The Sterling rally

Boris Johnson’s Conservative Party secured its best election result since 1987 paving the way for Britain to leave the European Union by the end of next month.

The value of Sterling was very volatile in recent months and vulnerable to the outcome of the election. In fact, an international currency strategist had published an article in recent weeks explaining that a result that paves the way to a Brexit deal between the UK and the EU could send the pound firmly higher while a no-deal Brexit could force Sterling to slump. The worst scenario was a hung parliament whereby neither Prime Minister Boris Johnson’s Conservatives nor opposition leader Jeremy Corbyn’s Labour party gets a majority adding further uncertainty to the country’s economic outlook.

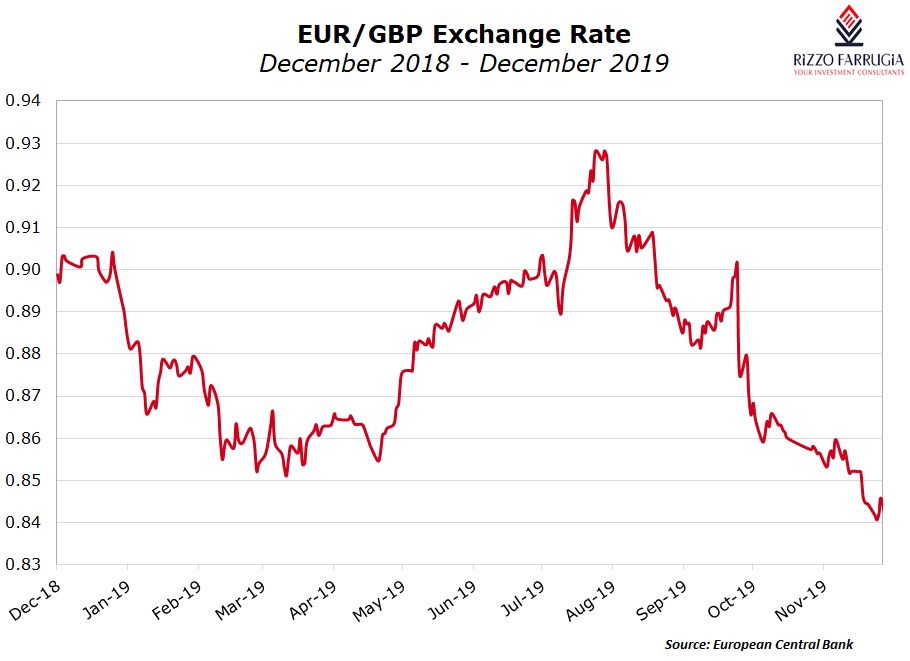

In the run-up to the election held last Thursday, sterling had rallied consistently from the lows seen over the summer in the peak of the political crisis. In August and early September during the lengthy Parliamentary debates which led to the Tories losing majority in the House of Commons the value of the British pound had dropped to its lowest levels since 2016.

Sterling began to recover consistently since early October once a positive outcome emerged on talks with the Irish. Thereafter, once an election was called and with early indications that the Conservatives could secure a majority in the House of Commons, the value of the British currency continued to strengthen.

The vulnerability of the Sterling exchange rate to the outcome of the election was very evident again early last week. As the polls continued to indicate a clear victory for the Conservatives, sterling had traded at its highest level since March 2019 against the US Dollar and at a two-and-a-half-year high against the euro (representing a 10% gain from the lows in summer 2019). However, two days before the election, sterling had lost some of its previous gains after Boris Johnson’s election lead was slashed by more than half in the closely watched YouGov opinion poll.

On Friday early morning, it was immediately evident from the exit polls that Prime Minster Johnson was set to win a commanding majority in Britain’s Parliament giving him the power to deliver Brexit after 46 years of membership within the European Union. Sterling continued to rally following the wider-than-expected margin of victory for the Conservatives with the value of the British Pound rising to above GBP0.84. This is the highest level since the 2016 referendum but still substantially weaker compared to the exchange rate of GBP0.70 in 2015.

The renewed upturn of Sterling on the news of the strong majority of Boris Johnson’s party came about since it will enable the Prime Minister to carry out an orderly Brexit from the EU by 31 January 2020 thereby reducing the risk of a hard Brexit.

The share prices of many companies listed on the London Stock Exchange also enjoyed a strong rally last Friday which continued on Monday following the result of the election with the major outperformers being the homebuilders, banks, retailers and utilities.

The equities of the companies that were vulnerable to a Labour-led nationalisation drive fared particularly well in the aftermath of the clear election victory. Labour had threatened to take back into public ownership many of the services that had been privatized by Margaret Thatcher and her successor John Major between 1980 and 1997. The share prices of BT Group, Centrica, SSE, Severn Trent and National Grid rallied in recent days following the election result.

The FTSE 250 index which includes many more domestic-focused companies outperformed the FTSE 100 index. At the start of trading last Friday, the FTSE 250 index rallied by 5% to reach a new record high. On the other hand, the strength of the British pound negatively impacted a number of the FTSE 100 constituents that derive the bulk of their revenues from outside the UK.

Sterling’s continued rally beyond current levels could be capped by the fact that the UK still has no trade deal with the EU, which is likely to limit appetite for UK assets going forward. On the other hand, however, in the electoral manifesto Boris Johnson had promised a sharp rise in public spending in various areas such as hospitals, the police force, schools and renewable energy. Should this program be fully implemented, it would represent a major fiscal stimulus package for the British economy.

Although it is almost certain that Brexit will now take place on 31 January, Boris Johnson then faces another difficult Brexit deadline - to negotiate a trade deal with the EU by the end of 2020 when the current Withdrawal Agreement (the Brexit bill) expires. The current arrangement states that if Britain wants to extend the transition period beyond the end of next year, the government must give notice to Brussels by the end of June.

Boris Johnson consistently promised he will be able to secure a trade deal with the EU by the end of 2020 or leave without one. As such, the UK could still have a hard exit from the single market and customs union at the end of 2020 if the UK and the EU do not manage to strike a free-trade agreement by the time the transitional period ends in December 2020.

Trade talks with the European Union are therefore set to drag on for several months. The political debate about the terms of Britain’s departure from the EU will be at the forefront once again in the near term and any delays could hit the value of the pound and share prices of the domestically-focused companies. In fact, on Tuesday morning, the pound dropped by more than 1% after the British media reported that Prime Minister Boris Johnson will add a revision to the Withdrawal Agreement Bill that would explicitly rule out any extension to the transition period beyond December 2020. Financial markets are seemingly concerned that the government may not be able to agree a new trade deal with the EU by the end of 2020.

UK asset prices will therefore remain vulnerable to headline risks as Boris Johnson’s Conservative government will turn its attention on negotiating a trade deal with the EU. Ultimately, the future performance of all asset classes in the UK will reflect the terms of the country’s relationship with its largest trading partner, the EU, and the outlook for the economy.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.