Warren Buffett’s favourite stock

Berkshire Hathaway Inc (the investment vehicle of Warren Buffett) published its Q2 financial results on 8 August. Meanwhile, regulatory filings were published late last week showing the changes made to Berkshire Hathaway’s stock portfolio on a quarterly basis. The quarterly publications of the financial results and the updated portfolio are very closely-watched events by many financial journalists and analysts given the remarkable track record of Warren Buffett over the years. Berkshire produced a compound annual return of 20.3% over the past 55 years, which equates to an aggregate gain of more than 2,700,000%.

The recent announcements regarding Berkshire Hathaway were also widely anticipated by many followers and critics alike to understand the changes made to the portfolio in the midst of the COVID-19 pandemic when share prices tanked during the latter part of Q1 but then rallied remarkably during the second quarter of the year.

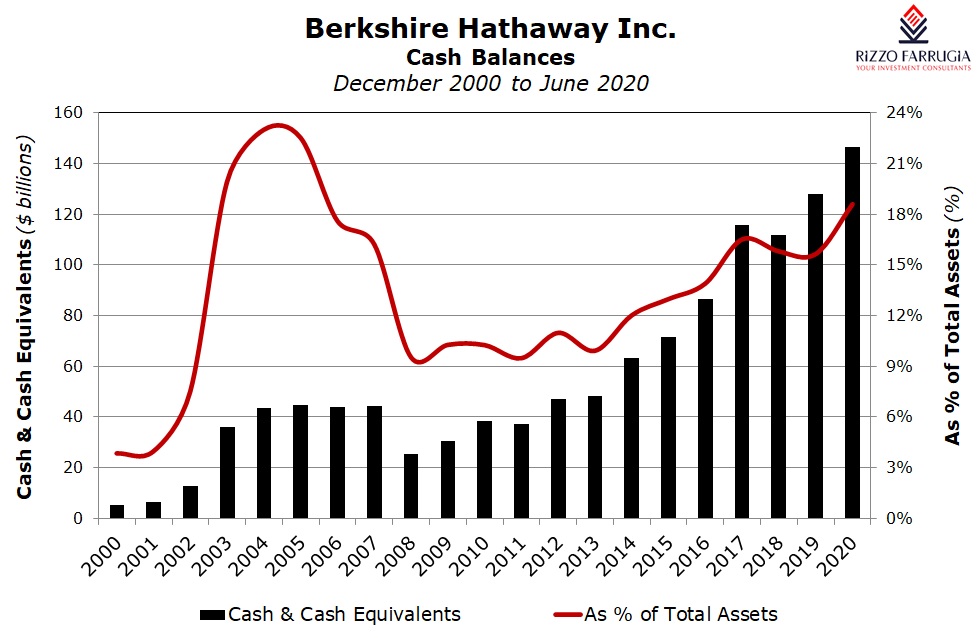

Berkshire Hathaway reported a rise in profitability during the second quarter of the year as the sizeable increase in the value of the investment portfolio (led by the 43% rally in Apple’s share price) offset both a huge write-down of its largest manufacturing business and also a decline in operating profits. Berkshire recognised a USD9.8 billion goodwill and intangible asset impairment charge against its acquisition of Precision Castparts in 2016 for USD32.1 billion. The aerospace parts and systems supplier has been among a large group of companies that have suffered from plunging demand for aircraft in the wake of travel bans and reduced flight traffic. Berkshire reported that it held almost USD146.6 billion in cash, cash equivalents and short-term fixed-income investments as at 30 June.

Berkshire Hathaway is required to provide updates to the Securities and Exchange Commission (SEC) on a quarterly basis regarding its portfolio of publicly traded companies. During Q2 2020, the value of Berkshire Hathaway’s investment portfolio increased by circa 15% from USD176 billion to USD202 billion. The top five positions account for more than 75% of the overall portfolio. The largest position is in Apple Inc (valued at USD90 billion as at 30 June 2020) followed by Bank of America (valued at USD22 billion), Coca-Cola (valued at USD18 billion), American Express (valued at USD14 billion), and Kraft Heinz (valued at USD10 billion).

