The volatility in the price of oil

Movements in the price of oil is a recurring theme in financial markets as it impacts, directly or indirectly, both the business world as well as our daily lives in view of its widespread usage. Given the importance of oil and the various factors influencing it (including geopolitical and economic factors), volatility in the price of oil tends to be high.

Oil is traded and quoted in various forms with the two most common standards being the West Texas Intermediate (WTI) and Brent Crude. Although prices for these two standards differ, the trends are generally the same. For the purpose of this article, I will be using WTI as the benchmark price of oil.

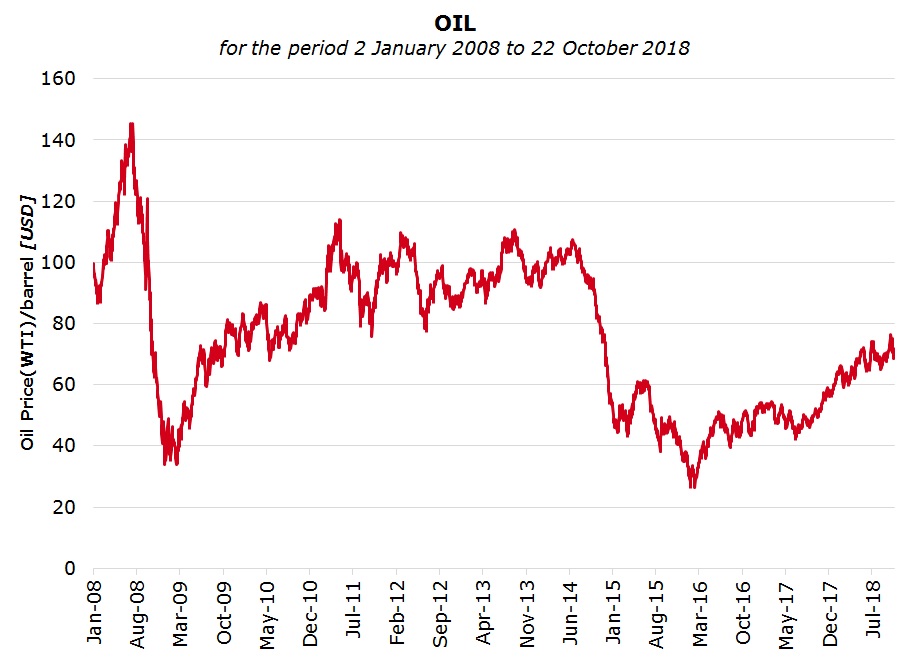

The price of oil registered an unprecedented rally that lasted approximately 7 years from November 2001 (as the US exited an eight-month recessionary period) until the outbreak of the 2008 global financial crisis. In 2008, the price of oil exceeded the USD100 level for the time ever and reached an all-time high of USD147.27 in July of that year. At the time, various analysts had speculated that a price of oil above the USD100 level was probably the new norm. However, as the 2008 global financial crisis started to unfold, the price of oil slipped all the way down to a level of USD32.40 within a matter of months. This sharp drop in the price of oil largely reflected serious concerns over the state of health of the global economy at the time which also contributed to a stronger US Dollar due to its perception as a ‘safe-haven’. The value of the US Dollar tends to have a negative correlation with the price of oil. Since oil is mostly traded in US Dollars, a stronger US Dollar makes oil relatively more expensive to buy, thus dampening overall demand. In addition, the price of oil was also negatively impacted by increased supply reflecting the easing of geo-political tensions between the US and Iran as well as attempts by the then US President George W. Bush to lift a ban on offshore drilling in the US.

The price of oil started to steadily recover in the first few months of 2009 and by early 2011 it reached a range of between USD80 and USD110 that persisted until mid-2014. One of the major factors which lifted the price of oil during this period was the Arab Spring. This led to a shutdown in the production of oil from Libya which, in turn, offers oil of superior quality than that extracted from other regions in the world. Several other factors also influenced the price of oil during this period including geo-political issues related to Iran, Syria and Crimea, the European debt crisis (which exacerbated uncertainty in the single currency region and reduced demand for oil), the US Presidential Elections and the US fiscal cliff as well as a 16-day US government shutdown in 2013. Similarly, the unprecedented monetary policy measures implemented by the major central banks around the world also weighed on the price of oil including the second and third tranches of quantitative easing by the US Federal Reserve.

