RS2 doubles dividend despite slight profit decline

The top executives of RS2 Software plc convened a meeting for financial analysts immediately after the publication of the 2014 financial statements last week.

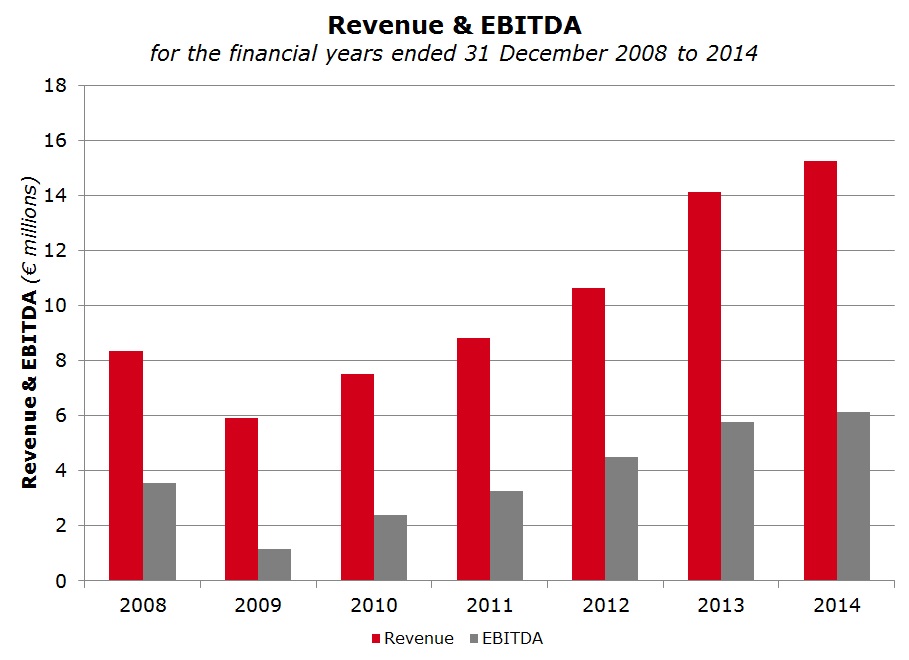

During 2014, RS2 generated revenue of €15.24 million (+7.9%) and EBITDA of €6.13 (+7%) but pre-tax profits dropped by 1.5% to €4.19 million largely due to the incidence of higher finance costs. This may seem surprising given the decline in borrowings during the year. Chief Financial Officer Fiona Ciappara Cascun explained that the increase in finance costs relates to the discounting to present value of long-term receivables, namely licences that are booked but not yet invoiced. Ms Ciappara Cascun noted that these will be reversed once payment takes place in the years ahead.

Another factor that negatively impacted the 2014 financial performance was the increase in other expenses to €0.99 million from only €0.1 million in 2013. The CFO revealed that this relates to an impairment provision on one of its receivables and although the entire licence was booked upon signing some years back, the scope of work may be reduced due to strategic changes at client level which may lead to lower income.

On the other hand, RS2 benefited from the weakness of the euro against US Dollar and Sterling. In 2014, other income surged to €0.73 million (2013: €0.01 million) reflecting realised and unrealised gains on exchange rate movements since income received from two of its major clients is denominated in US Dollars and Sterling.

“the Company may resort to debt funding in the future to accelerate growth by conducting an acquisition.”

RS2’s CFO also gave a detailed account of the revenue breakdown showing the changes in revenue streams over the past three years. Overall revenue grew by 7.9% following a surge in service fee income by 84% to almost €8 million largely due to the implementation and consultancy services provided to the two new major clients. The CEO Radi El Haj confirmed that the Company expanded its service offering over recent years and this should help this line of business to continue to grow in 2015 and future years especially due to the global reach of Barclays and the global processing company signed up last year.

The surge in service fee income helped offset the 46% drop in income from licence fees. Ms Ciappara Cascun explained the different accounting treatment adopted for perpetual licences as opposed to term licences which would need to be renewed upon expiry. Perpetual licences which were the core business of RS2 in the past are recognised immediately upon confirmation and the licence signed with OK-Q8 in February 2014 was fully recognised in the first half of last year. The drop in licences fees compared to 2013 was due to the recognition of €5.5 million in 2013 related to the agreement with Barclays for the BankWorks software which was not repeated in 2014. The CFO also added that although this licence agreement was a perpetual one, the balance will only be recognised upon other milestones being achieved in the future. On his part, Mr El Haj confirmed that the timing of the recognition of the balance of circa €4.5 million is not yet known although discussions take place regularly with Barclays on the possible implementation of BankWorks in other geographical regions. Moreover, the CFO clarified that the licence agreement of €12 million signed last year with one of the largest global payment processing companies is a term licence and as such the 2014 financial statements only reflect circa €2.2 million of this licence. Similar amounts will also be booked in the next four years with an additional amount during the final year should the client opt to convert the licence to perpetual use. In November 2014, RS2 had announced that it is negotiating a new licence deal with a client in Europe and this was expected to be concluded during the first quarter of 2015. During last week’s meeting, the CEO did not provide details on the size of this agreement and the timing when it will be concluded, but he expressed his confidence that this will be among the Company’s achievements during 2015.

