Monitoring bond issuer developments (3)

In the third article reviewing the financial metrics across the corporate bond market, the two companies operating in the food and beverage sector rank among the strongest bond issuers on the Malta Stock Exchange.

In August 2017, Simonds Farsons Cisk plc launched a €20 million bond (the fourth bond issue in its long-standing history) mainly earmarked for the refinancing of the outstanding €15 million bonds which were redeemed at the first optional repayment date of 13 September 2017. The financial year of Farsons comes to an end on 31 January and the group registered another record performance during the last financial year. While revenues increased by 2.4% to €88.1 million, EBITDA surged by 10.8% to €19.3 million giving a very strong interest cover of 13.1 times. Moreover, despite the relatively high capital expenditure requirements associated with the industry, the gearing ratio stood at only 22.6% as at 31 January 2017. The Farsons Group also boasts of a very low net debt to EBITDA multiple of just 1.8 times as at 31 January 2017. This implies that the group can repay its overall level of debt in under 2 years assuming that the underlying operational profitability is sustained. This is a very strong ratio even when compared to large multinational companies.

The Financial Analysis Summary annexed to the Prospectus dated 31 July 2017 provides the financial forecasts for the current financial year ending 31 January 2018. The Prospectus also included a pro-forma set of financial statements for the financial year ended 31 January 2017 since Farsons was expecting to complete the spin-off of its property division by the end of 2017 into a separate company listed on the Malta Stock Exchange. Unfortunately, following the unexpected and surprising decision by the Board of the Planning Authority, this will not take place for the time being as Farsons confirmed that the spin-off process has been put into abeyance.

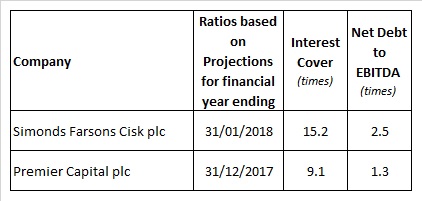

Farsons was estimating a 3.4% growth in revenues to yet another record of €91.1 million for the 2017/18 financial year while EBITDA is anticipated to reach €19.2 million, representing an increase of 3.3% compared to the pro-forma EBITDA of €18.6 million during FY2016/17. Based on these figures, the interest cover is expected to improve even further to reach 15.2 times in FY2017/18. Although the gearing ratio is expected to increase to 34.4% by the end of the current financial year ending 31 January 2018 (reflecting additional debt taken on for the injection of €6.52 million into Trident for the purpose of part-financing the development costs related to the Brewery Façade as well as for part-financing the €15.5 million capital investment projects which are either close to completion or are committed to be undertaken in the near term), this is still considered to be on the low side and highly sustainable given the group’s strong cash-generation capabilities. Although the net debt to EBITDA multiple is envisaged to deteriorate to 2.5 times in FY2017/18, it remains one of the strongest amongst local corporate bond issuers.

Premier Capital plc is the development licensee for the US-based fast-food giant McDonald’s Corporation in the Baltics (Estonia, Latvia and Lithuania), Romania, Greece and Malta. As at 30 June 2017, Premier Capital operated 134 restaurants of which 68 are situated in Romania, 33 in the Baltics, 24 in Greece, whilst the remaining 9 are in Malta. In October 2016 Premier Capital approached the bond market for the second time with a €65 million 10-year issue.

The acquisition of McDonald’s Romania late in January 2016 led to a complete transformation of the financial performance of Premier Capital. In fact, from a company which generated an average annual EBITDA of €10 million in 2014 and 2015, EBITDA increased more than threefold to reach €32.7 million during the financial year ended 31 December 2016 with McDonald’s Romania accounting for 55.2% of aggregate revenues, 65.2% of total EBITDA and 75% of overall pre-tax profits. In essence, although Premier Capital has now become almost entirely dependent on the performance of its Romanian subsidiary, this acquisition has strengthened the overall group in a notable manner. The EBITDA margin jumped to 14.2% in 2016 from 10.4% in 2015, the interest cover improved to 6.9 times (2015: 4.6 times) and the net debt to EBITDA multiple almost halved to 1.8 times in 2016 from a level which was already comfortable at 3.2 times in 2015.

The Financial Analysis Summary dated 21 June 2017 indicates that Premier Capital expects to generate total revenue of €255.1 million during the current financial year to 31 December 2017 and an EBITDA of €35.7 million (representing an increase of 8.9%). Should these financial estimates be achieved, the interest cover is anticipated to strengthen to 9.1 times and the net debt to EBITDA multiple should improve to 1.3 times. Overall net debt is expected to decrease from €59 million as at the end of 2016 to €47.5 million while shareholders’ funds are anticipated to improve from €41.6 million to €55.4 million. This will help the gearing ratio to improve as well to 60% as at the end of 2017 from 74.5% in 2016. While this may be considered to be high when compared to Farsons as well as other bond issuers in different sectors, the strong cash-generation capabilities of Premier Capital should not be over-looked. Should the group maintain such a strong level of EBITDA in the years ahead and assuming most of the profits generated are retained and not distributed to shareholders, the gearing ratio should fall to well below 50% in the coming years.

Given Premier Capital’s strong financial performance and credit metrics coupled with other important strengths such as the relationship and considerable power of the McDonald’s brand worldwide, Premier Capital should be a serious contender for an equity listing. Maltese equity investors need to be given added opportunities to gain exposure to certain local companies that are expanding overseas in a very successful manner.

Meanwhile, following the surprising decision in recent weeks, all investors should hope that the necessary planning approvals are eventually granted to Farsons and the spin-off of Trident Estates materialises in the not too distant future. The level of sophistication across the local capital market needs to improve and corporate actions such as spin-offs and share buybacks are indeed necessary to generate more widespread interest for locally listed securities.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.