A volatile 5 years for the Maltese equity market

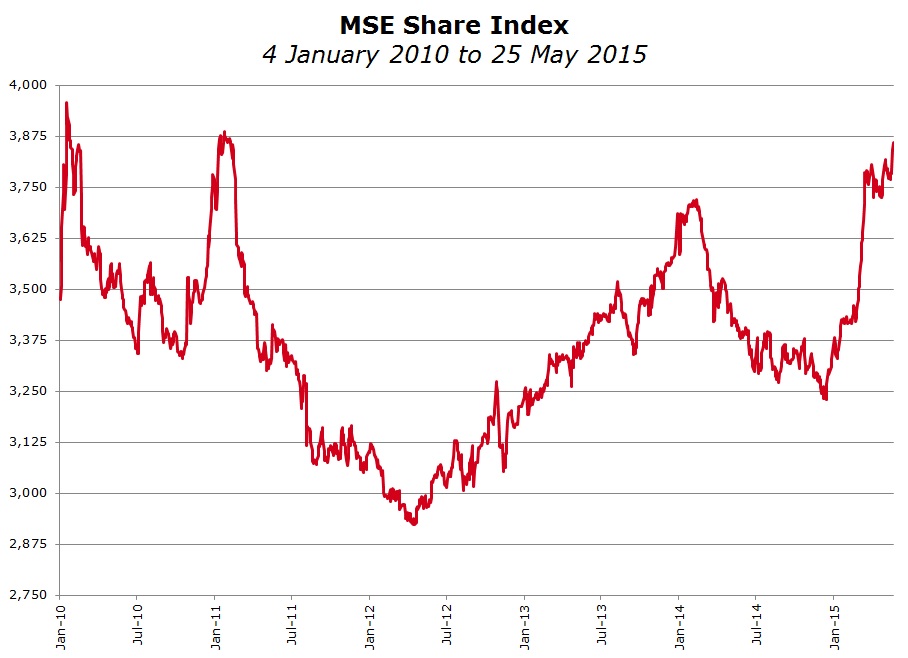

Last Friday the MSE Share Index touched a 4-year high of 3,841.516 points (a fresh 4-year high was reached again on Monday). This milestone encouraged me to dwell on the developments across the local equity market over the past few years.

A 5-year graph of the performance of the equity benchmark immediately revealed the intense volatility that investors were subjected to over the past few years. At first glance it was difficult to immediately identify the reasons for these wide movements. In fact, it took some time analyzing a number of events that occurred during the years that caused these fluctuations. The findings helped me reach some important conclusions which I thought I should share with readers of my weekly column.

The MSE Share Index was last at the 4,000-points level in September 2008 and the equity benchmark almost touched this level again on two occasions over the past 5 years – in January 2010 and again in January 2011. On each of these occasions, the rally at the start of both years was mainly as a result of a jump in the share prices of the two large retail banks ahead of the annual reporting season. However, in both instances, the surge was short-lived and the Index subsequently declined during the following months. In 2010 the decline largely reflected the downturn in the share price of HSBC Bank Malta plc during the first six months of 2010 as profit and dividend expectations were not met. Meanwhile, in 2011 the Index was dragged lower by a wider sell-off as all the largest four equities by market capitalization at the time performed negatively, namely HSBC Bank Malta plc, Bank of Valletta plc, International Hotel Investments plc and GO plc. Despite the first half volatility, 2010 was an overall positive year for the equity market with a rise of 9.3%. This followed from a gain of 7.9% in 2009 as share prices gradually recovered from the sharp declines during the second half of 2008.

On the other hand, the political uprising in Libya in February 2011 was the major reason for the strong downturn during 2011 with the share prices of many local companies posting double-digit losses and the MSE Share Index closing 18.2% lower. Another notable event in late 2011 was the initial rumblings regarding the La Valette Property Fund which negatively impacted the share price of Bank of Valletta plc.

The Index retreated all the way down to 2,900 points by April 2012 but partly recovered in subsequent months to end the year with a mild gain following an upturn in the share prices of GO plc, Bank of Valletta plc and HSBC Bank Malta plc and more significant gains from some of the smaller capitalized companies including Crimsonwing plc, Simonds Farsons Cisk plc and RS2 Software plc.

