The resilience of core Maltese banks

The Central Bank of Malta (CBM) published the 12th edition of the Financial Stability Report (FSR) on 27 August. The lengthy study reviews and assesses the financial conditions and developments of the financial system in Malta. It evaluates the resilience of the system and identifies sources of potential systemic risk. The FSR is published in August on an annual basis followed by a mid-yearly update published in December.

Investors should be made aware of the key findings of the report on an annual basis since as the report explains, “a sound and robust financial system is the cornerstone of the national economic infrastructure as it fosters the economic growth potential of a country”.

The FSR takes on added importance this year since it also appropriately highlights that “the COVID-19 pandemic poses the biggest test to the resilience of the Maltese financial system since the Great Financial Crisis”.

Today’s article highlights a number of findings of what the CBM classifies as the ‘core domestic banks’, namely APS Bank plc, Bank of Valletta plc, BNF Bank plc, HSBC Bank Malta plc, Lombard Bank Malta plc and MeDirect Bank (Malta) plc. Four of these six core domestic banks have securities listed on the Malta Stock Exchange and therefore the investing community has access to their semi-annual financial statements via regular announcements which enable them to closely follow trends in their performance and financial strength.

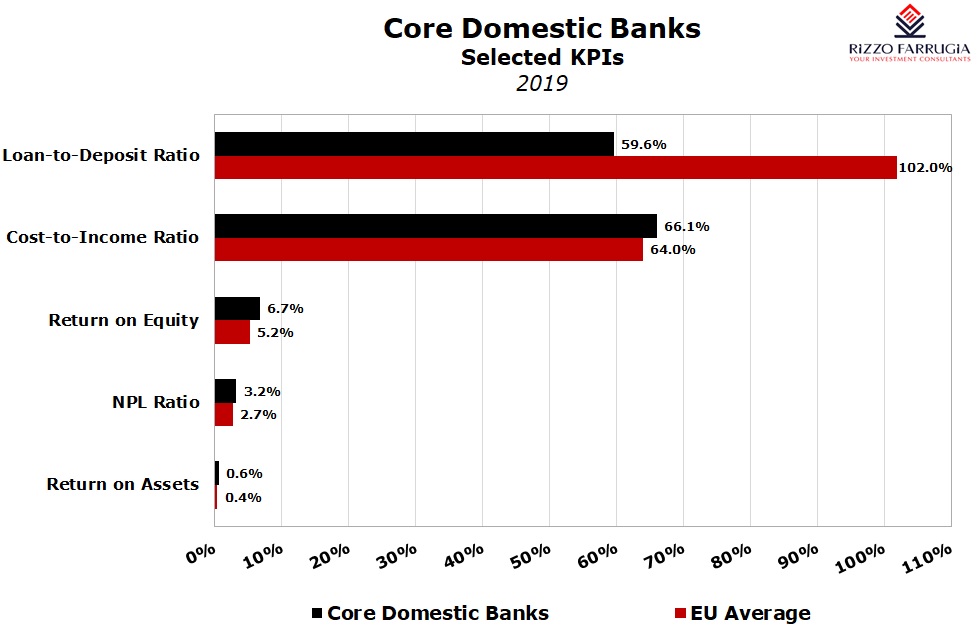

In the review of the 2019 performance of the financial system, the FSR notes that the profitability of core domestic banks improved in 2019, with pre-tax profits rising by just over 20% to a combined €200 million helping the post-tax return on equity (ROE) and return on assets (ROA) increase slightly to 6.7% and 0.6% respectively, surpassing the EU averages of 5.2% and 0.4%. Despite this relative outperformance, the returns on equity generated by Maltese banks dwindled over the years. In fact, until a few years ago, as highlighted in several of my articles in the past, the ROE of most of the core banks was well in excess of 10%.

An important contributor to the improved returns of core domestic banks in 2019 was the significant decline in net impairment losses mainly reflecting lower bad debts written-off and a corresponding reversal of provisions related to these bad debts recorded in previous years. The overall non-performing loan ratio improved marginally to 3.2% in 2019 although this remained above the average of 2.7% in Q4 2019 for banks monitored by the European Banking Authority.

On the other hand, the FSR also indicates that the operational cost-to-income ratio deteriorated to 66.1% in 2019 as operating expenses increased while gross income declined marginally. This ratio is broadly in line with the EU average of 64% and reflects the highly challenging operating environment across the sector amid continuous downward pressures on income coupled with the huge requirements for local banks to continue reshaping their business and invest in new technology.

