RS2 expects revenue to exceed €100 mln by 2023

The Prospectus published by RS2 Software plc last week in connection with the issuance of up to €50 million worth of preference shares provides detailed information on the company’s business model, the payment industry and naturally the risk factors that investors ought to consider when contemplating an investment in these preference shares.

However, a very interesting part of this lengthy document is Annex II which provides the financial projections prepared by the company not only for the current financial year but also for the next two years until 2023. This is possibly one of the first occasions that an issuer whose shares are listed on the Malta Stock Exchange has three-year financial projections within the public domain.

RS2 states that it is one of the few providers worldwide to offer global omni-channel payment services for issuers and acquirers through a cloud-based platform and is uniquely positioned to enable global clients to process both international and local payments. The financial projections indicate that RS2 is expected to experience a strong improvement in its financial performance as from the current financial year as it aims to capitalise on the strong shift within the industry towards consolidation of services and as the shift to cashless payments gather momentum across most economies worldwide.

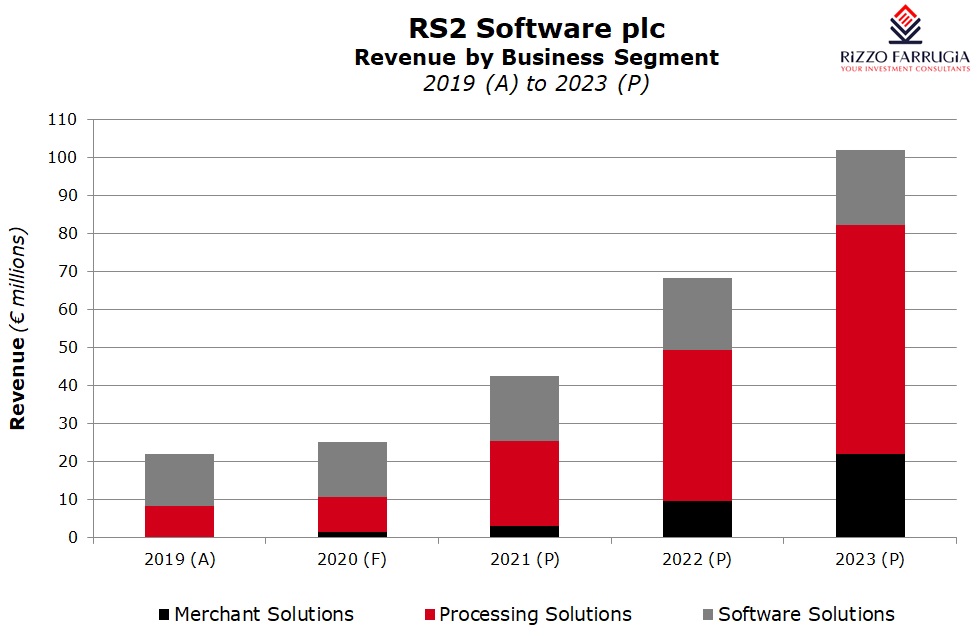

The directors anticipate that the group’s revenue will climb by 69% in 2021 to €42.5 million and continue to grow sharply by a further 61% in 2022 to €68.4 million and 49% in 2023 to €102 million. As a result of the significant hike in group revenue over the coming years, earnings before interest, tax, depreciation and amortisation is expected to reach €29.5 million in 2023 and profit before tax is anticipated to amount to €24.9 million.

At first glance many investors may question the attainability of such revenue and profitability figures given the financial performance of RS2 in recent years. However, the prospectus gives added information on the basis for these projections and investors must also take into consideration that significant investments were undertaken in recent years in view of the change in their business model which negatively impacted the financial performance of the company.

The revenue projections published last week take into consideration agreements with existing clients, the expected business from new contracted clients as well as the potential of new business pipeline. In fact, the total projected revenue for 2021 of €42.5 million includes 77% which is anticipated to be generated from existing clients, 14% from new contracted or committed clients and only 9% based on business pipeline which has not been secured to date. In 2023, 60% of the projected revenue of €102 million is expected to be generated from existing clients and from new contracted or committed clients with 40% based on business pipeline which has not been secured to date.

