Italy vs Spain

Although I am a keen football follower and openly support Juventus and the Italian national team, my article this week is not football-related but deals with the recent performances of both the Italian and Spanish economies and their significance for Maltese investors.

I will not delve too much into the rivalry between Spain and Italy on a football level due to some painful experiences in recent years. On a national level, Italy suffered humiliating defeats in recent years to Spain in the UEFA Euro 2012 final match and in a 2018 FIFA World Cup qualifier match. At club level, Juventus twice lost the UEFA Champions League final to Spain’s Barcelona (in 2015) and Real Madrid (in 2017).

The Spain-Italy analogy when it comes to the world of football and the world of economics and finance is remarkable. At the peak of the European sovereign debt crisis some years ago, both economies were suffering from a severe loss of confidence amid a dismal economic performance, various political uncertainties and serious concerns of their banking sectors. Since then, as in the world of football, Spain left its arch rivals at bay. This is mostly evidenced by the five consecutive credit rating upgrades attributed to Spain by the world’s foremost credit rating agency, S&P. Spain now has an ‘A-‘ grading with a ‘Positive’ outlook compared to a ‘BBB-‘, ‘Negative’ outlook in October 2012. In contrast, Italy’s grading today of ‘BBB’, ‘Negative’ outlook is the same as that in 2013.

Both Italy and Spain exert considerable weight on the economic performance of the euro area as they are the third and fourth largest economies respectively. Furthermore, Malta’s economy has important links with these two large countries, most notably in the tourism sector where the number of tourists from these two top markets are indeed significant and has grown very much in importance in recent years. Besides, as explained in various of my articles in the past, economic developments taking place in Spain and Italy should be of interest to many local investors, especially those who have large exposures to Malta Government Stocks (“MGS”). This is due to the evident relationship between changes in the yields of Spanish and Italian government bonds and corresponding movements in the secondary market prices for MGS. Moreover, a principal yardstick which is normally used when it comes to assessing the attractiveness of a local corporate bond is the relative yield spread (or credit risk premium) over the corresponding ‘risk-free’ MGS rate. As such, upward pressure on Spanish government bond yields usually leads to higher MGS yields (lower prices) which, in theory, should translate into increased borrowing costs for companies tapping the local bond market.

The most recent assessment on the economic performance, fiscal position and outlook of Spain and Italy came from the European Commission (“EC”). On 7 February 2019, the EC published its ‘Winter 2019 Economic Forecast’ covering all EU member countries. Overall, although the EC noted that “the fundamentals of the European economy remain sound”, it nonetheless acknowledged that the economic slowdown experienced in the second half of 2018 was “more pronounced than expected” amid “increased uncertainty regarding trade policies … and a declining trend in global manufacturing output”.

The analysis by the EC once again highlighted the contrasting dynamics of the Spanish and the Italian economies. With respect to Spain, the EC explained that although the country went through an “expected mild deceleration” in the first nine months of 2018, real GDP growth stood at 0.7% during the last three months of the year. For the whole of 2018, Spain’s real GDP expanded by 2.5%, representing a decline of 50 basis points from the previous year and only marginally lower than previously anticipated. Furthermore, although the EC revised lower the expected rate of GDP growth for Spain for both 2019 and 2020, such revisions were indeed relatively minor as the country’s economy is now expected to expand by 2.1% this year and by a further 1.9% in 2020 compared the earlier projections of +2.2% and +2% respectively. In turn, these remain well above the forecasted average GDP growth for the euro area of +1.3% in 2019 and +1.6% in 2020.

On the other hand, following news that Italy entered into a technical recession in the second half of 2018, the new projections published by the EC fuelled further worries on the poor state of the Italian economy. In this respect, the EC sounded the alarm over the weakening dynamics of Italian domestic demand amid higher uncertainties over the government’s economic and fiscal agenda. As a result, the EC is now expecting the Italian economy to grow by only 0.2% in real terms in 2019 compared to the previous estimate of +1.2% following the 1% growth in 2018.

Similarly, the EC also revised lower the projected growth of Italy’s economy in 2020 to 0.8% from the earlier forecast of +1.3%. Nonetheless, the EC also noted that this marginal improvement in 2020 over this year’s forecasted GDP growth is “subject to high uncertainty” amid “a weaker-than-expected global economy and the impact of heightened policy uncertainty” that, in turn, “could lead to a more protracted downturn”.

