MIA reduces dividend ahead of investment programme

The 2015 financial statements published by Malta International Airport plc on 24 February 2016 should not have contained any surprises for market participants and investors who follow the regular company announcements issued by the airport operator.

MIA publishes its traffic results on a monthly basis and given the fact that aviation income accounts for 70% of overall revenue, the movements in passenger volumes are a very reliable indicator for MIA’s financial performance. Moreover, on 17 November 2015, MIA had also disclosed to the market that during the 2015 financial year, it will be registering a one-off gain of €1.86 million on the sale of its equity stake in Valletta Cruise Port plc.

In fact, pre-tax profits of MIA during 2015 increased by 14.3% to €29.8 million and excluding the one-time gain on sale of the shareholding in the cruise line operator, the growth in pre-tax profits of 7.1% is very much in line with the increase in passenger movements of 7.7%.

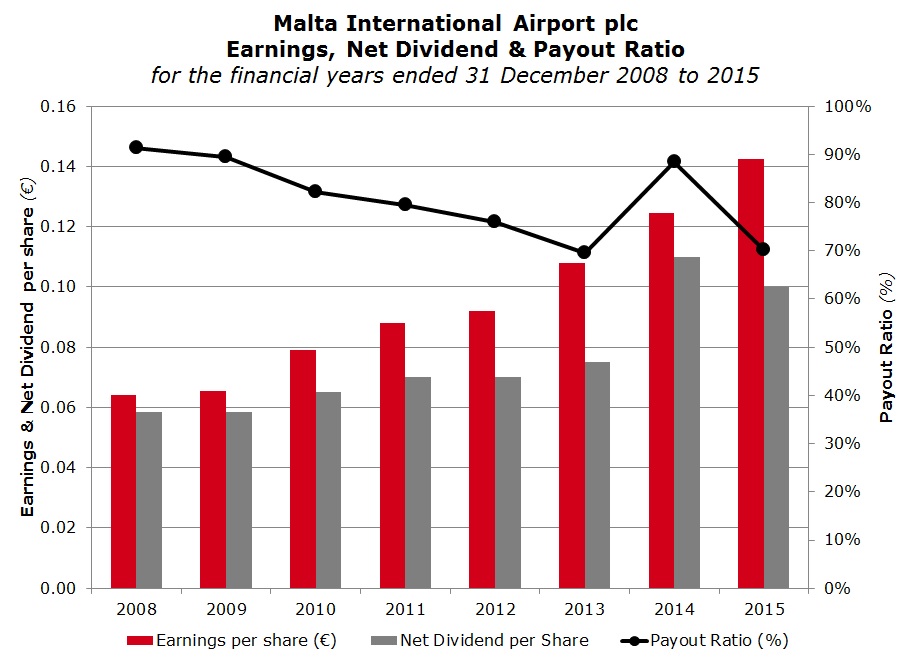

However, the major item of interest to the market was the final dividend recommendation. This time last year, the final dividend had surged by 77.8% with the overall dividend payout ratio for 2014 rising once again to 88.5% following the gradual downward trend in the dividend payout from 91.4% in 2008 to 70% in 2013.

The recommendation made by the Board of Directors of MIA on 24 February to reduce the final dividend payment by 12.5% to a gross dividend of €0.1077 per share (€0.07 net of tax) clearly disappointed the market. As trading resumed on the Malta Stock Exchange on 25 February, the share price of MIA dropped by 8.9% to an intra-day low of €4.30 before partially recovering to the €4.50 level, representing a decline of 4.7% over the previous day’s close of €4.72 when the equity had also traded up to a fresh intra-day record level of €4.76.

Since the interim dividend distributed in September 2015 was unchanged at a gross dividend of €0.0462 per share (€0.03 net of tax), the overall dividend with respect to the 2015 financial year of €0.1539 per share (net: €0.10) is 9.1% lower compared to the record dividend distribution of €0.1693 (net: €0.11) paid out in respect of the 2014 financial year.

During last week’s briefing with the financial community, MIA’s Chief Financial Officer Mr Karl Dandler defended the company’s decision and clearly indicated that the dividend policy is based on the long-term strategy of MIA and the ambitious investment programme announced a few months ago. The CFO indicated that while in early 2015, there was no concrete plan for the expansion strategy, the situation is different now and MIA have a very clear idea of the overall development of the airport including the investment related to the non-aviation sector which was announced in the media on 21 December 2015.

Mr Dandler also argued that other European airports do not have such aggressive dividend payout ratios.

MIA’s CFO announced that the company’s intention is to finance the capital expenditure required for the terminal expansion from the company’s internal cash flow while external financing will be considered for other projects in the future such as SkyParks 2 and the business hotel.

On his part CEO Mr Alan Borg gave financial analysts a more detailed overview of the expansion plans in the years ahead. Phase 1 of the investment programme which will start in the fourth quarter of 2016 will cost €8 million. It is expected that this project will be completed in just under 2 years. The Terminal expansion as part of Phase 1 will entail the re-organisation of the check-in hall (the number of desks will increase from 28 to 34), the relocation of the security area (an increase in the number of security lanes from 4 to 6) and the relocation of the La Valette Lounge which will make way for the security area. The new passenger lounge will be on level 3 replacing the bistro overlooking the runway. These changes to the terminal will also lead to an increase in the size of the duty free walk-through shop from circa 850 sqm to 1,500 sqm.

The timing of Phase 2 of the terminal extension has not been determined as yet although the CEO indicated that this can take place at the end of 2018 immediately after the completion of Phase 1. The cost of this major extension is of €20 million and will include the construction of an extension to the check-in hall and departures area (the number of desks will increase by a further 15 to a total of 49) as well as an additional 3 gates to 21. The expansion of the terminal as part of the second phase will also include new space for food and beverage outlets.

Moreover, with respect to the non-aviation sector, the more significant investment would include a €40 million development on a footprint of 4,000 sqm. This will comprise a business hotel and another commercial development following the success of the Sky Parks Business Centre. MIA’s CEO also indicated that this project, which still requires approval from the Malta Environmental and Planning Authority, will include the construction of an additional floor of parking on top of the existing car park. MIA’s executive management did not indicate when this project may commence but Mr Dandler remarked that when the time comes, the company will assess whether to finance this project via bank loans or via the bond market.

While this ambitious investment programme is exciting news for shareholders, the more immediate focus for investors will be on the number of passengers passing through the terminal given the direct impact on the company’s financial performance. The airport operator, together with other industry stakeholders (the MTA and the Tourism Ministry), have been successful in attracting additional airlines to Malta and existing airlines to increase the number of routes over recent years. In fact, since 2005, the only two years when passenger growth decreased was in 2006 and 2009. Meanwhile, since 2010, passenger traffic has grown at an average increase of 6% per annum from total passenger movements of 3.3 million in 2010 to 4.6 million in 2015. More importantly, while a number of new airlines will be flying to Malta in 2016, the major impact this year is expected to come from Ryanair with an additional 10 routes starting from May 2016. On the other hand, however, the market will be attentive to developments surrounding the fate of Air Malta plc and how this will affect seat capacity of the airport’s largest client especially in the short to medium term.

The news regarding Air Malta will not only play a determining role in MIA’s financial performance going forward but naturally also on the resultant dividend to shareholders. Given the current interest rate environment which is expected to remain subdued for a prolonged period of time, the dividend of MIA and other companies becomes a more important consideration for all investors.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.