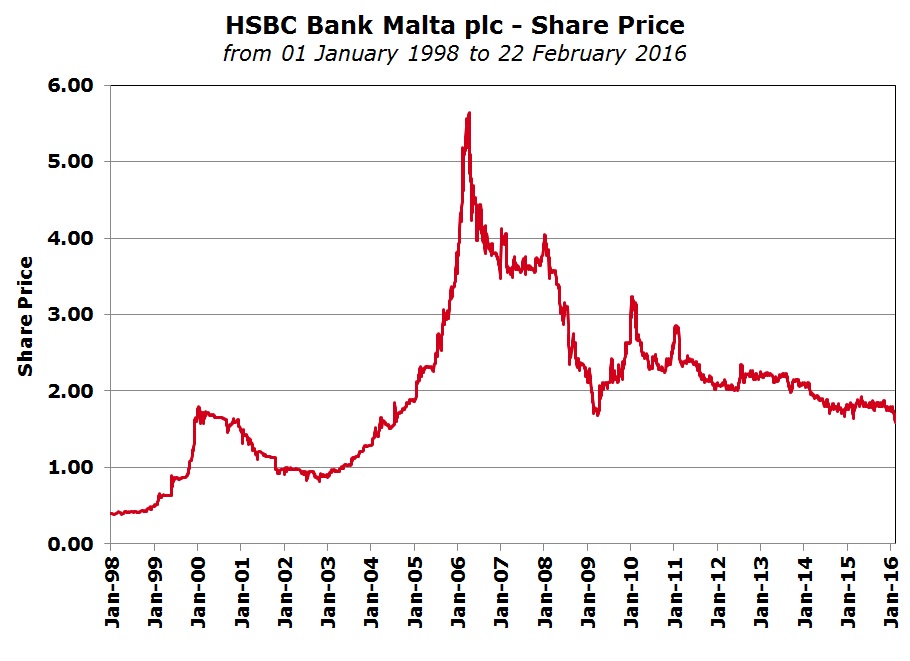

HSBC Malta share price at its lowest level in almost 12 years

Last week, the share price of HSBC Bank Malta plc dropped below the €1.60 level for the first time in almost 12 years. More precisely, the equity had not traded at these levels since July 2004.

Many investors may not be aware of this fact and may also be wondering what caused the equity to drop to this multi-year low. Today’s article aims to shed light on some of the factors that may have contributed to the decline in the share price of HSBC Malta in recent years.

HSBC acquired Mid-Med Bank plc in June 1999 and the Bank’s profitability increased steadily on a yearly basis from €32.4 million in 2000 to a record of €114.6 million in 2007, equivalent to an average annual increase of 31%. This extraordinary increase in profits led to the return on equity (a key measure for investors calculated by dividing profits after tax with average shareholders’ funds) to rise from 13.9% in 2000 to a high of 26.7% in 2007.

During this 8-year period, the Bank adopted a very aggressive dividend policy with the payout ratio increasing from 25% in 2000 to 50% in 2003 and 2004 and increasing further to 75% in the following three years until 2007. Besides this steep rise in ordinary payments to shareholders, HSBC also distributed elevated special dividends between 2004 and 2007 totalling €0.317 per share net of tax during the four-year period.

It is therefore not surprising that the steady growth in profits coupled with the very handsome dividend distributions led to a steep rise in the share price of HSBC Malta. The equity had rallied from an adjusted price of €0.639 in April 1999 at the time of the news of the planned takeover by HSBC to a high of €1.793 in January 2000 (also adjusted to take account of all share splits and bonus shares issues since then). This was also a time when the Maltese market experienced its first bull market. A widespread price correction took place across the Maltese equity market in 2001 and 2002 and this also coincided with the international bear market following the dot.com bubble and the September 2001 terrorist attacks in the US.

The equity of HSBC Malta declined from a high of €1.793 in January 2000 to a low of €0.816 in 2002. However, following the strong growth in profits and the extraordinary dividends to shareholders between 2003 and 2005, the equity staged its second strong upswing and jumped to a high of €5.642 in April 2006.

Apart from the profitability growth and the very generous dividend distributions, another factor that may have contributed to the bullish investor sentiment surrounding HSBC Malta were the share splits and bonus share issues. In fact, in March 2005, HSBC’s equity was split on a 2-for-1 basis and the following year, there was a 3-for-1 bonus share issue. These corporate actions may have also unduly influenced investor expectations across the local equity market.

