Investing in a 25-year MGS

Last Friday morning, the Treasury announced details of the two new upcoming Malta Government Stock issues as follows: (i) the 2.00% MGS 2020 (V) fungible issue and (ii) the 3.00% MGS 2040 (I). Pricing details will be announced this afternoon ahead of the offer period which closes on Wednesday 25 February at 1700 hours for retail investors.

This is the first time that the local investing public would be faced with the prospect of investing in a 25-year bond. Corporate bond issues have never exceeded a 10-year term. Meanwhile, in recent years the Treasury extended the maturity profile of MGS but limited this to a maximum duration of 20 years. A new issue with a maturity of over 20 years was expected given the downward movement in yields over recent months following the deflationary environment across the eurozone and the announcement by the European Central Bank (ECB) that a quantitative easing (QE) programme will commence in March. In fact, as explained in my articles over recent weeks, extending the maturity beyond 20 years was the only option for the Treasury to offer investors a coupon of at least 3% per annum. In my recent articles, I had also speculated about the possibility of a 30-year MGS issue since this is the maximum duration that will be covered by the upcoming quantitative easing programme.

Although two new offerings will be available for subscription over the coming days, the large majority of retail investors would undoubtedly be choosing the new 25-year bond over the shorter-term bond since the 5-year paper would not be attractive enough. In fact, this same 5-year MGS is already in existence and should the Treasury price this bond in line with the secondary market at circa 105.75%, the yield to maturity would be of just under 1% per annum. Retail investors will find it hard to part with their money at such a premium to par value also considering that the resultant yield to maturity is less than 1% per annum. This 5-year bond is directed at institutional investors, especially the banks, due to the negative deposit rates applicable to them when placing excess liquidity with the ECB. This proposition may therefore be viewed as a relatively good alternative in the present circumstances. Local financial institutions have sizeable amounts of excess liquidity as bank deposits continued to rise steeply despite the record low interest rate environment and therefore the auction for the 5-year bond should attract numerous tenders.

“…extending the maturity beyond 20 years was the only option for the Treasury to offer investors a coupon of at least 3% per annum.”

Meanwhile, the price of the new 25-year bond is unlikely to exceed par value (100%). In reality, assuming the price of the new 2040 bond is fixed at par, if one compares this new offering to the longest dated MGS currently in issue (the 4.1% MGS 2034 at 119.71% giving a yield to maturity of 2.79%), the yield differential is of only 21 basis points. Although, it is widely debatable whether the extra yield of 21 basis points is sufficient to compensate for an additional 6-year term, the assumed 3% yield seems to be out of sync with the yields published by the Central Bank of Malta for the other bonds already in issue.

Another way of analyzing this is by comparing MGS yields over the eurozone benchmark which is the German bund. An equivalent German 19-year bund is currently yielding 0.769% while the 19-year MGS, the 4.1% MGS 2034, at 119.71% gives a yield of 2.79%, representing a premium of 202 basis points over the benchmark. However, the 25-year German bund maturing in 2040 is currently yielding 0.886% and if the Treasury prices the 3% MGS 2040 at par, the yield differential over Germany is 211 basis points. Once again, it is very doubtful whether this minimal additional premium of 9 basis points is sufficient to compensate for the additional 6-year term and shows a measure of inconsistency between the pricing of the MGS’s in the market by the Central Bank of Malta and the pricing adopted by the Treasury on the primary market.

The investor reaction to last week’s announcement by the Treasury was mixed. While some investors immediately started to mobilise funds to participate in the upcoming issue even before the prices were announced, other investors were shocked at the low coupon of 3% per annum although I had opined earlier this month that the only way for the Treasury to offer a coupon of 3% or higher was to extend the term beyond 20 years. These same investors however were quick to acknowledge that they were very pleased that the value of their other MGS holdings had appreciated so much over recent weeks. This is somewhat contradictory. It indicates that many investors still do not seem to understand how bond markets truly function. As prices of bonds increase, their yields decline and vice versa. As such, since the prices of bonds on the secondary market have increased rapidly in recent months, their yields declined.

Some investors actually stated that they would prefer to wait for the next MGS issue in a few months’ time in the hope of obtaining a coupon of more than 3% per annum. If prices and yields on the secondary market remain at around current levels or prices improve further, there is no reason why the Treasury would offer more attractive terms in the months ahead.

