Overview of the Hili Ventures Group

Following the large bond issues that took place in 2018 and 2019, Hili Finance Company plc recently launched its third bond totalling €50 million which was fully subscribed within a very short period of time and closed last Thursday.

Since Hili Finance is essentially a special purpose financing vehicle for the Hili Ventures Group, all three bonds are guaranteed by Hili Ventures Limited. In turn, Hili Ventures Limited is the parent and holding company of the Group with three main operating subsidiaries, namely 1923 Investments plc, Hili Properties plc and Premier Capital plc which all have financial instruments listed on the Regulated Main Market of the Malta Stock Exchange.

As a result of the recent bond issue by Hili Finance, the projected financial statements of Hili Ventures Limited were published both for 2021 and 2022. Given the overall bond issuance by Hili Finance as well as the three main operating subsidiaries, a review of these financial statements is important for the numerous investors who have exposure to this large group of companies.

In fact, the Hili Ventures Group is the second largest bond issuer in Malta (after the Corinthia Group) with a total of €308 million in issue. Furthermore, in recent years, the group also tapped the equity market through Harvest Technology plc and Hili Properties plc.

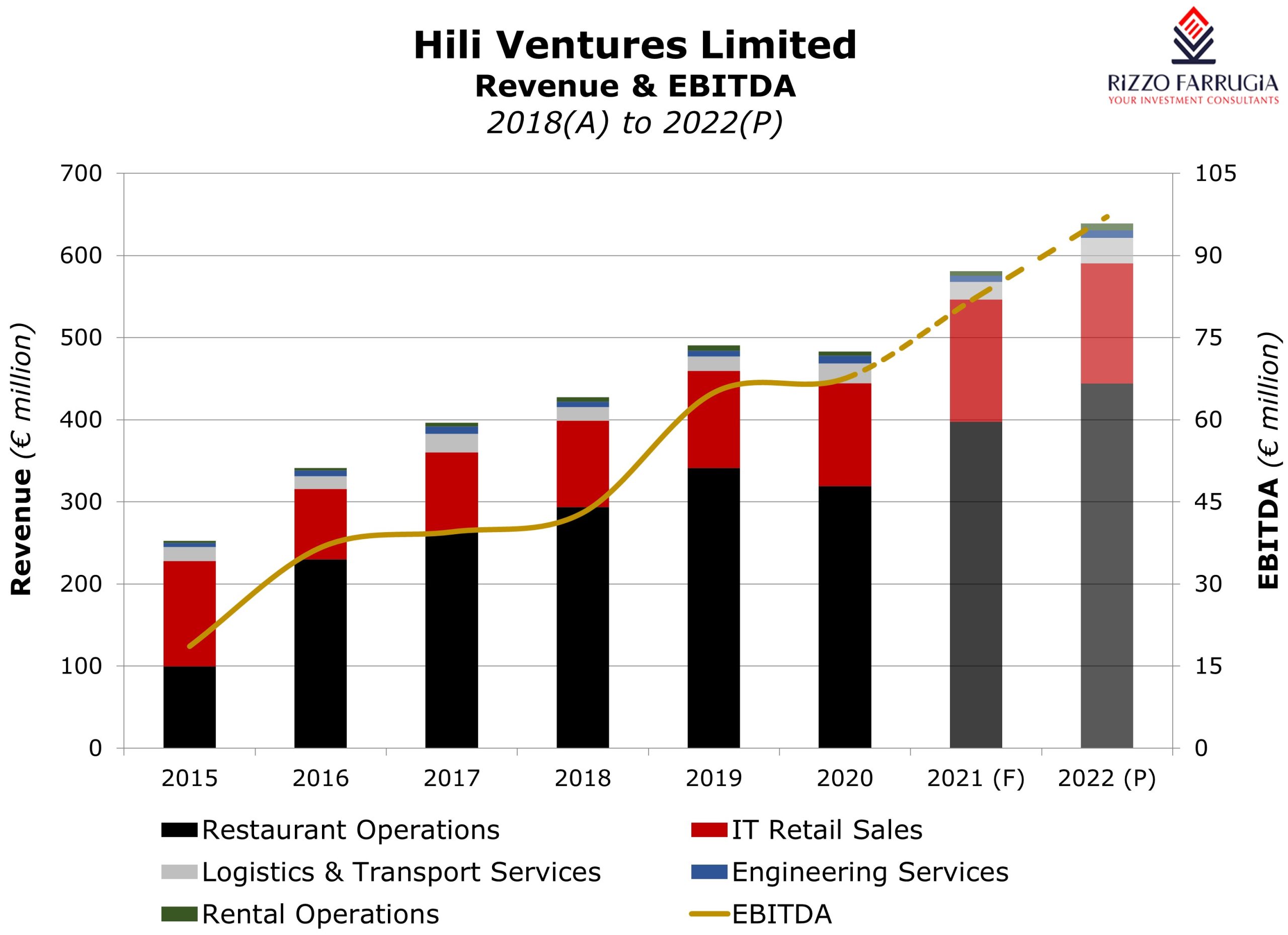

Hili Ventures has become one of the largest conglomerates in Malta following a very successful international expansion strategy. Hili Ventures conducted several acquisitions in various economic segments including technology, energy, transportation and logistics, as well as quick service restaurants. Nonetheless, despite the extensive diversification in terms of economic segments and also geographically, the majority of revenues and EBITDA that Hili Ventures generates (which are expected to have exceeded €580 million and €82 million respectively in 2021 rising to €638 million and €97 million in 2022), emanate from the operation of McDonald’s restaurants through Premier Capital primarily in Romania.

