International equity markets in correction phase

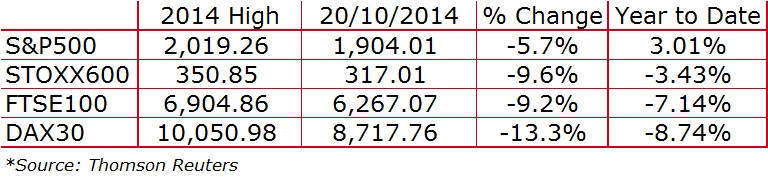

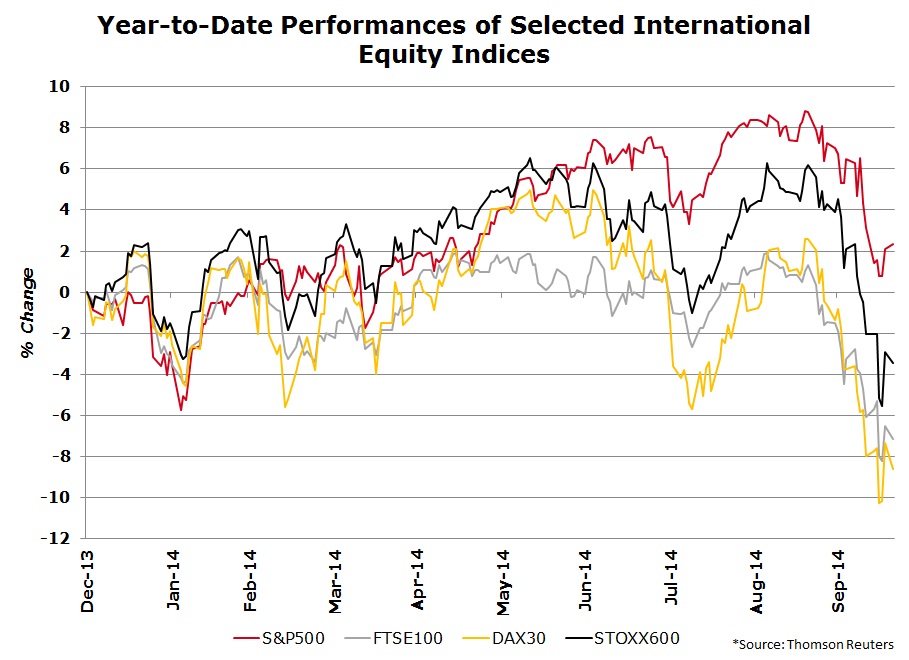

Global equity markets tumbled during the middle part of last week after poor data from the US heightened fears over the health of the global economy. The Dow Jones Industrial Average index dropped to a low of 15,855.12 points on Wednesday, down by 1,495.52 points or 8.6% from its recent high of 17,350.64 points reached on 19 September – the day of the flotation of the Chinese internet company Alibaba on the New York Stock Exchange. Likewise, the broader S&P 500 index shed 3% on Wednesday to a low of 1,820.66 points representing a 9.8% decline from the all-time high of 2,019.26 points also on 19 September.

European equity markets were harder hit last week with the FTSE MIB in Italy down 4.4% on Wednesday, the CAC 40 in France losing 3.6% and the German DAX declining by 2.8% during the day. The European Stoxx Europe 600 index, a broader measure of the equity markets across continental Europe, declined by 3.2% last Wednesday and by a further 2.9% on Thursday morning to its lowest level since September 2013. The sudden decline last week resulted in the index declining by 13.8% from its recent high on 19 September implying that the index officially entered a correction phase in less than 4 weeks.

A market correction refers to a decline of at least 10% in an index or an individual security while a bear market refers to a drop of at least 20%.

The UK’s FTSE 100 also entered correction territory as the stock market rout continued on Thursday morning with the index dropping to a low of 6,098 points compared to its recent high of 6,904.86 points on 4 September. The FTSE 100 then recovered to close the day marginally above Wednesday’s close. However, it is worth highlighting that the 2.8% slump on Wednesday represented the largest one-day fall for the UK index since June 2013 and its lowest level in the past 15 months.

