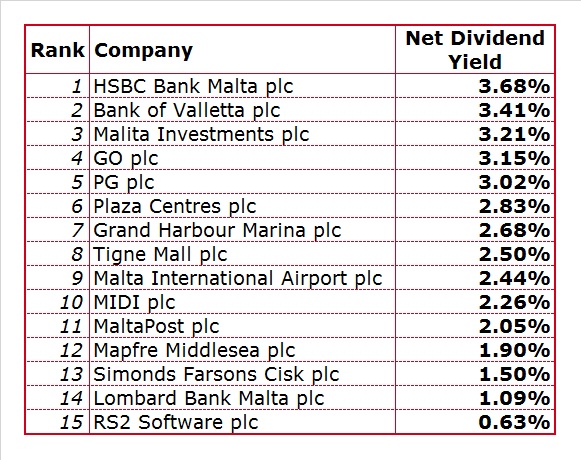

The dividend league table

Following last week’s article on the ROE league table, I am now publishing the updated dividend league table. Presumably, this is a more popular financial indicator used by many local investors due to their main objective of generating a regular income stream from their investments.

As I stated in previous years, the dividend league table is based on the net dividend yield and not the gross dividend yield by each of the companies in their last financial year. This provides a better comparison since some companies benefit from tax incentives and distribute dividends out of tax free profits or reduced tax compared to the standard 35% tax rate. As such, the net dividend yield is calculated by dividing the net dividend distributed to shareholders in the last financial year by the current share price. Naturally, a higher share price leads to a lower dividend yield and vice-versa.

For the second successive year, the two largest retail banks which are also the largest in terms of market capitalisation, top the dividend league table. However, HSBC Bank Malta plc now ranks as the top dividend yielding equity while Bank of Valletta plc now ranks in second place after two years in top position. The current historic net dividend yield of HSBC Malta is 3.68%. Despite the strong recovery in the share price in recent months, the yield on HSBC’s equity has improved as the dividends in respect of the 2016 financial year increased by 45.5% compared to the previous year. This was due to the improved profitability of the bank as well as the slight increase in the dividend payout ratio to 65%.

The dividend yield of Bank of Valletta plc also improved from last year to a current yield of 3.41%. BOV’s share price has also edged higher in recent months and is currently trading at a near 9-year high. However, the yield improved as the total dividend distributed to shareholders in respect of the last full financial year to 30 September 2016 increased by 8.6% over the previous year’s dividend. One point worth highlighting is the difference in the dividend payout ratio between the two large retail banks. While HSBC Malta had a dividend payout ratio of 65%, that of BOV was of 33%. The major reason for the striking difference is the upcoming capital requirements of both banks. In fact, BOV recently revealed that within the next 12 months it will be conducting a capital raising exercise of €150 million and therefore one of the objectives of the bank in recent years was to retain an increased level of profits to support the bank’s capital ratios. Meanwhile, it is also worth pointing out that the net dividend yield of BOV does not take account of the recent interim dividend (+24%) for the current financial year to 31 December 2017.

Malita Investments plc ranks in third place with a net dividend yield of 3.21% which is far higher than the yield in the last two years. However, this is solely due to the steep decline in the share price in recent months. In fact, the overall dividend in respect of the 2016 financial year declined by 2.2% from the previous year. However, the dividend is in line with the policy laid out in the IPO Prospectus published in July 2012. In fact, the current dividend of €0.0231 per share still represents a gross dividend yield of 7.1% (net: 4.6%) on the IPO price of €0.50. Malita recently announced that it amended its agreement with the Government of Malta in relation to a number of improvements that have been made, as well as others in progress which are being undertaken to the Parliament Building. One would need to see whether the incremental revenue from this amended agreement will translate into higher dividends to shareholders in the years ahead.

