The impact of IFRS 16

In last week’s article I mentioned that the calculation of certain financial ratios will be impacted as from the 2019 financial year due to the adoption of IFRS 16.

IFRS 16 has been described as the most wide-ranging change in accounting standards in several years and due to its material impact on the key performance indicators and financial ratios of certain companies, it is important to explain the background of this new accounting standard.

The International Accounting Standards Board issued IFRS 16 ‘Leases’ in January 2016 with an effective date of 1 January 2019. The new standard, which replaces its predecessor known as IAS 17, requires the lessee to recognise almost all lease contracts on the balance sheet as finance leases – the only exemptions are for certain short-term leases and leases of low-value assets.

Under the previous accounting standard, a lessee had to make a distinction between a finance lease (which is recognised on the balance sheet) and an operating lease (which was an off-balance sheet item).

Leasing is an important and widely used financial solution since it enables companies to access and use property and equipment without incurring large cash outflows immediately. It is also the only way for companies to obtain the use of a physical asset which is not available for purchase.

For companies that lease ‘big-ticket’ assets such as properties, aircrafts, trains, ships and equipment, the impact on the financial results will be significant.

IFRS 16 will affect the financial statements since with effect from 1 January 2019, a company will have to recognise on its balance sheet (or statement of financial position) a ‘right-of-use’ asset as well as a lease liability which upon initial recognition, will equate to the present value of the future lease payments.

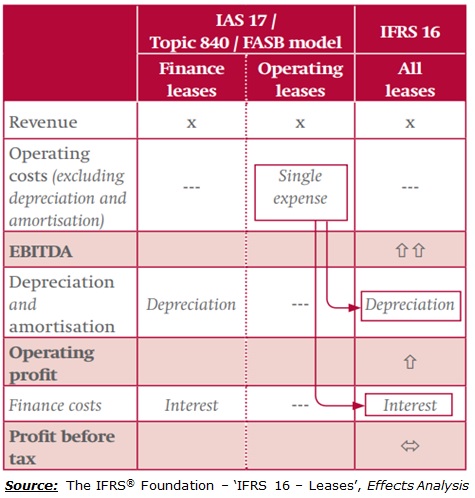

Furthermore, in the income statement, the lease expense will no longer be accounted for within operating expenses as was the case until 2018 using the previous accounting standards. Instead, the lease expense will now be treated partly as amortisation and partly as finance costs. In essence, annual leasing expenses will move down the profit and loss account and therefore lease-related charges will not be included within earnings before interest, depreciation and amortisation (EBITDA). This figure, which has become a regularly used metric to gauge the operational profit of a company, will therefore automatically increase.

Moreover, total debt is also expected to increase as all leases will now be treated as finance leases and hence will be incorporated in the calculation of a company’s total borrowings.

So how will this impact the commonly-used financial ratios? The adoption of IFRS 16 will generally lead to an improved interest coverage ratio (given the higher increase in EBITDA than finance costs) and a weaker net debt to EBITDA ratio (given the higher increase in borrowings than in EBITDA), keeping everything else unchanged.

Moreover, many companies have opted not to restate previous years’ figures (under the ‘modified retrospective approach’) which will make a comparison with prior years even more difficult. However, although some performance measures such as operating profit, EBITDA and operating cash flows would improve, the underlying cash flows or business activity will not change.

On the other hand, since this new financial reporting standard requires companies to place leases on balance sheets, those commentators in favour of the change argue that it will give all stakeholders (lessors, suppliers and financiers) sight of all assets and liabilities that had been previously hidden off-balance sheet. The overall objective of the new reporting standard is to improve the comparability across different companies and the accuracy of a company’s financial statements.

In view of the impact on certain key performance indicators (KPI) and financial metrics, some may argue whether EBITDA should continue to be used as one of the main important KPI’s.

In view of these changes, IFRS 16 could therefore have profound effects on several financial metrics used by several stakeholders. In the bond market, analysts generally gauge the level of overall indebtedness and leverage by calculating the gearing ratio in various manners with the net debt as the main component. Since the net debt will rise due to the recognition of the lease liabilities, it will increase the level of gearing and indebtedness compared to prior year figures.

How does IFRS 16 impact those companies listed on the Malta Stock Exchange? At first glance it would seem that the companies that are impacted mostly are Medserv plc, PG plc, Malta International Airport plc, Grand Harbour Marina plc, GO plc and BMIT Technologies plc.

While Medserv had opted for an early adoption of IFRS 16 as from 2017 recognising a lease liability of €25.9 million, the other companies will all be adopting the new standards as from the current financial year. The 2018 annual report of most of the companies already made certain references to the adoption of IFRS 16. For example, GO plc expects to recognise a ‘right-of-use’ asset and lease liability of €38.3 million. Moreover, GO’s pre-tax profit in 2019 is expected to increase by €0.46 million from €31.7 million in 2018 and EBITDA to increase by €3.9 million from €69.5 million in 2018 simply due to the changes in the accounting treatment of leases introduced by IFRS 16. Furthermore, although there is no overall impact on the cash flow statement, cash from operating activities is expected to increase by €3.9 million whilst cash from investing activities is expected to decrease by an equivalent amount as the repayment of the principal portion of the lease liabilities will be classified as cash flows from financing activities rather than within operating activities.

Across the bond market, the issuers that are most impacted (apart from Medserv plc and Grand Harbour Marina plc) are Premier Capital plc, 1923 Investments plc, Hudson Malta plc, United Finance plc and Dizz Finance plc. The Financial Analysis Summaries of most of these companies all made reference to the adoption of IFRS 16 providing varying levels of information.

It would possibly be best for investors to understand the impact of IFRS 16 by publishing the financial ratios and metrics of a specific company. In my view, Premier Capital plc is a very good case study due to the significant leases in place across its wide portfolio of restaurants. As I had explained in some of my articles over the past two years, Premier Capital is among the strongest bond issuers in Malta given its very high EBITDA generation compared to its net debt. In fact, the net debt to EBITDA multiple in 2018 was of only 1.5 times (2017: 1.81 times) implying that the overall net debt can be fully repaid in a mere one and a half years assuming that operating profits are sustained at current levels. The FAS published by Premier Capital plc a few weeks ago indicates that the EBITDA will rise by 48.5% during the current financial year (from €38.4 million in 2018 to €57.1 million). However, the significant rise in EBITDA is mainly due to the adoption of IFRS 16 since overall revenue will rise by 15.1% to €338 million. Moreover, the impact of IFRS 16 is also evident from the sizeable increase in depreciation from €12.4 million to €22.8 million and in finance costs to €6.6 million from €3 million in 2018 notwithstanding a decline in bank borrowings and bonds in issue. Premier Capital is recognising lease liabilities of €76.5 million which will result in a significant increase in the net debt to €145 million in 2019 from only €56.2 million in 2018. Using the traditional metrics, the interest cover will deteriorate from 12.6 times in 2018 to 8.6 times in 2019 and the net debt to EBITDA multiple will likewise deteriorate from 1.5 times to 2.5 times. Despite this, the metrics are still among the strongest across the bond issuers in Malta.

The interim financial reporting season continues today with the publication of the half-year results of Malta International Airport plc. The adoption of IFRS 16 adds another important dimension to the current reporting season. Hopefully, the equity issuers which do not publish a Financial Analysis Summary will provide detailed explanations on the impact of IFRS 16 on their financial statements with a clear distinction between debt obligations and lease liabilities.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.