Some interesting observations emerge from the balance sheet structure of the core domestic banks. As at the end of 2019, total assets reached 186.7% of Malta’s Gross Domestic Product (GDP). The FSR reiterated that the core domestic banks have an “abundance of liquidity” as placements with the CBM were one of the main drivers behind the growth in assets increasing to around 17% of assets.

The six core domestic banks became more focused on business activities in Malta as their foreign assets declined to just over 25% of their overall balance sheets. The majority of these foreign assets comprise investments in sovereign bonds as well as bank bonds.

As one would expect, customer loans remained the largest asset component of the balance sheets of the core domestic banks accounting for around 48% of total assets. The report explains that the continued expansion in the loan book of the core domestic banks was largely driven by mortgages.

Moreover, almost 90% of the loan book of core domestic banks is channelled towards residents and the increase in mortgage lending continued unabated in 2019 as it rose by 10.3%. Consequently, the share of resident mortgages increased further to 51.3% of resident loans. Although lending to construction and real estate grew by 7.6%, its share of resident lending increased marginally to 13.3%.

Meanwhile, customer deposits remained the preferred funding source for core domestic banks, financing just over 80% of assets in 2019.

Another interesting observation is that the weighted average interest rate on loans fell by 0.2 percentage points to 3.6% while that of deposits remained relatively unchanged at 0.3%, thus contributing to a further contraction in interest margin.

With respect to the capital base, the Tier 1 capital ratio of the core domestic banks continued to improve during 2019, rising by a further 1.4 percentage points to 17.4% as at end of 2019.

While the latest report published last month is based on the financial data for 2019, given the threat of the pandemic to several sectors of the economy and thus on the resilience of the Maltese financial system, the data for 2020 and also 2021 will be much more important to analyse. In fact, the FSR highlights a number of downside risks since the “adverse repercussions on the revenue generation of various companies” leading to an “economic shock” will result in a weakening in bank profitability “as the positive trend in asset quality observed since 2015 is likely to be reversed, with banks needing to step up further their provisioning levels”. This has already been evident in the interim financial statements published by Bank of Valletta plc, HSBC Bank Malta plc as well as MeDirect Bank (Malta) plc, and to a lesser extent, of APS Bank plc and Lombard Bank Malta plc.

Moreover, the FSR notes that “the prolonged low interest rate environment, coupled with lower fees and commission income, as well as possible higher market funding costs amid slowdown in credit, are all expected to impact the profitability of credit institutions”.

The report also indicates that the leverage of many companies is likely to rise as they will “increasingly resort to borrowing from banks or the capital market as their internal funds dry up”.

The CBM conducts regular stress tests and scenario analysis to assess the resilience of the domestic financial system to extreme shocks, under different hypothetical scenarios. In view of the COVID-19 pandemic, the CBM modified its stress testing frameworks to assess the impact of the pandemic on banks’ solvency and liquidity positions. The concluding remarks of the lengthy explanation to the stress test results indicate that “the banking system in general appears to be resilient against the contemplated scenarios”. However, the CBM warns that “the duration and extent of the pandemic remains unknown and thus any potential further deterioration in the macroeconomic environment would likely exacerbate the adverse impact on the results”.

More recently, following the publication of the Times of Malta editorial of 3 September which concluded by requesting “a reassurance that our banks will continue to be solvent”, the CBM issued a further press release referring to the conclusions of the FSR and highlighting the fact that “the resilience of the banking sector has improved and the sector entered the pandemic phase with healthy capital levels and strong liquidity" thereby providing the necessary reassurance that domestic banks are indeed solvent.

During the great financial crisis of 2008/9 when many large and well-known international banks required state bailouts to remain afloat, many observers expected Maltese banks to also require emergency funding. However, this was not needed given the prudent business model of the core domestic banks which over the years remained reliant on retail deposits for funding. Although the impact of COVID-19 on the global economy and also on Malta will possibly lead to a deeper recession than that experienced 11 years ago, and will likely have a long-lasting impact on certain sectors of the economy, it is positive to note the resilience of Maltese banks and their critical role in providing quick support and assistance to businesses. Nonetheless, the forthcoming period will indeed be crucial for the local core domestic banks to mitigate the repercussions of the economic shock. This will help to ensure the continued soundness of the Maltese financial system. Concurrently, banks need to also pursue any initiatives aimed at restoring more positive returns to shareholders.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.