The impact of a rising US Dollar

2022 is proving to be a very difficult year for investors as most asset classes are performing negatively as a result of fears of an economic slowdown which can force some of the largest economies across the world into a recession. In fact, the S&P 500 index in the US just missed dropping into ‘bear market’ territory last week following a brief rally last Friday. By close of business last Thursday, the main equity benchmark in the US was down 18.1% from its record high on 3 January but recovered by 2.4% on Friday to avoid moving into a technical bear market. The NASDAQ composite on the other hand has already dropped well into bear market territory with a year-to-date decline of 25.5%.

The performance across the international bond markets is also going through a period of intense volatility. Despite the uncertainties related to economic growth, inflation across the globe is running at multi-year highs which in turn is forcing major central banks to tighten monetary policy aggressively. Indeed, commonly-used bond benchmarks such as the Bloomberg Barclays Corporate Bond EUR Index registered a decline of 8.9% since the start of the year while the Markit iBoxx USD Liquid High Yield Capped Index shed 6.7%.

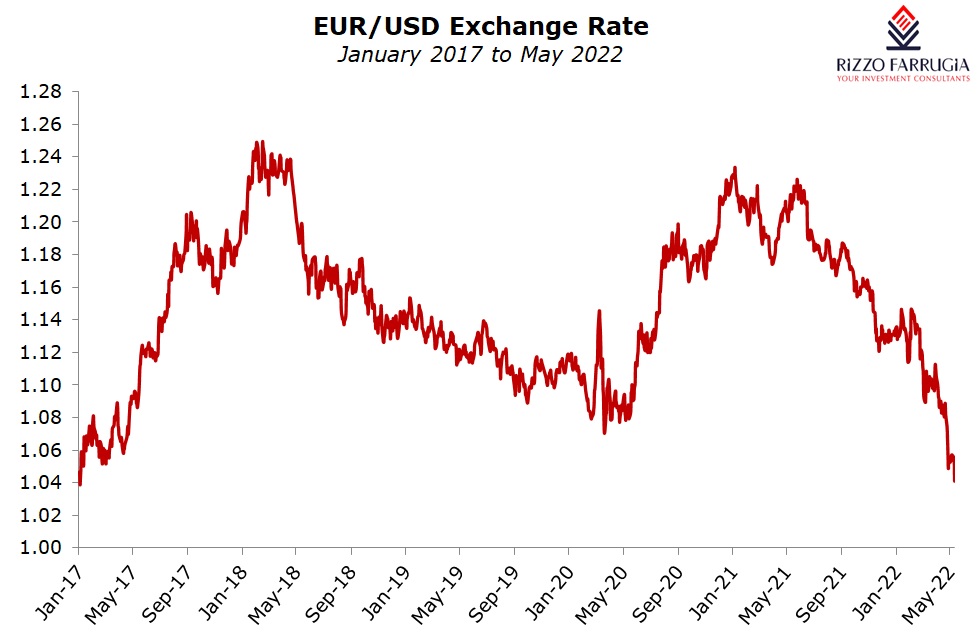

Meanwhile, across the currency markets there were some sharp movements too also as a result of the monetary policy decisions being taken by the major central banks. The EUR vs USD exchange rate started off the year at the USD1.13 level and the US Dollar strengthened substantially by the end of last week to USD1.035, marking the weakest point for the euro against the greenback since the start of 2017 when it had reached a level of USD1.0341.

The euro’s plight is mainly a function of US Dollar strength as the Federal Reserve presses on with bigger interest-rate hikes than those being contemplated by the European Central Bank. In early May, the Federal Reserve raised its key interest rates for the second consecutive time (following the initial hike of 25 basis points in March 2022) as the annual inflation rate in the US remained elevated at 8.3% in April. The recent 50 basis point increase by the Federal Reserve was the sharpest uplift in 22 years. The Federal Reserve also decided to commence its balance sheet reduction programme on 1 June 2022 by selling securities up to USD47.5 billion per month until August 2022. This will rise to USD95 billion per month as from September 2022.

