The Net Debt to EBITDA multiple

In last week’s article, I explained the importance of analyzing the financial strength of issuers across the bond market. In my analysis, I only take into consideration those bond issues approved by the Malta Financial Services Authority and listed on the regulated Main Market of the Malta Stock Exchange which are obliged to publish their financial projections annually via the Financial Analysis Summary (FAS).

Apart from the interest coverage ratio which was dealt with last week, another very important financial metric is the net debt to EBITDA multiple. The ‘Earnings before interest, tax, depreciation and amortisation’ (EBITDA) has become a widely used measure of a company’s operational profitability and is referred to in most announcements by local companies. The ‘net debt to EBITDA’ is arrived at by dividing a company’s interest-bearing borrowings net of any cash or cash equivalents, by its EBITDA. The net debt to EBITDA ratio is essentially a debt ratio that shows how many years it would take for a company to pay back its debt if net debt and EBITDA are assumed to remain constant in future years.

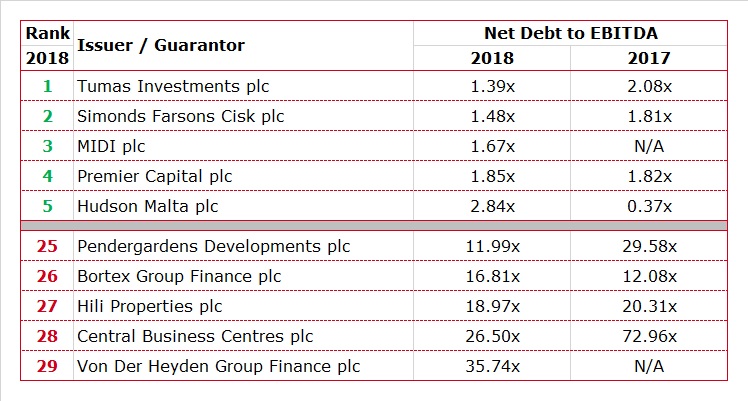

In the table ranking the interest cover metric which was published last week, the top positions went to Simonds Farsons Cisk plc, Premier Capital plc, Virtu Finance plc, MIDI plc and Tumas Investments plc. Interestingly, four of these companies (namely Simonds Farsons Cisk plc, Premier Capital plc, MIDI plc and Tumas Investments plc) also rank within the top five positions in the net debt to EBITDA rankings.

However, it is also important to explain that while the financial performance of MIDI plc is susceptible to wide fluctuations from one year to the next due to the timing of the final deeds of sale of any residential units, the performances of Simonds Farsons Cisk plc, Premier Capital plc and Tumas Investments plc have been very strong and consistent in recent years.

As such, it is reasonable to conclude that these three companies (Simonds Farsons Cisk plc, Premier Capital plc and Tumas Investments plc) are the most creditworthy among the various companies listed on the regulated Main Market of the MSE. This is also reflected in the market, as the bonds of these companies are currently giving the lowest yields.

Due to space restrictions and following the information provided in last week’s article, I will not be commenting on each of the companies ranked in the net debt to EBITDA table. The table depicts those companies having the lowest net debt to EBITDA (therefore the stronger companies) and also those with a high net debt to EBITDA showing that it will take a significant number of years for the companies to repay all their borrowings.

Simonds Farsons Cisk plc, Premier Capital plc, MIDI plc and Tumas Investments plc all have a projected net debt to EBITDA multiple below 2 times for 2018. However, MIDI’s EBITDA will decline as from 2019 from the record level of €25 million projected for 2018 since the 2018 EBITDA includes a large amount of revenue recognition of the apartments within the Q2 block. As such, the 2018 net debt to EBITDA may be somewhat misleading for this company.

On the other hand, it is worth highlighting that although the EBITDA of Spinola Development Company Ltd as guarantors of the bonds of Tumas Investments plc amounting to a projected €29 million for 2018 includes a sizeable amount of sales of apartments (€11 million in EBITDA representing half of the stock of apartments) within the ‘Laguna’ development, it does not include the significant profit arising from the sale of the new business centre which is adjacent to the Portomaso Business Tower. The FAS published a few weeks ago by Tumas Investments indicates that an amount of €19.4 million will be recognised in 2018, representing 55% of the agreed amount, and the balance will be reflected in the 2019 financial statements in line with the conditions of the public deed.

