FIMBank in shock USD53 million loss

FIMBank plc had long been warning that 2014 was turning out to be a very challenging year. At the time of the publication of the financial statements as at 30 June 2014, various impairment charges were taken totaling USD10.2 million and the Directors emphasized some particular impairments in the factoring portfolios of the Russian and Indian factoring companies. FIMBank had increased its participation in these two factoring joint ventures in early 2014 in order to exercise increased control in each of these entities following the entry of two new institutional shareholders into the FIMBank Group, United Gulf Bank and Burgan Bank (both part of the KIPCO Group of Kuwait). FIMBank increased its stake to 80% in Russia and 79% in India.

Moreover, in the Interim Directors’ Statement published on 17 November 2014, while FIMBank indicated that its operating results in the main entities and some of the factoring ventures were healthy, it warned that the “impairment situation is materially challenging” as new unquantified impairments were identified across the Group during the second half while no progress was achieved on the recovery efforts of previous impairments. Similar warnings were also given by Chairman Dr John C Grech in his message to shareholders in the first newsletter published in January 2015.

Moreover, on 26 January 2015, the international credit rating agency Fitch downgraded FIMBank’s rating to ‘BB-‘ after it confirmed that severe impairments were suffered particularly in Russia and India. Fitch indicated that a reversal of this downgrade would only materialize if there is a substantial recovery of the performance and asset quality of the Group sustained by evidence of improved risk controls.

Despite the various warning signs over previous months, the extent of the overall loss during 2014 was probably a shock to many observers. FIMBank convened a meeting for financial analysts last week soon after the publication of the financial statements. Apart from FIMBank’s Chairman Dr John C Grech, the newly appointed CEO Mr Simon Lay the CFO Mr Marcel Cassar, the CEO of Burgan Bank Mr Eduaordo Eguren was also present for the meeting. Mr Eguren emphasized the strong support being given to the Bank by the two large institutional shareholders owning 80.92% of FIMBank, United Gulf Bank and Burgan Bank, which both form part of the KIPCO Group of Kuwait.

