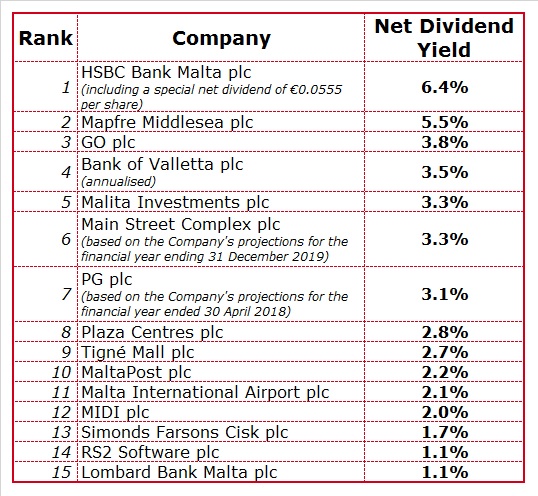

The dividend league table

The annual reporting season for companies that have a December year-end has finally come to an end earlier this week.

The main objective for the majority of Maltese investors is that of generating an income stream from the various securities within their investment portfolio. While most investors have a general tendency to favour bonds, a growing number of investors are realizing the benefits of also including an exposure of dividend-yielding equities to their portfolio to supplement the interest income on their various bonds.

In view of the focus on the income-generating aspect of an investment, in recent years I published the dividend league table to assist the investing community when comparing equities producing the highest dividends. Moreover, the dividend league table also enables investors to compare these dividend yields to the yields on corporate bonds and Malta Government Stocks especially following the sharp decline in bond yields in recent years.

The dividend league table is based on the net dividend distributed by the various companies listed on the regulated Main Market of the Malta Stock Exchange. Some are subject to different rates of tax and therefore the net dividend is the best measure for comparison purposes. For example, some companies benefit from tax incentives such as property companies which pay 15% tax on their rental income.

While it is good to monitor the historic dividend payments, it is equally important to understand the sustainability of a company’s dividend and whether the company may distribute higher dividends to shareholders in the future or may need to slash the dividend due to upcoming investment requirements. The dividend cover is a good indicator for investors to gauge the sustainability of a company’s dividend.

The two largest banks have always been among the highest ranking equities in the dividend league table. However, these yields may need to be adjusted in view of some particular circumstances. On the one hand, HSBC Bank Malta plc distributed a €20 million special dividend and therefore the 6.5% yield (which places HSBC in top position of the league table) should be adjusted to cater for the fact that this special dividend may not be repeated next year. However, HSBC Malta has shown that it is open to distribute excess capital to shareholders. Decisions on any future announcements may also be conditioned by any news related to the continued presence of HSBC in Malta following the statements across the international media a few weeks ago. In the case of Bank of Valletta plc, the last financial year was made up of a 15-month period due to a change in the year-end and therefore it may be best to annualize this dividend to make it comparable to the dividends of BOV in prior years and also to dividends of other companies listed on the MSE.

The company that advanced the most positions in the league table is Mapfre Middlesea plc following the extraordinary increase in the dividend to €0.1054 per share from €0.0383 per share last year. The insurance company generated a significantly improved performance but the dividend cover of 0.88 times may indicate that the dividend is not easily sustainable.

GO plc continued to rank among the best dividend-yielding equities on the MSE. Following the 18% increase in the final dividend which is being recommended to shareholders at next week’s Annual General Meeting, the yield improved from 3.15% last year to 3.78%. GO has improved its dividend distributions in recent years from €0.07 per share to €0.13 per share reflecting the consistent positive financial performance and strong cash flow generation as well as the low level of borrowings on their balance sheet. The net debt to EBITDA multiple is another important indicator that analysts and investors should monitor.

The yield on the equity of Malita Investments plc has also improved slightly from one year to the next reflecting the sizeable hike in the dividend as well as the increase in the company’s share price. A higher share price leads to a lower yield. Malita is one of the many companies that consistently distributes dividends semi-annually to shareholders and has always maintained that any future projects will not jeopardise the dividend to shareholders.

In last year’s article explaining the 2017 dividend league table which is normally based on the historic distributions, I had also included PG plc which had only recently been admitted to the equity market following its hugely successful Initial Public Offering (IPO). However, PG had a clear dividend policy in its prospectus and therefore I felt the need to include this company in the league table. PG had stated that its objective is to distribute not less than 50% of the group’s net profit to shareholders by way of dividends. PG also indicated that dividends will be paid twice a year with around 40% of the overall dividend at the interim stage while the balance of 60% will be distributed as a final dividend subject to shareholders’ approval at the Annual General Meeting.

PG has a 30 April year-end and it distributed its maiden interim dividend of €0.01574 per share in December 2017. PG’s 2017/18 financial year came to an end last Monday and the financial statements should be published in August 2018. PG had projected that it will generate a profit after tax of €8.4 million and based on the total issued share capital of 108 million shares, this equates to an earnings per share figure of €0.0779. As such, assuming a dividend payout ratio of 50%, the overall net dividend would amount to €0.03895 per share. Following the payment of the interim dividend of €0.01574 per share, the final dividend should amount to €0.02321. The total estimated dividend for the 2017/18 financial year equates to a net yield of 3.08% based on the current share price of €1.30.

The expected new entrant in the coming weeks, Main Street Complex plc, also has a clearly defined dividend policy in its prospectus. Given its simple business model with visible revenue streams and no financial obligations as a result of the lack of any borrowings following the issuance of new shares in the IPO which will be used to repay borrowings, the objective is to distribute the entire annual net profit in the form of dividends to shareholders. The dividend will be split into two payments with around 40% of the overall dividend expected to be distributed as an interim dividend (payable around the end of October) while the balance of 60% will be distributed as a final dividend around May subject to shareholders’ approval at the Annual General Meeting. The total dividend expected to be distributed covering the 2019 financial year (in October 2019 and May 2020) is anticipated to amount to a total of €422,000 which is equivalent to €0.0218 per share. Based on an offer price of €0.65 per share, this results in a net dividend yield of 3.3%.

The other two commercial property companies that have also consistently paid dividends to shareholders since their IPO’s have slightly lower dividend yields at the moment mainly as a result of the increase in their share prices over the years. The net yield of Plaza Centres is 2.8% with Tigne Mall slightly lower at 2.7%.

There are six other companies that pay dividends to shareholders while a further eight companies are not distributing dividends in respect of the last financial year. One of these companies is International Hotel Investments plc. In the Annual Report published last week the Chairman of IHI indicated that “whilst it is not technically possible to recommend dividends on the basis of the 2017 parent company balance sheet, notwithstanding net profits on a group basis, I am pleased to inform you that your Board is considering the issue of an interim dividend to all shareholders later this year, as soon as this process of rationalizing the parent company balance sheet is completed to a point that the issue of such a dividend becomes permissible from an accounting and cash flow point of view. The necessary announcements will be issued in due course”. This would be a welcome development for the several shareholders who have supported the company since the IPO in the year 2000.

Many of the companies that are displayed on the dividend league table can easily maintain a consistent distribution to shareholders. Following the steep decline in bond yields as a result of the quantitative easing policy of the European Central Bank, investors should compare these bond yields to dividend returns from equities in order to optimize their income generation from their portfolio and protect this from inflation.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.