting a cautious approach in view of the immediate impact of the Omicron variant on passenger volumes, a foreign financial analyst reviewing Vienna International Airport issued a report at the end of 2021 which also included financial forecasts for MIA until 2024. This analyst anticipates MIA’s revenue will amount to €80 million in 2022 rising further to €96 million in 2023 and €106 million in 2024. To put this into perspective, MIA had registered a record revenue of €100.2 million in 2019 when passenger volumes amounted to 7.3 million. During 2021, this analyst anticipates that revenue at MIA would have amounted to €47 million compared to €32.2 million in 2020.

Just before the onset of the pandemic in early 2020, MIA had unveiled a €100 million investment in a major terminal expansion project which was then suspended “with immediate effect” in April 2020 in view of the severe blow to the industry from COVID-19. The CEO had clarified in 2020 that this major project was put on hold “temporarily” until MIA gains better visibility of the developments and the business dynamics going forward. Although during last week’s press conference no reference was made to the major terminal expansion, the company confirmed that a call for tenders for construction works for the SkyParks 2 project will be issued during the first half of 2022.

The extent of the recovery in passenger traffic is very much dependent on any further COVID-19 variants that may emerge and any resultant restrictions that may be imposed by various governments. Contrary to the general belief at the start of the pandemic, the demand for travel remains strong which bodes well for the continued recovery in air travel as was evident in the second half of 2021. Although a significant level of uncertainty is still prevalent, the recent indications from a number of governments following the Omicron variant is that restrictions will be eased further, and in some instances eliminated completely for vaccinated people since it is inevitable that we need to ‘learn to live with the virus’.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.