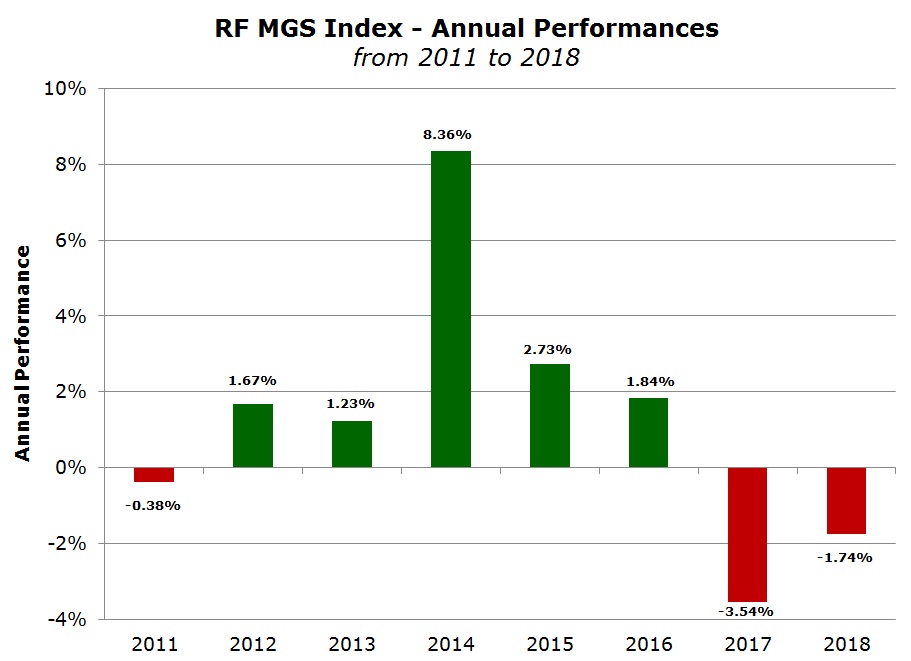

Second consecutive annual decline for RF MGS Index

After reviewing the 2018 performance of the Maltese equity market over the past two weeks and highlighting the main developments across various companies, it is also important to assess the performance of the Malta Government Stock market.

Following the 3% decline in the RF MGS Index during 2017 (representing the first annual decline since 2011), it is immediately worth highlighting that Malta Government Stock prices suffered their second consecutive annual decline as the RF MGS Index shed a further 1.7% in 2018. Moreover, the prices of the large majority of MGS’s ended the year lower with the exception of the longest dated securities, namely those maturing between 2035 and 2041.

When looking back at the overall trend of the RF MGS Index during the past 12 months, the intense volatility from one period to the next is immediately evident. Few investors may appreciate the volatility in MGS prices from one week or one month to another. However, in recent years, sovereign bond prices have indeed experienced wide bouts of volatility and 2018 was no different.

In fact, the 2018 performance of the RF MGS Index can be analysed in four different parts. During the first five months of the year, prices initially declined (yields rose) but then recovered quickly. Meanwhile, between early May 2018 and the third week of November, the decline in prices was almost uninterrupted with the RF MGS Index shedding 3.3% to its lowest level since September 2014. However, the RF MGS Index partially recovered during the last six weeks of the year as MGS prices rebounded strongly helping the RF MGS Index to climb by 1.5% and trim the 2018 overall loss to “just” 1.7%. It is worth highlighting that the 4-year low in November 2018 of 1,077.817 points represents a decline of an extraordinary 8.8% since the peak in the RF MGS Index in October 2016, just before the US Presidential elections.

Once again, movements in MGS prices were influenced by the regular publication of economic data and credit rating assessments, statements by key officials of the major central banks across the world as well as global political developments. I will now endeavour to highlight the main developments that led to the wide periods of volatility in Malta Government Stock prices over the past twelve months.