Moreover, the US Dollar is benefiting from its safe-haven appeal as risk aversion increases due to increased market turmoil and ongoing developments across Ukraine.

On the other hand, the outlook for the European economy is weakening. The International Monetary Fund recently slashed its 2022 growth forecast for the eurozone to 2.8% with potential further risks to the downside as a result of the severe impact from the war in Ukraine and the continuing standoff with Russia over the supply of natural gas. Moreover, earlier this week, the European Commission issued its revised economic forecasts for 2022 and lowered its economic growth forecast for the eurozone to 2.7% from the previous estimate of 4.0% as the war in Ukraine is severely curtailing the European Union’s economic rebound from the COVID-19 pandemic. Meanwhile, the European Commission sharply increased its inflation forecast to 6.1% from the previous estimate of 3.5%. Inflation is expected to peak at 6.9% during the second quarter of 2022 and to decline thereafter until falling to 2.7% in 2023.

The weakening economic prospects for Europe is naturally impinging on the monetary policy decisions by the European Central Bank. The ECB needs to balance the need for tighter policy to supress the upsurge in inflation to record levels against the prospect of the economic implications for such tighter monetary policy decisions. Although several officials from the ECB have clearly indicated that rates will move above zero before the end of the year from the present level of minus 0.5%, there are continued doubts over further hikes beyond that level due to the uncertainty over the growth outlook as a result of the war in Ukraine.

Nonetheless, a number of investment banks are predicting that sometime during the course of 2022, the euro will reach parity against the US dollar for the first time in two decades. This will likely make matters worse for the eurozone economy as a weaker euro would lead to higher imported inflation – a point that was also brought up this week by a member of the ECB Governing Council who warned that “a euro that is too weak would go against our price stability objective.”

The US dollar also exhibited strength towards virtually all other major currencies. The US dollar index, which measures the US Dollar’s strength against a basket of other currencies, has surged to a near 19-year high. For example, against the Japanese yen, the US Dollar has risen more than 13% so far this year.

A stronger US Dollar has various implications for the global economy. On the one hand, it makes US exports more expensive which may lead to a decline in revenue and profits across some of the large US exporters. Many of the US multinational companies generate sizeable profits from overseas so a stronger dollar is not a positive sign for US companies. For example, the largest company in the US by market value – Apple Inc – generates nearly two-thirds of its sales outside the US and therefore a stronger US Dollar will impact the company’s profit margins. Similarly, Google’s parent company – Alphabet Inc – generates more than half of its sales from outside the US and therefore such companies will suffer from a strengthening US Dollar.

In contrast, European companies with high exposure to North America may benefit from a weaker euro and a stronger US Dollar. This may help some of the most renowned automobile companies such as Volkswagen Group, Mercedes Benz and BMW.

A rising US dollar tends to tighten financial conditions especially for emerging markets as they would face higher repayment burdens for US dollar-denominated debt. Moreover, a stronger US Dollar results in higher commodity costs for non-US consumers which could in turn lead to subdued consumer demand.

One of the positive aspects of a stronger US Dollar is that it causes a decline in consumer inflation in the US. As such, if the value of the US Dollar continues to rise, the Federal Reserve may not need to tighten monetary policy as aggressively as anticipated which would be welcome news across various asset classes.

Financial markets are essentially dealing with three major themes, namely, persistently high levels of inflation, slower economic growth and tighter monetary policy. By raising interest rates sharply when the US Dollar was already helping to pull down inflation, the Federal Reserve may be driving the economy into a recession which is one of the key concerns affecting investor sentiment.

The upcoming monetary policy meeting by the ECB on 9 June is likely to be one of the main factors influencing the EUR vs USD movements in the months ahead together with further economic data across the world most especially inflation data in the US.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.