In July 2014, the price of oil drifted again below the USD80 level mostly due to the restart of oil production in Libya reflecting an improved socio-political setting in the country. Another important factor was the increase in the supply of oil from the US as well as other countries such as Iraq and Canada. Moreover, the Organization of Petroleum Exporting Countries (OPEC) decided not to reduce oil supplies given their view that the market would adjust itself as certain countries would be constrained to reduce their supply at lower prices. Additionally, economic challenges in Europe and China were still very evident leading to a continued level of weak demand. These factors forced the price of oil to drop to a fresh 13-year low of USD26.05 on 11 February 2016.

Since then, the price of oil embarked on an upward trajectory and has recently also recorded its highest level in four years. The strong rebound was mostly driven by OPEC’s decision in late 2016 to limit output for the first time since 2008. Shortly afterwards, other countries which are not part of OPEC, such as Russia, decided to further contribute to OPEC’s efforts at stabilising the oil market by also agreeing to reduce oil supplies. This important collaboration between OPEC and non-OPEC countries persisted further in 2017 and this year, resulting in oil stocks for OPEC countries to drop to a 3-year low by May 2018.

The recovery in the price of oil over the past four years was also aided by the improved dynamics of the world economy (led by the US), various supply disruptions in Libya, Venezuela and Nigeria, as well as heightened geo-political tensions between the US and Iran. In contrast, however, the fast pace at which the US continued to infiltrate the oil market and gain market share in recent years partly offset the upward strong momentum in the price of oil. Similarly, this latest rally in the price of oil was also somewhat dampened by the trade dispute between the US and the world’s largest oil importer, China. The price of oil will continue to be impacted by various factors also in the future. In fact, some events are already shaping up and will likely be among the main protagonists in future oil price movements. These include the diplomatic relations between the US and Saudi Arabia after these were recently dented by the murder of the Saudi Arabian-born journalist Jamal Khashoggi who, in turn, was a critic of the Saudi ruling family. In this respect, in an opinion piece, the general manager of Al Arabiya (a Saudi-based television station) said that if sanctions were to be imposed against Saudi Arabia, the price of oil might hike considerably through retaliatory measures.

On the other hand, news from the US indicates that the country is preparing to enact a bill (which was first drafted in 2007) known as the No Oil Producing and Exporting Cartels Act (NOPEC). This piece of legislation could revoke the sovereign immunity from US legal action which oil producing countries, including OPEC members, currently benefit from. In fact, OPEC has already instructed its members to refrain from disclosing the targeted oil price as this could eventually lead to legal action from the US for manipulating the oil price.

Other possible factors include developments in connection with the trade disputes between the US and most of its trading partners as well as other geopolitical events in Russia, North Africa and the Middle-East, particularly those related to oil producing countries, as well as the continued drive by developed countries to seek alternative sources of energy.

Economic developments will also continue to play a major role in the price of oil. In this respect, it is important to highlight the different stages of the economic cycle at which major economies are in. The US economy has been performing well in recent years and various factors point to further sustained growth in the months ahead. This is positive for the price of oil. On the other hand, recovery across the European Union has been weaker and fragmented with economic growth in Q2 2018 ranging from 2.5% for Ireland to 0.2% in Denmark, France, Greece and Italy. In China, expansive monetary policy measures are still being adopted to support its economy. Moreover, elevated debt levels continue to be an issue across the world, including the US, Europe and China, which could ultimately derail any economic progress achieved so far.

Notwithstanding the evolving factors and scenarios that influence the price of oil, this commodity is likely to remain a dominant one for several decades in view of its widespread use. Consequently, the price of oil is very likely to remain highly volatile also in the future.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.