The revenue breakdown also reveals that processing fee income via the fully-owned subsidiary RS2 Smart Processing Ltd increased by 26% to over €1 million and this should continue to grow in 2015 and beyond following the addition of new clients in 2014 which will start contributing to the performance in 2015. Furthermore, the Directors also reported last week that the pipeline is very healthy and further contracts are being negotiated.

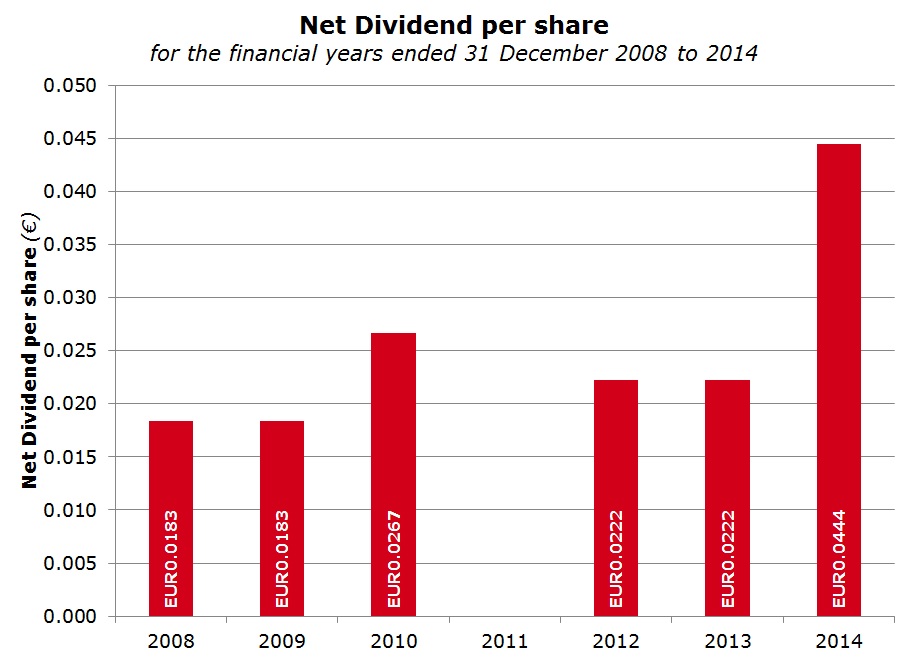

Despite the slight decline in profits, shareholders may be surprised that the final net dividend of €0.044 per share being recommended for approval at the upcoming Annual General Meeting on 9 June is double that of the previous year. This is probably due to the very healthy cash balance of €4.5 million as at 31 December 2014 as well as the low leverage of the Company with borrowings of only €3.4 million compared to an equity base of just under €23 million.

At last week’s meeting the CEO touched upon this point and mentioned that the Company may resort to debt funding in the future to accelerate growth by conducting an acquisition. Mr El Haj confirmed that this scenario is catered for in the Company’s 3-year business plan. While no concrete developments may take place in the months ahead, the CEO re-iterated that the strategic focus is to immediately expand in the US and Asia by setting up regional offices to win more business and support both existing as well as new clients. Mr El Haj singled out the huge potential in Asia since many banks require new card management software in view of upcoming new regulation in the region.

Moreover, Chairman Mario Schembri revealed that during 2014 RS2 increased its equity stake in the US company Transworks from 25% to 64% for a cost of USD0.5 million and this subsidiary will be used to expand in the US. The remaining 36% is held by ITM Holding, the majority shareholder of RS2 which is owned by the CEO and his wife. Mr Schembri explained that the imminent expansion in the US and Asia will be financed from internal cash flow and no additional debt funding will be required.

RS2’s CEO concluded the meeting by mentioning that in the coming years the company will regularly guide the market on earnings expectations. However, he believes that currently the timing is not ideal since other changes need to take place. In the interim, the Company needs to keep the market regularly informed of its business pipeline and new client additions and guide the market on the timing of the revenue recognition to assess the impact on the immediate financial performance.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.