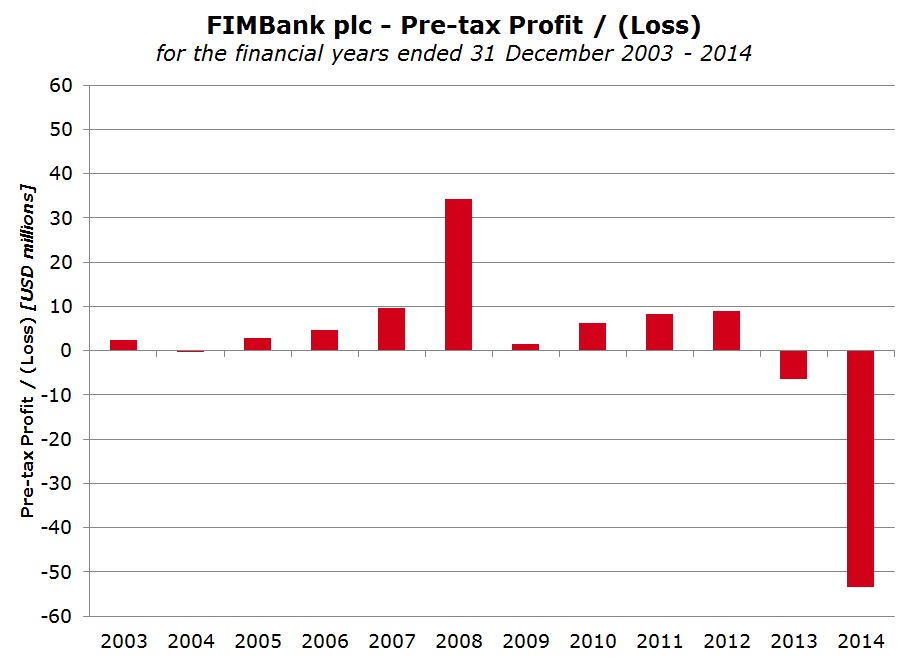

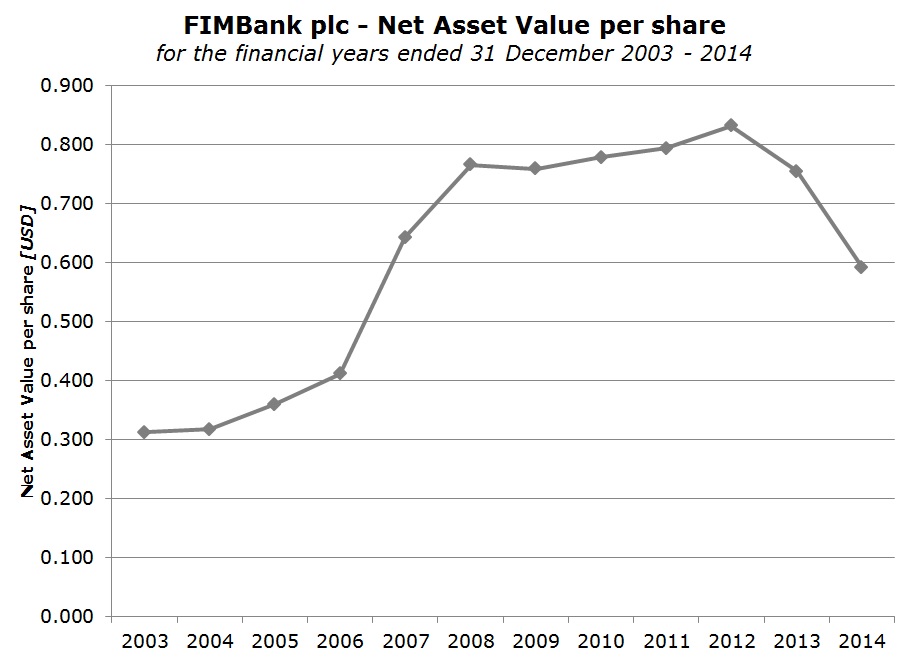

Although operating income grew by 47% to USD49.2 million, the FIMBank Group reported a pre-tax loss of USD53.43 million in 2014 compared to the USD6.4 million pre-tax loss in 2013. Operating expenses grew by 31.1% to USD39.77 million (largely due to the consolidation of three factoring companies during the year) while net impairment losses surged to USD50.7 million from USD6.5 million in 2013. These impairments mainly relate to the factoring books of the Russian and Indian subsidiaries as well as an USD8.9 million downward revision in the goodwill relating to the Group’s investment in the Russian and Indian joint-ventures including the additional investment made during the first half of the year.

It may be confusing for some of FIMBank’s shareholders to understand the developments with respect to the subsidiary in Russia. Although in the first half of 2014 FIMBank acquired a majority stake in CIS Factors (Russia), the Directors decided to close down this factoring company by the end of the year. Mr Eguren explained that although this decision was very painful, the situation in Russia changed dramatically in a short period of time and “what was initially an attractive market became a major risk due to the political environment”. The CEO of Burgan Bank indicated that although Russia is the biggest commodity market and is attractive if the right partners are involved, the prevailing political and economic environment is not conducive for profitable business activities to take place and this is not expected to improve for some years.

The most disappointing news for FIMBank’s shareholders was the situation in India which accounted for a large part of the impairments during 2014. Although the Indian market is still an attractive one, FIMBank’s Chairman referred to lack of controls in place while the CEO of Burgan reported that some transactions were not within the pre-agreed risk parameters. The top management of the Indian company has since been replaced and new control procedures have been implemented.

While FIMBank’s top executives all claimed that a lot of important lessons were learnt from the developments in 2014, they all spoke with increased conviction on the future prospects of the Group. Both FIMBank’s Chairman and the CEO of Burgan Bank highlighted the ability of Mr Simon Lay (the newly appointed CEO) to “turnaround situations” in his previous working experiences especially with the operation in London which returned to profits immediately after FIMBank acquired full control many years ago. Mr Lay noted that although the circumstances are extremely challenging, the immediate focus is to implement a turnaround strategy to bring the Group back to a profitable situation in the shortest time possible. Although he failed to provide actual figures in this respect, the CEO indicated that management is forecasting an overall return to profits as from the current financial year ending 31 December 2015.

With respect to the future strategy, the CEO of FIMBank explained that the business model will not be changing but there will be a modification in the direction with a focus on consolidation and a strict emphasis on the oversight of the individual performances of the respective subsidiaries. The CEO of Burgan Bank Mr Eduoardo Eguren claimed that although the business model has very attractive features, the Group was expanding too rapidly and mistakes were made in the implementation. Mr Eguren noted that the task ahead is not an impossible one and the two institutional shareholders (Burgan Bank and United Gulf Bank) are fully committed to assisting FIMBank in the immediate future.

"...it would be necessary for FIMBank to provide more regular communications to the market and possibly also publish some key financial figures on a quarterly basis ..."

During the presentation, the CFO Mr Marcel Cassar provided an overview of some key financial ratios. Despite the sizeable losses incurred in 2014, it was surprising to see that the capital structure is still robust with a Tier 1 ratio of 13.3%. Notwithstanding this, FIMBank’s top executives indicated that the second rights issue was still on the cards although the timing is as yet unknown. The additional capital to be raised in the future rights issue would be required to assist FIMBank in implementing its strategy going forward which still entails seeking growth once the necessary managerial changes are undertaken and the turnaround in current operations is evident. The CEO of Burgan stressed that given the current infrastructure, the aim is to generate more volumes as this would be the only way to bring down the excessive cost to income ratio to within the norm across the banking industry. The rights issue would therefore assist the Group in achieving the desired increase in business activity in the years ahead.

Following the horrific results during 2014, the bold claims of a quick turnaround and a return to profits as from 2015, it would be necessary for FIMBank to provide more regular communications to the market and possibly also publish some key financial figures on a quarterly basis to reassure shareholders that the ‘annus horribilis’ is truly behind them and the future is more encouraging. At a later stage, once the turnaround is evident, management needs to then ensure that an adequate return on equity is being achieved and other key performance indicators are also in line with the rest of the banking industry, most notably a more efficient cost to income ratio which has been too excessive for far too long.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.