The fifth position in the net debt to EBITDA ranking goes to one of the newcomers to the bond market, Hudson Malta plc, with a multiple of 2.8 times. The company issued a €12 million bond earlier this year and the FAS indicated that it is projected to generate an EBITDA of €2.9 million in 2018 while its net debt is estimated at €8.3 million since it includes a cash figure of €3.6 million partially representing unutilised bond proceeds ahead of additional investments still being undertaken. The main business activities of the Hudson Malta Group include the operation of various retail stores in Malta (Nike, Go Sports, New Look, 3INA, Benetton, KIABI and River Island) and the distribution of Nike products to Urban Jungle Italy and a number of third party stores (operating under the Urban Jungle franchise) in Malta. However, it is also worth highlighting that this bond issuer has a low EBITDA margin of only 7.7% while the amount of shareholders’ funds at €7 million is below the overall level of borrowings leading to a net debt to equity multiple of 1.2 times – which is another important measure of gearing.

Although SD Finance plc and AX Investments plc are not featured in the top 5 net debt to EBITDA rankings, it is still worth mentioning these companies given the fact that their figures are very close to Hudson Malta’s multiple of 2.8 times. In fact, the projected net debt to EBITDA multiple of SD Holdings Ltd (as guarantor of SD Finance plc) is of 2.9 times and of AX Holdings Ltd (as guarantor of AX Investments plc) is of 3.3 times, primarily reflecting the strong profitability of both companies operating within the tourism sector.

When looking at the weakest performers from a net debt to EBITDA multiple, the companies featuring in the last three positions also rank weakest from an interest coverage perspective.

In last week’s article, I explained that the Von der Heyden Group has a sizeable amount of assets under development and the receipt of rental income or sale of part of these assets in future years could boost the company’s financial metrics accordingly. The group’s largest asset is a shareholding in one of the Bavaria Towers in Munich, Germany and as this sizeable project is estimated to be completed by the end of 2018, one would expect a significant change in the financial situation of the guarantor.

In the case of Hili Properties, apart from the portfolio of 24 properties valued at €104 million as at 31 December 2017, the company had used a portion of the bond proceeds to partially finance the purchase of a sizeable parcel of land measuring circa 92,000 sqm in Benghajsa, Malta. The balance sheet reflects the deposit of €24.5 million and the transfer of the land should take place during the course of 2018. The subsequent sale or eventual development of this asset could also improve the financial metrics of Hili Properties in the future.

Central Business Centres plc also does not yet generate any EBITDA from the St Julian’s development which is still nearing completion.

Pendergardens Developments plc is another property development company similar to MIDI plc whose financial performance is dependent on the timing of the final deeds of sale of any residential units. In its latest FAS, the company provided an update on the various blocks of units being constructed. The company encountered a 12-month delay in the development of Block 17 and the two towers. Block 17 is now expected to be completed by the end of 2018 with the delivery of some of the apartments now projected to take place in late 2018. The two towers are expected to be completed in 2019. Nonetheless, despite the delay, Pendergardens Developments only has 3 apartments which remain unsold from Block 17 (out of 47 units) and 19 apartments in the two towers (out of 30 including 2 duplex penthouses which have not yet been placed on the market). Some retail and office space also remains unsold.

Another recent newcomer to the bond market, Bortex Group Finance plc, features within the weakest positions on a net debt to EBITDA basis. The group is principally involved in the manufacturing and retailing of garments but also operates in the local property market as well as the hotel industry. In fact, most of the proceeds from the €12.75 million bond issue in October 2017 were earmarked for the refurbishment and extension of the “Hotel 1926” and beach club development project in Sliema as well as the development of a mixed-use complex located in Mriehel. The contributions from these new ventures will feature in subsequent years but in the meantime the financial projections for the current financial year to 31 October 2018 were already revised downwards in the updated FAS published on 25 April 2018 compared to the initial estimates published in the Prospectus dated 30 October 2017.

The lengthy FAS’s contain important information for analysts as well as investors who ought to consider the various findings within such reports before contemplating an investment in any bonds.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.