The Value vs Growth Debate

Over recent years, the international financial media gave a lot of prominence to the debate across the investment community regarding the preferred style of investing.

The concept of value investing dates back to at least the 1920’s, when Benjamin Graham and David Dodd were finance professors at Columbia University and later published the book “Security Analysis”, which for many years has been regarded as one of the most influential financial books ever written. The book revealed the fundamental principles of value investing. Value investors normally purchase a company’s shares when the price is below its estimated intrinsic or fair value and hold the shares until its market price rises to reflect this valuation. Value stocks usually have low price-to-book (P/B) ratios and low price-to-earnings (P/E) ratios. One of the most renowned value investors over the years has been Warren Buffett who successfully adopted this strategy through his investment vehicle Berkshire Hathaway Inc.

On the other hand, growth investing is based around a strategy that focuses on fast growing companies with less emphasis on current pricing metrics. A growth company is expected to increase its profits or revenues faster than the average business in its industry. Companies that are able to do so for extended periods stand to command higher share prices because investors are willing to pay a premium for such above-average returns. Growth companies reinvest most or all of their profits into growing the business rather than distributing a dividend to shareholders.

During the past 10 years, growth companies in the US largely outperformed those within the value category as the big tech companies such as Apple, Microsoft, Alphabet and several others experienced exponential growth and now dominate the top positions within the S&P 500 index.

