Strong but volatile year for MGS

Over the past two weeks I reviewed the main movers across the Maltese equity market during 2019 showing the wide discrepancies between the equities that performed strongest and those that registered double-digit declines. In today’s article, I will be reviewing the 2019 performance of Malta’s sovereign bond market.

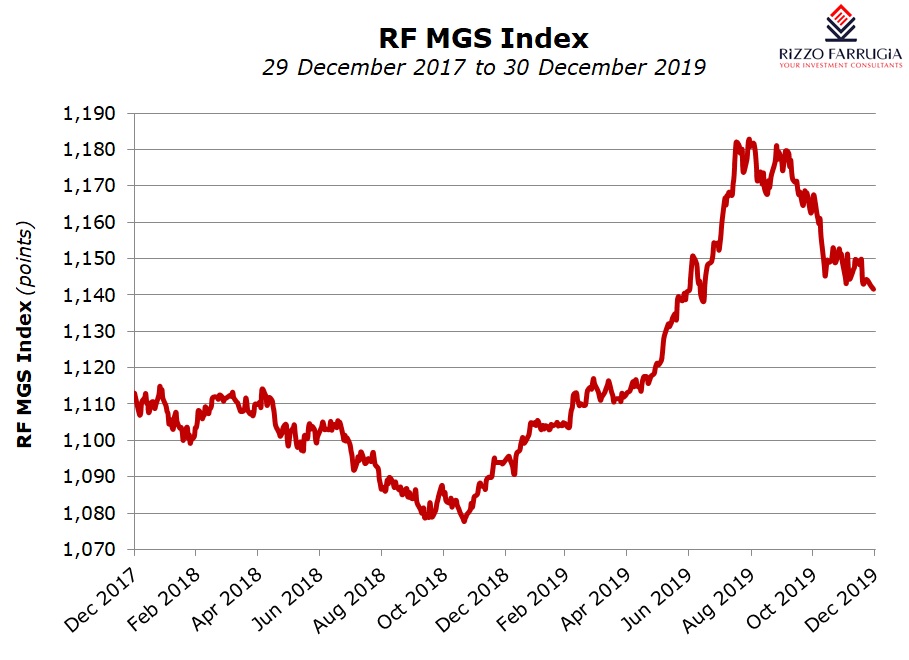

The RF MGS Index measures the performance of the Malta Government Stock market. Following two consecutive years of declines, the RF MGS Index registered a gain of 4.3% in 2019 – the second-best annual performance since 2014. Very coincidentally, the 4.3% gain of the RF MGS Index is almost identical to that of the MSE Equity Price Index during 2019 (+4.4%).

It was an eventful year for the MGS market as prices rallied above their previous record levels of late 2016 before suffering a sharp downturn in the last quarter of the year. In fact, the RF MGS Index had climbed by 8.2% until late August 2019 but then shed 3.5% by the end of the year which is quite remarkable considering that bonds are generally viewed as being less volatile than equities. Some other noteworthy observations to make are that in early August 2019, yields in Malta dropped below the 1% level across the entire spectrum of Malta Government bonds and for the first time, an offer of new MGS in the primary market was made with negative yields to maturity.

The strong upward movement in MGS prices during the last few weeks of 2018 caused by a flight to safety as international equity markets tumbled continued at the start of 2019 also as the Federal Reserve announced that it would be halting its programme of interest rate hikes. Moreover, although the quantitative easing programme of the European Central Bank came to an end in December 2018, yields continued to edge lower as a result of heightened global political uncertainties (including the trade spat between the US and China) and weak economic data across the eurozone. The 10-year German bund yield dropped back into negative territory during the second half of March 2019 compared to a high in the previous year of +0.81% in early February 2018 clearly indicating the extent of volatility across the sovereign bond markets in only one year. The RF MGS Index performed positively in each of the first two quarters of 2019 leading to a 4.3% gain in the first six months of 2019.

The second half of the year proved to be more volatile. Sovereign bond prices across the eurozone including Malta staged a strong rally during most of the summer months as it had become increasingly evident from the disappointing economic data emerging and statements that were being made by key officials of the ECB that the central bank would have to introduce new stimulus measures.