The recent prospectus indicates that the restaurant operations business segment is forecasted to have generated just under €397.5 million in revenues during 2021 (+24.6% over 2020). Although the prospectus did not provide the segmental breakdown of the EBITDA figures across the entire group, the Financial Analysis Summary of Premier Capital plc published in mid-2021 disclosed a projected EBITDA of €64 million for 2021 based on a revenue figure of just under €393 million. The updated figures for 2021 indicate a slight improvement in overall revenue generation from the restaurant operations business. As was evident over recent years, the bulk of profits within this business segment comes from the large portfolio of restaurants in Romania accounting for around 80% of the pre-tax profits generated by Premier Capital. The acquisition of the McDonald’s franchisee in Romania in 2016 was undoubtedly a key turning point for the Hili Ventures Group. Revenue from restaurant operations via Premier Capital is anticipated to register further growth of 11.7% during the current financial year to 31 December 2022 to just over €440 million (69.5% of total group revenues). The company aims to add more restaurants especially in Romania and Greece given the low penetration rate of the McDonald’s franchise in these two countries.

The other principal subsidiary of Hili Ventures is 1923 Investments contributing around 30% of the group’s revenues and 20% of EBITDA. 1923 Investments derives the bulk of its revenues (around 70%) from iSpot Poland (“iSpot”) which, in turn, is the largest Apple products retailer in Poland with a total of 27 outlets. Moreover, through the Financial Analysis Summary published by 1923 Investments in mid-2021, it transpires that iSpot is expected to have contributed over 40% of the EBITDA generated by 1923 Investments in 2021 of €14.2 million. On the other hand, although the operations of Harvest Technology plc are smaller in size in terms of revenue generation, it contributes around 30% of the EBITDA generated by 1923 Investments on the back of the healthy profit margins of the company’s electronic payments division. Meanwhile, the other operating arm of 1923 Investments is transportation and logistics which incorporates several activities including warehousing, ship-to-ship operations, as well as cargo handling. In this respect, 1923 Investments acquired the non-US ship-to-ship operations in April 2020 that were previously owned by marine energy transporter Teekay Tankers Limited for USD26 million.

Interestingly, the Prospectus indicates that 1923 Investments plc intends to intensify its mergers and acquisitions activity to the tune of €50 million by forging strategic international partnerships. The property division falling under Hili Properties is a minimal contributor to overall group revenue and EBITDA given the sheer size of the other business segments. Nonetheless, revenue of Hili Properties is expected to surge by almost 50% during 2022 to €8.4 million presumably on the back of the recent conclusion of the property acquisition in Lithuania.

The COVID-19 pandemic that has been around for almost two years now has provided ample evidence to the investing community of those industries that were significantly impacted, those that showed strong resilience and others which saw a positive impact as a result of changes in consumer patterns. The financial performance of Hili Ventures over the past two years clearly indicates a very strong level of resilience during the pandemic with overall group revenues only declining by 1.5% in 2020 to €483.2 million but then rising to over €580 million in 2021 thereby easily surpassing the 2019 figure of €490.6 million.

As a result of the significant amount of borrowings undertaken in recent years, it is important to gauge the level of leverage of the group. While Hili Ventures is highly leveraged from a capital structure perspective with an estimated net debt of €349 million (when including lease liabilities amounting to almost €90 million) as at the end of 2021 compared to shareholders’ funds of €155 million, the group’s indebtedness is more contained when analysed from a cash flow and profitability point of view. In fact, given the business nature of the company, the net debt to EBITDA multiple is a better measure of indebtedness. This multiple is anticipated to drop to 4.3 times in 2022 (which essentially means that it will only take a little more than four years for Hili Ventures to pay back its total debt from its cash earnings if net debt and EBITDA are assumed to remain constant in future years). Similarly, the interest cover is expected to improve to 4.5 times in 2021 and 2022 compared to less than 4 times in prior years. Another important observation is that Hili Ventures is projecting to generate €45 million in free cash flow in 2022.

These metrics are also important in view of the upcoming plans for the Comino Hotel and Bungalows project which had been expected to be completed by 2024.

Apart from possible financing requirements of some of the upcoming expansion plans, Hili Ventures is expected to retain an active presence across the capital markets since in each of the years between 2024 and 2029, the €308 million worth of bonds in issue are all due to mature. The utilisation of the capital markets by the Hili Ventures group was instrumental in enabling the company to pursue its successful international expansion strategy as is evident from the sizeable profitability generated even during the pandemic.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.