Record trading activity in corporate bond market

In some of my recent articles, reference was made to the increased activity across the Maltese corporate bond market both in terms of new issuance (primary market) as well as with respect to trading in existing issues on the secondary market.

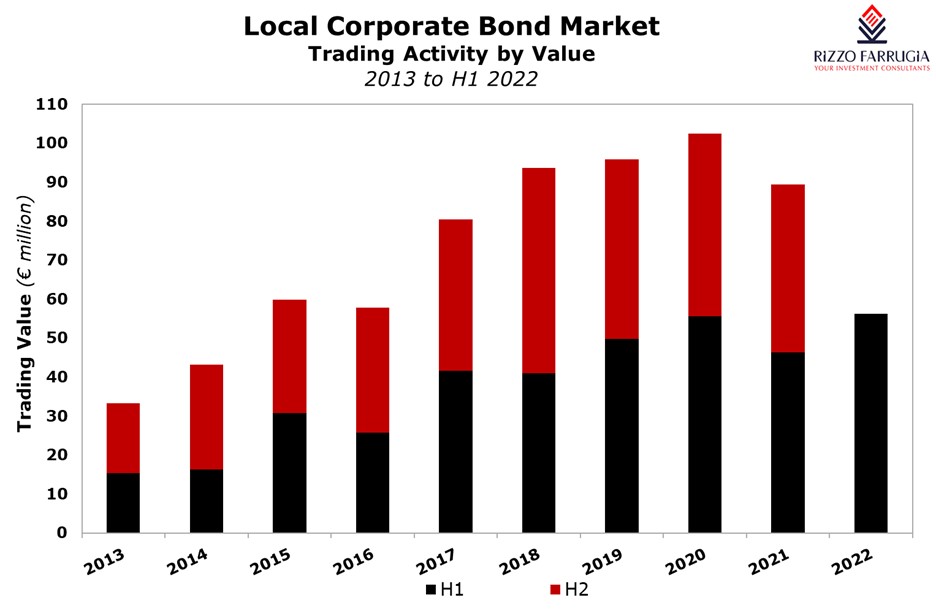

During the first half of 2022, trading activity across existing corporate bonds on the secondary market reached a record level of €56.3 million. In prior comparative periods, trading activity in the first half of the year was always below the €50 million level except in the first six months of 2020 when almost €56 million worth of bonds changed hands. The high level of activity two years ago was undoubtedly as a result of the increased level of concern by many investors during the start of the COVID-19 pandemic. This translated into a very busy trading period between March and June 2020 as several investors sought to liquidate a number of positions within their portfolios while others took advantage of the decline in prices to obtain more favourable yields from a number of fundamentally asset-rich companies.

The surge in activity on the secondary market may go largely unnoticed by many retail and institutional investors. Prior to 2017, trading activity on the secondary market during the first half of the year hardly ever exceeded the €30 million level. In fact, the €56.3 million worth of bonds that changed hands in the first half of 2022 represents an increase of 118% from the level of trading activity in H1 2016 and is almost equivalent to a full year’s worth of trades in 2015 and 2016.

When analysing the statistics of the trading volumes seen in the first half of 2022, it is interesting to note that the most actively traded bond was the 3.5% GO plc 2031 issue with a total of €4.9 million changing hands. This represents just over 8% of the overall size of the bond issue of GO plc at €60 million. The second most actively traded bond was the 4.25% Best Deal Properties Holding plc 2024 issue with almost €4.5 million changing hands. This was mainly a result of the buy-back programme by the company following the successful property development activities undertaken over the years. In fact, the outstanding amount of bonds in issue has been reduced to €9.2 million compared to the original issuance of €16 million at the end of 2018.

Another particularly actively traded bond was the 3.65% Mizzi Organisation Finance plc 2028-2031 issue with just over €3 million changing hands thereby representing almost 6.7% of the overall issue size of €45 million.

From the trading statistics during the first half of 2022, it is also interesting to highlight that the three largest bonds in issue – namely the €80 million 3.65% International Hotel Investments plc 2031, the €80 million 3.80% Hili Finance Company plc 2029, and the €66.9 million 3.50% Bank of Valetta plc 2030 – do not feature among the top 10 of the most actively traded bonds. Incidentally, all three issues are currently trading below their par value.

This significant rise in bond trading is a natural outcome from the increased number of bonds in issue over the years. The size of the bond market now exceeds €2.24 billion with 78 bonds listed on the Regulated Main Market of the Malta Stock Exchange.

2022 has been a particularly busy year so far with a total of €336.6 million in bonds that have already been listed or are in the process of being listed after obtaining regulatory approval.

The increased depth of the bond market should be viewed positively by various market participants as well as from the investing public. While the Maltese capital market has so far correctly been defined as one that is generally very illiquid thereby providing difficulties for investors to dispose of their holdings in a relatively short period of time, the higher level of activity across both the primary market and the secondary market for corporate bonds is welcome news since it is clearly becoming a more liquid market.

The new entrants to the corporate bond market over recent months and years also from other economic sectors is thereby enabling investors to build up a better diversified portfolio of investments. Moreover, this also helps investors to devise an investment strategy based on the concept of ‘bond laddering’. This entails having a portfolio of bonds with varying maturity dates thereby spreading out the timing of the reinvestment. Such an investment strategy gains popularity in a rising interest rate environment since an investor will have bonds maturing at regular intervals which can then be reinvested at higher interest rates in the future upon maturity.

Hopefully, the high level of new bond issuance seen since the start of the year will continue in the months ahead thereby providing investors with an increased choice of potential opportunities to grow their investment portfolios and achieve further diversification. The continued surge in resident deposits registered by the main retail banks in the first half of the year is further testament to the high levels of liquidity across the financial system and the growing appetite by retail investors to increase their participation across the corporate bond market.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.