Investors cannot expect on the one hand to benefit from rising bond prices and still be offered high coupons by the same issuers. Had the Treasury offered a higher coupon bond of say 4% without extending the maturity, this would have negatively impacted the existing securities with a sharp decline in prices on the secondary market. Surely this is not what investors would have wished.

Notwithstanding the surprise reaction by some investors, the new 25-year bond is likely to attract high demand. Retail investors have been enquiring about this upcoming MGS issue for quite a while since the last retail offering took place in July 2014. The amount on offer in the coming days at a maximum of €180 million is not huge and there may be an insufficient amount to ensure full allotment for retail investors alone. Last July retail investors had applied for €193 million in the 4.1% MGS 2034 and applications had been scaled down due to the excess demand. Should such a situation materialize once again, there will also be a crowding-out effect whereby retail investors would take all stock on offer leaving institutional investors without any allocation. This could lead to a situation whereby such institutions would have no choice but to resort to purchasing this bond on the secondary market upon listing in the weeks ahead. This is probably one of the reasons driving demand from retail investors. Moreover, the imminent launch of the QE programme by the ECB could also be adding to market speculation on future MGS price movements following the recent strong rally. Although it is not yet known how the QE programme will be conducted in Malta, it is likely that this will mirror similar programmes in the US and the UK over recent years. Their respective central banks (the Federal Reserve in the US and the Bank of England in the UK) purchased large amounts of government bonds with the resultant effect of an increase in prices and lower yields over time. In fact, some international analysts continue to claim that despite the sharp drop in 10-year German bund yields in recent weeks to 0.35%, yields may drop even further in the months ahead. A few analysts are also speculating that yields on 10-year German bunds may actually drop towards zero.

"...the assumed 3% yield seems to be out of sync with the yields published by the Central Bank of Malta for the other bonds already in issue."

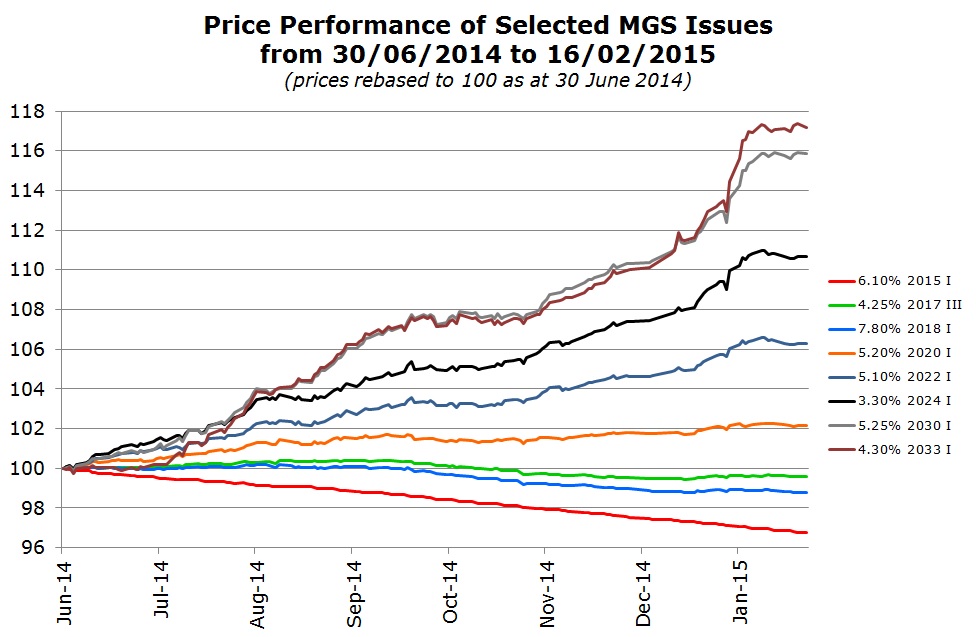

Although I have been warning that some of the exceptional price gains on MGS may start to unwind as economic circumstances change, I have so far been proved wrong, as prices continued to rally following well documented developments across the eurozone. The best performers were undoubtedly the longer term bonds as depicted in the chart while the short-term bond prices actually declined as they approach maturity. Given their recent experience, many retail investors seem to be hoping that these exceptional gains will be repeated in the months ahead. While further price gains are possible over the short-term given the increased responsiveness of long-term bonds to movements in yields, a reversal of the recent yield trend may cause sharp downward price movements especially in the 2040 bond and other long-dated bonds. As such, investors need to keep a very close watch in the future to avoid unwelcome surprises.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.