GO plc also continues to rank among the top dividend yielding equities for the second successive year. Based on the current share price, the net dividend yield of 3.15% places GO in fourth position in the league table. Many inverstors may have doubted whether the 43% increase in the dividend in 2015 declared prior to the exit by Emirates International Telecommunications Malta Ltd from its majority stake was to be repeated. However, GO not only maintained this dividend in respect of the 2016 financial year but the dividend improved by a further 10% to a net dividend of €0.11 per share. During the recent Annual General Meeting, GO’s acting CEO provided the EBITDA figures for the Cypriot subsidiary showing a strong uplift in EBITDA over the past three years. Coupled with the equally resilient performance in Malta as well as the group’s strong balance sheet showing a very low net debt to EBITDA multiple, GO could easily continue to maintain a dividend of €0.11 per share to all shareholders in future years.

While the dividend league table is based on the historic dividends distributed to shareholders, one exception was of the new entrant PG plc. In this case, the estimated forward dividend yield was calculated. PG has an April year-end and the Prospectus provided the forecasts for the 2016/17 financial year that came to an end on 30 April 2017 and a projection for the 2017/18 financial year that commenced on 1 May 2017 and runs through 30 April 2018. In the Prospectus, PG’s Directors claimed that the objective is to distribute not less than 50% of the group’s net profit to shareholders by way of dividends. PG also indicated in the Prospectus that dividends will be paid twice a year with around 40% of the overall dividend expected at the interim stage while the balance of 60% will be distributed as a final dividend subject to shareholders’ approval at the Annual General Meeting.

PG should be publishing its 30 April 2017 annual financial statements by the end of August while the interim financial statements to 31 October 2017 ought to be published by the end of December. Since the IPO took place towards the end of the 2016/17 financial year, it is highly unlikely that a maiden dividend will be distributed immediately. We aniticpate that the first dividend will be paid by the end of December or early January 2018 as an interim dividend based on the group’s financial performance for the six-month period to 31 October 2017. The projections for the 2017/18 financial year that commenced on 1 May 2017 indicated that the group will generate a profit after tax of €8.4 million. Based on the total issued share capital of 108 million shares, this equates to an earnings per share figure of €0.0779. As such, assuming a dividend payout ratio of 50%, the overall net dividend would amount to €0.03895 per share. The share offer was conducted at €1.00 per share which placed PG plc at the top of the dividend league table given the prospective net dividend yield of 3.89%. However, following the rally in the share price to €1.29, the resultant net dividend yield of 3.02% places PG in fifth position.

Due to space restrictions, it is difficult to include a comment on all the companies within the league table. However, a comparison between two very similar companies – Plaza Centres plc and Tigne Mall plc – is called for. Plaza ranks in sixth position with a dividend yield of 2.83% while the yield of 2.50% on Tigne Mall plc places this equity in eight place. While Tigne Mall is solely exposed to the retail sector and is dependent on the sales generated by the various retail outlets within the shopping complex, Plaza is also very much dependent on the rental income generated from the sizeable area dedicated to offices. The rental of offices became even more important for Plaza following last year’s acquisition of an additional property. It will be interesting to see whether the income from the new property will translate into higher dividends to shareholders. However, this is also dependent on Plaza managing to achieve rental increments from the expiring leases within the newly acquired property. In the current political climate whereby Malta’s image is being tarnished unduly on an international level, this may pose an additional risk that may need to be factored in by investors in the years ahead.

While it is important to look at the historic dividends, it is even more important to understand the sustainability of a company’s dividend or the ability of a company to distribute higher dividends to shareholders in the future. It is also very important to highlight that actual dividend yields to shareholders may differ following the changes announced in last year’s Budget on the treatment of dividend income from companies listed on the Malta Stock Exchange. In essence, upon a dividend distribution (applicable with respect to dividend distributions made out of profits derived after 1 January 2017), a shareholder holding not more than 0.5% of the capital of a company listed on the Malta Stock Exchange, may claim a refund on the tax deducted at source on such dividend. The tax refund amount would depend on the effective tax rate applicable to the shareholder. While some readers may expect next year’s dividend league table to be updated accordingly following this change, this would not be possible since the effective tax rate is dependent on the specific circumstances of each shareholder. What is certain however is that many pensioners would benefit from such a change in legislation and the resultant dividends would be far more attractive than that announced by the companies. In view of these changes, it is likely that some investors would therefore tend to view certain equities more favourably in the future from a dividend perspective.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.