The prospectus also gives data on the expected revenue from each of the business segments, namely Software Solutions, Processing Solutions and Merchant Solutions.

Revenue from the traditional licensing model within Software Solutions is not expected to grow very strongly given the new business model and strategic initiatives of RS2 to control the entire payments value chain by acting as the processor for issuers and merchants. As a result, Processing Solutions will be the major growth driver in the next three years.

Revenue from the ‘Processing Solutions’ segment is expected to climb from €9.3 million in 2020 to €22.4 million in 2021, €39.8 million in 2022 and €60.3 million in 2023. The Prospectus states that “during the first quarter of 2021, the Group will see a fundamental shift in operations, particularly in the Processing Solutions segment. A number of large processing customer implementations that were ongoing during 2020 are now being completed and going live, thus resulting in new recurring revenue with effect from late 2020 and throughout 2021”. One of the important contributors to such an increase in revenue from Processing Solutions is undoubtedly the Tier 1 US bank which was signed up in 2020 for a 10-year term. As a result of this milestone achievement and other high-volume clients being onboarded, RS2 is expected to see an exponential growth in transactions processed on behalf of its clients.

The 10-year contract with the Tier 1 bank in the US is structured on the basis of a hybrid Software and Processing Solutions model with revenue being accounted for both under Software Solutions and also under Processing Solutions.

In a recent interview on social media, RS2’s CEO and majority shareholder Mr Radi El Haj indicated that further growth in services may materialise from this major client in the US as it seeks to expand into 27 markets. Moreover, the CEO also explained that the company is negotiating with potential clients (especially in the Asia Pacific region) for possibly larger contracts compared to the 10-year agreement entered into with the US bank.

The shift in RS2’s strategy from its original Licensing Solution towards the Processing and Merchant Solutions is altering its revenue generation model from one that is highly dependent on one-time licensing fees to one which is mainly characterised by ongoing and recurring revenue based on the number and value of transactions processed. This change in the revenue model is possible because RS2 is now positioning itself across the entire payments value chain.

RS2’s full-owned subsidiary RS2 Financial Services GmbH is in the final stages of being awarded an E-Money-Institution (EMI) licence by the German financial authority BaFin. This will enable the company to enter direct merchant acquiring and issuing with revenue based as a percentage of the transaction value, rather than a flat fee per transaction, as in case of the Processing Solutions. The Merchant Solutions business is expected to be launched in Europe during 2021 and in the US in 2022. Overall revenue from Merchant Solutions is expected to amount to €3 million in 2021 before rising steadily to €9.6 million in 2022 and €22.1 million in 2023.

The financial projections are modelled on the basis that €25 million in additional capital will be raised. These funds are being earmarked for further investment in the United States (€4 million); additional investment in the Merchant Solutions business (€6 million); product enhancements in line with the Group’s strategic product road map (€5 million) and the repayment of short-term bank facilities (€10 million).

RS2 is also contemplating M&A transactions which will complement its business and growth plans. It is estimating that €10 million of the proceeds from the issuance of preference shares, coupled with added debt funding, will be used for acquisitions that could help accelerate market entry. In view of the difficulty in estimating the timing and nature of acquisitions, the financial projections do not include any benefits from such a transaction.

Although the amount being sought through the preference share issue of €50 million may seem to be large compared to normal transactions across the Maltese capital market, the company will hopefully succeed to raise the full amount and thereby enable it to accelerate its future growth trajectory and generate significant value for all its stakeholders.

Since the company issued financial projections for a 3-year period and given the robust business pipeline which is a major determinant in enabling the company to reach the projected figures, RS2 ought to consider publishing updated financial forecasts annually as from next year shortly after the publication of its annual financial statements in April. This will help the investing community gauge the progress being made by the company in its international expansion and understand whether the projections within the prospectus are likely to be achieved or indeed exceeded. After all, RS2 is now a fully-fledged fintech company and such guidance will help it emulate the communication by companies across the larger international capital markets and which in any case will be a requirement in the future if RS2 achieves a secondary listing on a larger stock exchange as advocated by the CEO recently.

Rizzo, Farrugia & Co. (Stockbrokers) Ltd is acting as Joint Sponsor to the preference share issue of RS2 Software plc.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.