One of the major revelations from the quarterly portfolio update was the sale of sizeable chunks of shares of some of the largest US banks. Berkshire Hathaway reduced its stakes in Wells Fargo & Co and JPMorgan Chase & Co and sold out completely of a small investment in Goldman Sachs Group Inc. On the other hand, in recent weeks, given Berkshire also holds in excess of 10% of the issued share capital of Bank of America Corp, it had to separately announce that it continued building its stake in the second largest bank in the US. In recent weeks, Berkshire purchased additional shares for a cost of more than USD2 billion increasing its stake to 11.9% for a current value of more than USD27 billion. The timing of the purchases of Bank of America shares in July following the sizeable reduction in the stakes of the other banks during the second quarter of the year will be scrutinised by many international analysts in the near future.

Another very surprising element within the portfolio changes during Q2 2020 was the addition of a gold mining company. Over the years Warren Buffett openly criticised the concept of investing in gold. However, Berkshire Hathaway revealed an investment in Barrick Gold Corp, one of the world’s largest mining companies. An investment of USD563.6 million was made in the Canada-based gold mining company representing a stake of 1.2% of the company.

At the Annual General Meeting in May, Warren Buffett had already disclosed that Berkshire sold its entire stakes in four airline companies by claiming that due to the pandemic, the industry dynamics changed completely. Warren Buffett was heavily criticised for selling these airline stocks at a significant loss for shareholders.

Apart from the criticism regarding airline stocks, Warren Buffett was also condemned for retaining such a huge level of cash and not investing in various technology companies as Berkshire Hathaway underperformed the S&P 500 in more recent years mainly due to the dominance of a handful of technology companies. However, few people realise the sheer amount of gains accumulated over recent years in Berkshire’s largest holding within its portfolio. In fact, Apple Inc accounts for circa 44% of the portfolio of publicly traded companies. Berkshire owns 6% of the issued share capital of Apple and only started acquiring Apple shares during the first quarter of 2016. The investment vehicle continued to regularly accumulate additional Apple shares until the first quarter of 2018 with an overall average cost of USD141 per share compared to a current market price of Apple of over USD450.

Although in early July, Berkshire invested USD9.7 billion to buy Dominion Energy's natural gas transmission and storage assets and Berkshire conducted further purchases of Bank of America shares in recent weeks, it seems pretty evident that Warren Buffett believes that Berkshire Hathaway is undervalued and therefore one of his favourite investment ideas at the moment. In fact, during the second quarter of 2020, Berkshire bought back USD5.1 billion of its own shares, which is significantly higher than the USD1.7 billion the company spent repurchasing its shares in the first quarter of 2020 and the USD4.9 billion Berkshire Hathaway spent buying back its own shares during all of 2019. Coupled with a buy-back of almost USD1 billion worth of shares during the second half of 2018, Berkshire Hathaway repurchased almost USD13 billion worth of its own shares during the past two years.

The recent regulatory filings reveal that the average price paid for the Berkshire Hathaway ‘B’ shares during the second quarter of 2020 was circa USD176 per share while the net asset value of Berkshire as at the end of June 2020 was USD163 per share. Since then however, the share price of Apple continued to rally by over 25%, which therefore boosted the net asset value of Berkshire by circa USD22 billion. During the second quarter, Berkshire shares were trading at their lowest price-to-book multiple in the past eight years so this may have contributed to the decision to repurchase such a large amount of shares.

Share buy-backs are a very popular tool across international financial markets as a means of enhancing shareholder returns also in conjunction with cash dividends. The future profits of a company conducting a buy-back are distributed among fewer shares leading to a rise in the earnings per share thereby giving more value to shareholders.

Despite the recent investments in Dominion Energy, Barrick Gold and Bank of America, there was a general lack of buying activity by Berkshire Hathaway despite the market gyrations and given the huge cash pile available. Various market commentators believe that this is an indication that equities are overvalued and due for a correction. On the other hand, the fact that Berkshire conducted such a large share buy-back in recent months also provides a useful insight on Warren Buffett’s beliefs on the underlying value of Berkshire Hathaway.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.