The share price had started to correct well before the 2007 record financial results were disclosed to the market in February 2008. In fact, between the equity’s all-time high of €5.642 in April 2006 and the publication of the 2007 results in February 2008, the equity had suffered a correction of 34%.

After eight consecutive years of remarkable profitability growth between 2000 and 2007, HSBC Malta reported its first decline in profits in 2008. Concurrently, the policy of distributing excess reserves via special dividends also stopped and moreover, the ordinary payout ratio eased from 75% to 65%. The combination of these important factors together with the start of the international financial crisis, which culminated in the bankruptcy of Lehman Brothers in September 2008, led to bearish sentiment across the Maltese and international equity markets with share prices dropping heavily.

The equity of HSBC Malta declined to a low of €1.685 in April 2009 but then staged a remarkable recovery to above the €3 level in January 2010.

Notwithstanding that pre-tax profits at HSBC Malta recovered consistently from a ‘low’ of €71.2 million in 2009 to €95.3 million in 2012, the share price edge lower amid bouts of brief spikes around the time of the publication of their semi-annual financial results. The further reduction in the dividend payout ratio to between 50% and 55% between 2010 and 2012 was possibly the main reason behind the continued downward trend in the share price.

In fact, profits increased considerably between 2009 and 2012 but the return on equity was largely unchanged at 16% as the Bank held on to additional retained earnings in the light of a changing regulatory landscape.

The increased regulation across the banking industry both across the EU and also in Malta also led to additional restrictions on dividend distributions. In December 2013, the Malta Financial Services Authority revised Banking Rule 09, requiring banks to hold additional reserves against non-performing loans by holding back on dividend distributions. Dividends to shareholders halved in 2014 to a mere €0.04 per share net of tax (a far cry from the dividends of between €0.195 per share and €0.265 per share in each of the years between 2005 and 2007). The lower dividend distribution was a major factor leading to the continued underperformance of HSBC’s equity at a time when bullish investor sentiment prevailed and other local equities strongly outperformed global equity markets.

Coupled with the reduction in dividends, HSBC’s de-risking strategy led to a closure of a number of business units starting off with the sale of the card management business in late 2010 to the winding down of the fund administration/custody business as well as the trust business in early 2014. In late 2015, HSBC Malta also started the process of exiting the custody business for retail and corporate customers and the closure of their investment/stockbroking services.

While this has led to a decline in non-interest income in recent years, the full impact will be evident in the 2016 financial year. Concurrently, the increase in costs over the years is also very evident, with the cost base rising from just below €70 million shortly after the take-over in 2000 to above €90 million. HSBC Malta’s Chairman Mr Sonny Portelli made specific reference to the cost challenges in the 2014 Annual Report where he singled out “the substantial rise in regulatory costs”. In fact, in 2014 alone, HSBC Malta incurred an additional €5 million in costs mainly related to the EU wide Asset Quality Review.

The increase in costs was again evident in the 2015 financial statements published last Monday morning. Even when excluding the one-off costs of €14 million related to the early voluntary retirement scheme, operating costs still grew by 6% due to additional compliance and regulatory costs.

On a more positive note, net interest income improved by over €4 million and impairment provisions declined leading to an adjusted pre-tax profit (excluding the impact of the non-recurring voluntary retirement cost of €14 million) of €61.4 million (+18%). The major surprise was probably the increase in the dividend payout ratio to 65% which helped the final gross dividend increase by 11% over last year’s final dividend.

Equity markets generally tend to undershoot in times of fear and pessimism and overshoot in times of euphoria and very bullish investor sentiment. However, as the legendary value investors Benjamin Graham and Warren Buffet claim: “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

This is very true in the case of HSBC Malta. This analysis indicates that the decline in the share price to an almost 12-year low reflects a decline in profits to levels last seen in 2002. Hopefully, the incoming CEO Mr Andrew Beane will manage to restore growth and achieve higher profitability levels in the years ahead. However, investors must remain cognizant of the fact that the very attractive shareholder returns achieved by the bank in the past (measured by the return on equity) are unlikely to be repeated given the more challenging conditions (the negative interest rate environment and weak loan growth) and especially the tighter regulatory landscape.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.