Bond markets were also impacted by the renewed global turbulence. The 10-year US Treasury yield surprised many commentators and crashed to a low of 1.86% (the lowest level since May 2013) on diminishing prospects for a rate hike by the Federal Reserve as early as June 2015. Likewise, the yield on the 10-year German bund dropped to a fresh low of 0.716% last Thursday while, on the other hand, the borrowing costs of some of the eurozone’s most highly indebted members started to climb again. The yield on the 10-year Greek government bond climbed as high as 7.85% (well above the 7% level that is deemed as unsustainable) amid fresh political turmoil surrounding the country’s plans to exit its bailout ahead of schedule. Greece is hoping to leave its bailout programme early and meet its funding requirements through the debt markets rather than asking the three organisations (the European Commission, the European Central Bank and the International Monetary Fund) for more assistance. However the renewed upswing in yields is making this situation much less likely. Sovereign borrowing costs have also increased in recent weeks in Spain, Portugal, Italy and France despite the decline in German yields. This yield divergence is implying that the markets are speculating again on the prospect of a eurozone break-up.

Some investors may wonder what caused last week’s sudden volatility across equity, bond and currency markets. Data on retail sales and manufacturing activity in the US indicating that the largest economy in the world was also being hit by a global fall in demand was the catalyst behind the sell-off. This added to the other gloomy headlines over recent weeks which initially seemed to have been ignored by the market but when taken all together led to some panic movements last week.

The stagnating eurozone economy was the major focus over the summer which culminated in the German government cutting its growth forecasts for the next two years amid growing evidence that the country could slide into recession. The inflation figures across Europe at a 5-year low led to an increased likelihood of deflation. The problem with deflation is that as consumers expect prices to decline in the future, they postpone certain purchases creating a drop in demand leading to further price cuts. This knock-on effect results in a worse recession.

Moreover, the international credit rating agencies Fitch and S&P revised their outlook rating for France downward from stable to negative after the French government last week announced delays in its plans to bring the country’s finances within the parameters of the Eurozone. Furthermore, Italy, the third largest eurozone member, is likely to experience another economic contraction in 2014.

Market sentiment also weakened amid rising geopolitical tensions including the protests in Hong Kong and evidence of the spread of the Ebola disease.

Additionally, the withdrawal of stimulus measures by the US Federal Reserve (which was instrumental in reducing volatility and pushing up equity markets since 2009) and the possibility of an interest rate hike in 2015 added to financial market fragility. Recent comments from the Bank of International Settlements also created further anxiety. The BIS, the world's oldest international financial organisation aimed at promoting monetary and financial stability, explained that “global financial markets are dangerously stretched and may unwind with shock force as liquidity dries up”. A spokesperson for the BIS also indicated that the biggest worry is a precipitous sell-off in the bond markets once the US Federal Reserve and other major central banks begin to tighten monetary policy. The BIS added that this time it could be even more severe compared to the US bond market crash in 1994 when the Federal Reserve unexpectedly increased interest rates from 3% to 6% starting in February 1994 with the resultant effect that 10-year bond yields climbed from 5.2% to 8%. This naturally led to a significant decline in US government bond prices.

Currency markets also became increasingly volatile last week as the poor data from the US resulted in the Dollar dropping to a 3-week low against the euro. The US Dollar had, rallied by over 10% since 8 May, to a two-year high of USD1.2499 against the euro on expectations of an early rate hike by the Federal Reserve amid a stronger outlook for the US economy during the summer.

Following last week’s sell-off, while some commentators are viewing this as a temporary correction in a continued long-term bull market, others are arguing that it is the start of a bear market. Only with hindsight can we know with certainty what last week’s events represent. What is evident is that investors are finally digesting some of the recent gloomy headlines and as a result we should brace ourselves for much higher volatility in the weeks and months ahead.

Print This Page Disclaimer

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.