Italy’s weak economic standing makes it particularly vulnerable across bond markets. Adding to the country’s chronic underperformance, it is also worth highlighting the large debt pile which according to the most recent ‘Economic Bulletin’ issued by the European Central Bank (“ECB”) accounts for 133% of GDP as at Q3 2018 compared to 98.3% for Spain. Furthermore, Italy remains susceptible to various political uncertainties, not least because of the erratic policy-making processes applied by the controversial government made up of the far-right Northern League and the populist Five Star movement. Similarly, the political scenario in Spain is also fragile and on 28 April 2019, the country will have the third round of parliamentary elections since 2015 after Socialist Prime Minister Pedro Sánchez had to call snap elections following resistance from the minority government’s coalition partners to the passage of the budget bill.

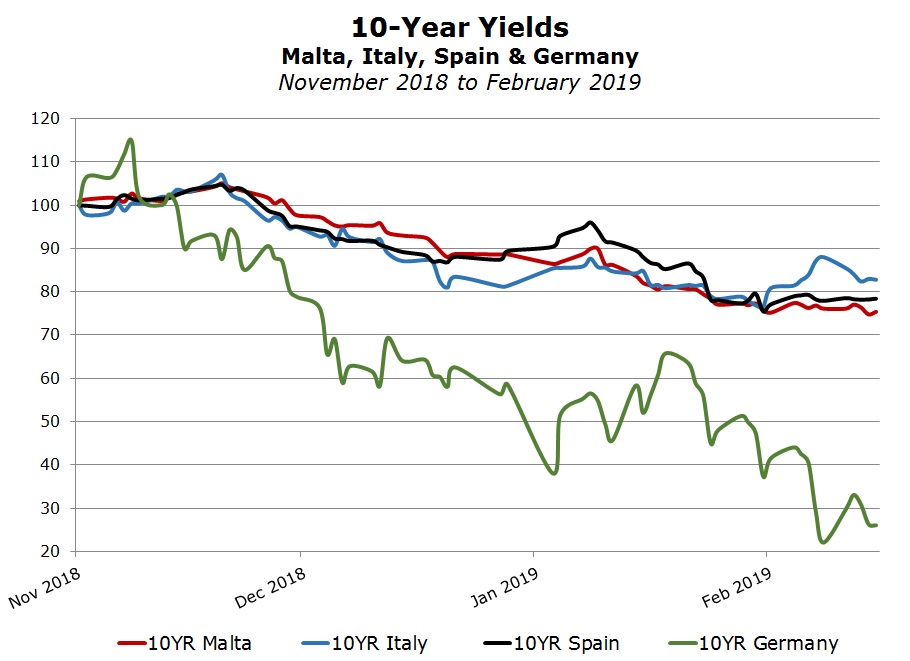

The close relationship between changes in the yields of Spanish and Italian government bonds and the corresponding movements in the secondary market prices for Malta Government Stocks was once again very evident in recent weeks. In fact, in November and December 2018 there was a remarkable ‘flight to safety’ across global international financial markets which sent bond yields lower. Moreover, the more patient tone of the US Federal Reserve and the ECB with respect to further monetary policy normalisation in the months ahead resulted in the benchmark 10-year German Bund yield plunging from a level of 0.40% at the start of November 2018 to just below 0.08% (the lowest since late October 2016) before marginally rebounding to the 0.10% level. In contrast, although the 10-year government bond yields of Spain and Italy are now at a lower level than at the start of November, the extent of the declines in these yields were relatively modest when compared to the benchmark eurozone yield, possibly reflecting the various uncertainties related to the political situation of both countries as well as the poor economic and fiscal standing of Italy. Likewise, the 10-year Malta Government Stock yield “only” dropped to 1.13% from 1.50%. This was more in line with the decline in the yields of Spain and Italy and was less correlated to the movements in the German bund yields.

The most recent developments again confirm the high element of sensitivity that certain developments across Italy and Spain have on the performance of Malta Government Stock especially those with longest-periods to maturity. In fact, over the past three months, prices of Malta Government Stocks increased by a smaller margin compared to those in Germany due to the impact of the developments in Spain and Italy. This is important for the many Maltese investors who continue to hold an over-weight exposure to long-dated MGS possibly purely for capital gains given the very low yields of below 2% per annum. Although Malta’s credit risk has indeed improved remarkably in recent years, the price risk being taken when holding long-term MGS should not be under-estimated. The strong rally in MGS prices over the past 8 weeks following the sharp downturn through most of 2018 shows the intense volatility that such investors may experience in the MGS market even within short periods of time. This is expected to continue given the political developments in Italy and Spain as well as the uncertain economic performance of the eurozone going forward.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.