Yields declined to fresh all-time lows in August and September with the 10-year German bund yield dropping to -0.74% (compared to the previous record low of -0.20% in July 2016) and the yield on the 30-year bund dropping to -0.31% (the previous all-time low of +0.29% had also been recorded in July 2016).

The movement in the eurozone bond markets was duly reflected in Malta as the RF MGS Index rallied by 3.2% during the third quarter of the year. Yields across the entire spectrum of MGS dropped below the 1% level for the first time ever on 5 August 2019. This was reflected in a significant upturn in MGS prices with the longest dated MGS, the 2.4% MGS 2041, rallying by an extraordinary 27.7 percentage points from 106.82% at the end of 2018 to an all-time high of 134.56% albeit recorded on 4 October 2019. The yield on the 10-year MGS dropped to a low of only 0.1% on 29 August 2019 compared to a level of 2.4% in mid-2014 before the start of the QE programme by the ECB in early 2015.

During the ECB monetary policy meeting that took place between 11 and 12 September, which was President Mario Draghi’s final meeting before the end of his eight-year term on 31 October, a decision was taken to introduce various stimulus measures in a fresh bid to boost the eurozone economy. The deposit facility was reduced by a further 10 basis points to a new record low of -0.50% (the first change since March 2016) and the QE programme was set in motion again at a monthly pace of €20 billion as from 1 November 2019. The ECB also stated that the purchases of bonds will “run for as long as necessary to reinforce the accommodative impact of policy rates” implying that this second QE programme is essentially open-ended until such time that inflation expectations are “sufficiently close to, but below, 2%”.

Despite the wide ranging measures announced by the ECB in mid-September 2019, eurozone yields began to edge higher from the all-time lows in previous weeks on some reassuring news on the trade negotiations between the US and China, a slight improvement in economic data in some economies and also as Brexit negotiations were becoming clearer. Although the 10-year German bund yield rebounded sharply to around the -0.4% level in mid-October compared to the low of -0.74% in August, MGS prices continued to rally until early October with the 2.4% MGS 2041 reaching a fresh all-time high of 134.56% on 4 October.

However, as there was increased optimism that the US and China were making progress on agreeing a trade deal and comments from the ECB indicated that it was unlikely for the eurozone to drop into a recession, the recovery in yields and decline in prices gathered momentum. In fact, the RF MGS Index performed negatively for 9 consecutive weeks (the longest trend on record) between early October and the first week of December. The Federal Reserve also provided a more positive view of the performance of the US economy and as the year came to a close, the negotiations between the US and China intensified leading towards a ‘Phase 1’ deal.

The yield on the 10-year German bund ended the year at -0.19% (compared to the low of -0.74%) and the yield on the 30-year bund closed off the year at +0.35% (compared to the low of -0.31%). Likewise, in Malta, the RF MGS Index shed 3% during the final quarter of the year with a sharp decline in some prices in a short period of time. The two longest dated MGS – namely the 3% MGS 2040 and the 2.4% MGS 2041 – dropped by over 6 percentage points from their peak in a matter of approximately five weeks after staging an extraordinary double-digit upturn in previous months.

At the start of 2019 I had argued that the future direction of MGS prices was very uncertain given the numerous factors that impinge on international bond yields and subsequent price movements. I had also warned that sizeable movements can take place in a relatively short period of time even in the bond market. The volatility that characterised the MGS market during the second half of 2019 proves how difficult it is to predict future movements in the sovereign bond market. While in 2020 many international commentators expect eurozone yields to drop back to their record low levels seen in summer 2019 which would lead to a renewed upturn in MGS prices, this is very much dependent on the economic data emerging around the world, statements by key officials of the major central banks and global political developments. The recent unexpected stand-off between the US and Iran is another example of how such events can lead to unpredictable movements across sovereign bond markets including Malta. The US Presidential elections due on 2 November 2020 could also lead to significant changes in prices and yields as some may vividly recall the November 2016 movements upon the election of Donald Trump. At the time, yields had risen and MGS prices declined rapidly and it was only in 2019 that a good number of MGS prices surpassed the record levels seen just before the US Presidential elections. 2020 should therefore be another year of volatility for the MGS market. Although the remarkable gains in the longer dated MGS was very positive news for investors holding these securities in their investment portfolios, such double-digit movements are not normal in the bond market and investors should not expect such performances to be repeated in the months ahead.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.