At the start of 2018, the RF MGS Index maintained the same trend as that seen in the final part of 2017 with MGS prices mainly declining as yields moved higher as a result of the evidence of stronger economic growth across most parts of the world. In the eurozone, business and consumer confidence rose to the highest level since late 2000 and the unemployment rate fell to a fresh nine-year low of 8.7%. The European Central Bank claimed an “increasingly self-sustaining economic expansion” which led many analysts to expect that the central bank would start a process of monetary policy normalisation by ending the quantitative easing programme and start focusing on very gradual increases in interest rates. The Bank of England had also signalled at the time that “monetary policy would need to be tightened somewhat earlier and by a somewhat greater extent” than previously anticipated amid inflation overshooting. Furthermore, despite a change at the head of the Federal Reserve, there was an evident indication to more aggressive interest rate hikes than previously estimated amid upbeat inflationary indications which led many of the renowned bond investors to declare that bonds are about to enter a new era after an end to the 30-year bull market in US bonds. Since MGS prices reflect developments across the eurozone with a specific inclination to those developments in some of the periphery nations such as Italy and Spain, the upgrade to the Spanish credit rating by Fitch Ratings to “A-” from “BBB+” was an important event at the start of the year. The same international rating agency also confirmed Malta’s ‘A+’ rating by making reference to Malta’s “robust economic growth” and very tight labour market conditions.

Shortly afterwards, another rating agency (S&P) also upgraded Spain to “A-“ (the most positive assessment since 2012) which led to lower yields and therefore a recovery in prices. The strengthening of the euro in the first half of 2018 began to be of some concern to economists due to the negative implications on inflation and exports while the economic data within the euro area started to disappoint leading to a number of ECB rate setters to send out conflicting signals about future monetary policy. The ECB highlighted that “monetary policy will remain patient, persistent and prudent” and that interest rates are expected to remain at their current levels for well past the end of the current asset purchase programme. The heightened political uncertainties in Italy and Spain in the first half of the year also impinged on the movements of euro sovereign bond prices including Malta’s.

Comments by the ECB largely shaped the rally in yields and the decline in prices during the second half of 2018. On 14 June 2018, the ECB announced the end to its €2.4 trillion bond-buying programme and revealed that it will be reducing its monthly assets purchases to €15 billion a month (from €30 billion) between October and December 2018 and subsequently bring the programme to an end at the close of the year. The ECB had also stated that it remained convinced that the slowdown in economic activity within the euro area was only temporary and that economic growth remained “solid and broad-based”. Moreover, after a period of political turbulence, Italy managed to form a new government (a coalition of the 5-Star Movement & the Northern League) and although concerns and doubts remained on the country’s fiscal stability and economic outlook as well as its membership of the euro area, yields in Italy began to slowly ease.

The more remarkable movement in MGS prices took place during the last six weeks of the year when yields plummeted in response to higher perceived risks across global equity markets due to various reasons, namely lingering doubts on whether the US and China will reach an agreement over disputes related to trade, concerns over the future prospects of the world’s largest technology companies, a surge in volatility in oil markets, questions about Italy’s debt levels as well as uncertainties related to Brexit. As equity markets tumbled during the final few weeks of the year (December was the worst month for global equities since 2008), there was a broad ‘flight to safety’ and sovereign bond yields declined rapidly. The Chairman of the Federal Reserve also remarked that the pace of interest rate hikes may slow in the months ahead.

Apart from the movement in MGS prices amid the various international developments, it is also worth commenting upon the trading activity seen in the MGS market. The volumes of MGS trades on the customary secondary market declined for the fourth successive year. During 2018, just under €215 million worth of MGS traded on the secondary market representing a yearly decline of almost 47%. Trading activity in MGS had reached a peak of €836 million in 2014. The decline must also be seen in the context of the start of the ECB’s quantitative easing programme in early 2015. Purchases of MGS under the QE programme take place as ‘off-market’ trades and therefore are not included in this data. In fact, given that the ECB publishes the bond repurchases across each of the eurozone nations, it is important to highlight that the Central Bank of Malta repurchased a total of €127 million worth of MGS in 2018 compared to €220 million in 2017. Since the start of the QE programme, a total of €1.15 billion were repurchased so this must be taken into account too when comparing the activity prior to 2015.

Given the most recent developments it is very difficult to judge whether MGS prices will face another negative performance in 2019 or whether they will recover some of the losses experienced in the past two years. The multitude of factors including political developments (such as a potential accord between the US and China over trade) will largely impact the performance of MGS prices especially those with longest-periods to maturity. Investors who regularly track the performance of their portfolios and continue to hold an over-weight exposure to long-dated MGS mainly for capital gains purposes should have realised that the future direction of prices is much more uncertain today and sizeable declines can indeed take place in a relatively short period of time as was seen over the past two years.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.