“These findings underline some key considerations for equity investors.”

The Maltese equity market then staged an almost unrelentless recovery to 3,700 points by February 2014 before dropping rapidly within a few months on the back of a weakening outlook for the local banking sector and a sharp decline in the share price of International Hotel Investments plc due to the renewed conflict in Libya and the challenges in Russia which historically had been two key markets for the Group.

An analysis of the equity benchmark in isolation could be misleading for many investors due to the large weighting of the banks in the Index. In fact, although 2014 may have been a negative year for the equity market with a decline of 9.6%, it may have gone unnoticed that 8 equities produced double-digit gains.

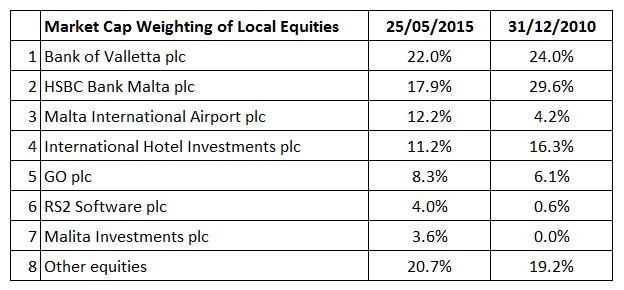

A comparison of the composition of the MSE Share Index between 2010 and 2015 reveals a number of important findings, namely: (i) the overall decline in the weighting of the two large retail banks which in early 2010 exceeded 50% and is now at 40% - this is solely due to the sharp decline in the value of HSBC Malta from a market capitalisation of circa €800 million to below €670 million reflecting the changing business models and reduction in profits amid a more challenging business environment for banks; (ii) the increased influence of the IT sector in the MSE Share Index mainly arising from the extraordinary jump in the value of RS2 Software plc to almost €150 million from merely €20 million 5 years ago; (iii) the strong recovery in GO plc from under €100 million due to the significant losses recognised in Greece to over €300 million as the local operations improved, plans are underway to restructure the property portfolio and on indications of a bidding war emerging for Forthnet; (iv) the decline in the value of International Hotel Investments plc as the problems in Libya and Russia overshadowed the beneficial impact from the London property and the increased diversification of the Group; and (v) the increased importance of some of the smaller capitalized companies namely Simonds Farsons Cisk plc, MaltaPost plc, Malita Investments plc, Plaza Centres plc, Tigne Mall plc and 6pm Holdings plc.

These findings underline some key considerations for equity investors. A diversified portfolio is a fundamental requirement for all retail and institutional investors within the context of their risk parameters. In fact, an adequate allocation to some of the smaller companies would have produced a mix of strong dividends as well as capital gains over the years.

Active management of a portfolio is another essential element and investors must not simply maintain a passive approach to investing with a ‘buy and hold’ mentality by ignoring changes in market and industry dynamics. The well documented challenges that have impacted the banking sector over recent years as a result of the regulatory burdens and the interest rate environment is a very clear case. On the other hand, the strong rise of the IT sector as the companies landed some sizeable international contracts resulted in some extraordinary gains for investors. Moreover, the ‘search for yield’ which was very evident from summer 2014 as the European Central Bank gave initial indications of the Quantitative Easing programme was another important development which left a strong impact on many equities over recent months.

Many investors believe that although share prices correct due to changing market circumstances, they eventually will regain their previous highs. This is not always the case and many investors sometimes simply maintain an exposure to a certain company so as not to sell at a loss. The well-documented developments many years ago relating to the significant losses at Mapfre Middlesea plc (at the time Middlesea Insurance plc) proves that when losses are permanent, share prices do not return to their previous levels.

Maintaining an element of cash in a portfolio is another key consideration which is possibly very topical in the current environment. Investors should not oppose capitalizing on some strong gains and maintaining a largish allocation to cash in a portfolio. Many value investors maintain high cash levels since this represents welcome ammunition if markets decline enabling them to acquire securities at cheaper entry-levels. The strong upturn in the MSE Share Index in 2010 and 2011 followed by sharp declines shows the benefits one would have derived if certain equities would have been sold and re-directed to other investments over the years. Sometimes, the greatest challenge for retail investors is remaining patient during a general upturn across the market and this is when investors must differentiate between investing and speculating.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.