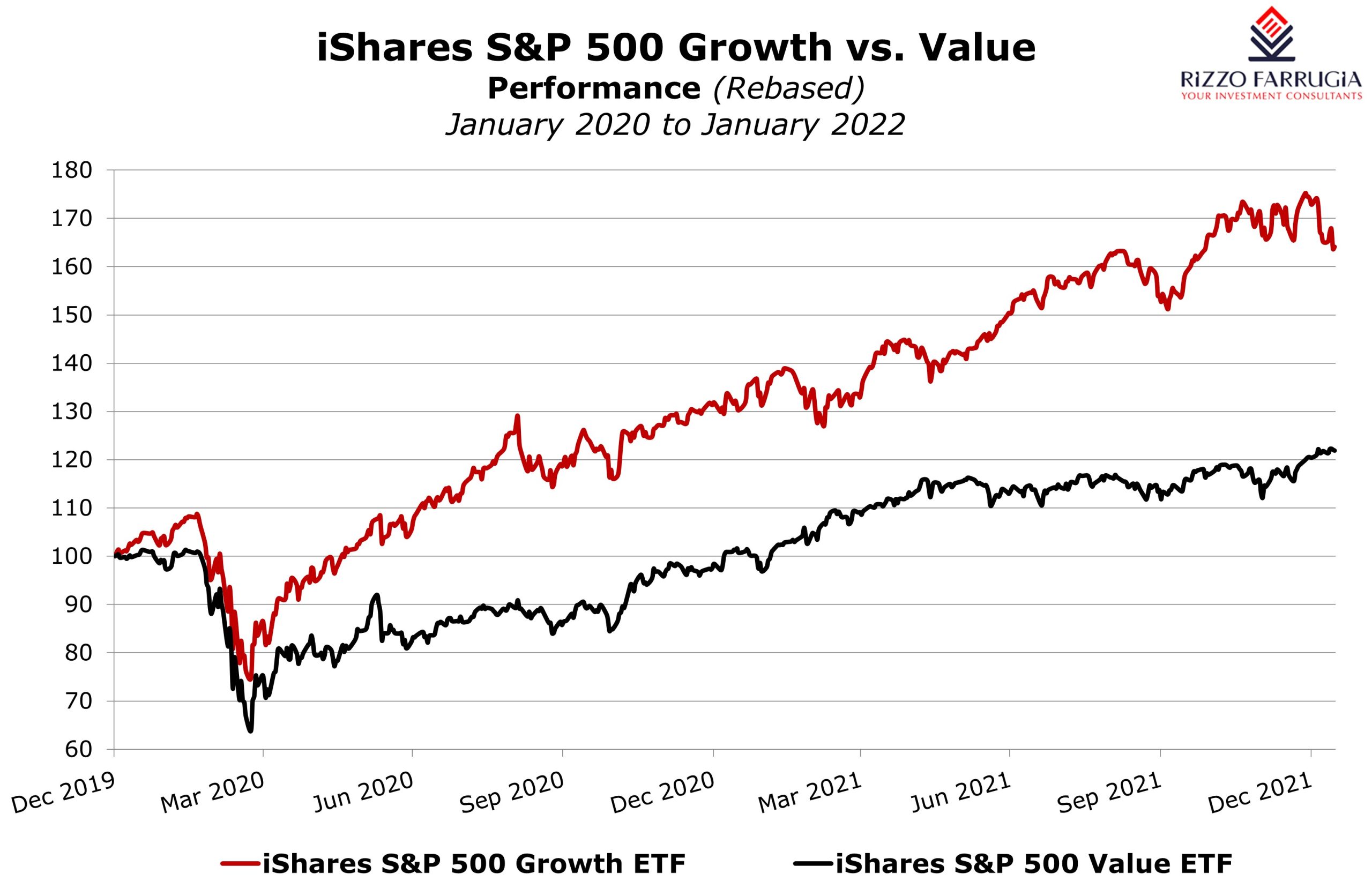

Investors can gain exposure to both styles of investing through a number of exchange traded funds such as the iShares S&P 500 Growth ETF and the iShares S&P 500 Value ETF.

Apart from the extraordinary growth in revenue and profitability of the big tech firms, another factor that helped to boost the valuation multiples of such growth companies was the sharp decline in the 10-year US Treasury yield. This dropped to an all-time low of 0.32% in March 2020 during the early days of the COVID-19 pandemic compared to the level of 1.8% today. Lower bond yields make the value of future earnings for growth stocks more attractive.

In fact, despite the widespread meltdown across equity markets in early 2020, growth companies still outperformed the value companies. This superior performance continued during the sharp recovery in the first half of 2020 following the wild market gyrations at the start of the pandemic.

However, following the unprecedented levels of fiscal and monetary stimulus in the US which enabled the US economy to rebound quicker than anticipated from the virus-induced recession, coupled with the positive news from the vaccine front in late 2020, value stocks largely outperformed growth companies between September 2020 and April 2021.

In fact, the iShares S&P 500 Value ETF registered a gain of 33.3% between October 2020 and May 2021 compared to the 19.3% rise in the iShares S&P 500 Growth ETF. This outperformance was however short-lived as growth companies performed more positively again during the final 7 months of 2021. The iShares S&P 500 Growth ETF rallied by 21.4% between June 2021 and December 2021 compared to the mild appreciation of 4.5% in the iShares S&P 500 Value ETF.

In recent years, many investors re-examined their exposure to value investing because of the extraordinary span of underperformance compared to growth companies and the sheer dominance of a number of the big tech companies. In fact, this debate came to the fore once again as a result of the spike in inflation and the clear path to monetary policy tightening by the Federal Reserve during the course of 2022. This is naturally resulting in an upturn in the 10-year US Treasury yield which is having a negative impact on valuation multiples of growth companies.

Inflation seems to be much higher and more persistent than most central banks had expected. On the other hand, many international economists and financial market commentators believe that despite the increases in interest rates being planned by the Federal Reserve, a period of negative real rates will persist in the long term. This environment is conducive to long-term growth in equity markets.

While some investors may favour one investing approach to another, both strategies can indeed be complementary and it would make sense to have exposure to both styles as part of a diversified investment portfolio.

Instead of fixating on a rigid approach to either value or growth companies, some other very successful investors advocate to focus on companies with strong fundamentals having high margins and superior pricing power. Essentially, the basis to a successful investing strategy is to own great companies for the long run without having overpaid for such shares at the outset.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.