The upcoming IPO of BMIT Technologies

On 3 October, GO plc issued a somewhat surprising announcement and explained that it intends to dispose of up to 49% of its shareholding in its fully-owned subsidiary BMIT Technologies plc (BMIT) through an initial public offering (IPO).

An extraordinary general meeting is taking place next Monday 3 December in order to obtain the approval of GO shareholders for this transaction to take place.

In line with the requirements of the Listing Rules issued by the MFSA, an explanatory circular was sent to all shareholders ahead of the EGM in order to provide detailed information on BMIT and the proposed transaction to enable shareholders to make an informed decision on the resolutions on the agenda of the meeting. The circular also provides the financial statements of the BMIT Group (both historic and projected) as well as the projected dividend policy which provides sufficient information for investors to understand most details of the upcoming new share offer.

Moreover, on 14 November GO announced that BMIT prepared a slideshow providing a graphical review of the business operations and future strategy as well as information on the valuation methodology adopted for the upcoming IPO which would be of interest to those investors contemplating an investment in the new share offer.

These details were also discussed during a meeting organised by GO with financial analysts in which GO’s CEO Mr Nikhil Patil also delved into detail about the rationale for the partial disposal of BMIT. The CEO explained that GO aims to maintain a balance between its capital expenditure requirements as well as its returns to shareholders while keeping an underleveraged balance sheet. Mr Patil referred to GO’s net debt to EBITDA multiple of under 1 times (effectively implying that all its net debt could be repaid with the operating profits generated in less than 1 year) which he indicated is possibly among the best gearing multiples across the global telecoms landscape. The CEO explained that the partial sale of BMIT will aim to deliver returns to shareholders in a tax-efficient manner via dividends but will also assist GO in accelerating its planned investment in fibre infrastructure across the Maltese Islands. GO is aiming for 80% coverage within the next 5 years. Moreover, the separate listing of BMIT on the Malta Stock Exchange will improve the company’s profile which will help to accelerate its market penetration among the local business community and provide the company with access to the capital markets for future expansion so as not to remain dependent on GO’s balance sheet for its funding requirements.

BMIT is a leading IT services provider in Malta and is primarily focused on the provision of data centre, cloud and managed IT services, offering an extensive range of services and solutions to a wide range of business customers. BMIT is the largest data centre provider in Malta with a leading market share currently operating from two sites in Handaq and SmartCity.

Historically, the main target clients of BMIT were online gaming companies operating out of Malta. However, over the years BMIT extended its product and service offering especially following the acquisition of Kinetix IT Solutions and as a result, BMIT’s client portfolio today (comprising 500 corporate clients) also includes business customers operating in other sectors of the local economy such as financial services, media, transportation and communication. In fact, 30% of BMIT’s revenue is currently generated from cloud and managed services (mainly to non-gaming customers) which is expected to grow in future years as BMIT aims for increased penetration among Maltese business. Moreover, BMIT aims to assist companies in other new sectors such as Blockchain, artificial intelligence and ‘internet of things’.

The financial information provided in the explanatory circular published by GO shows the profitable track record of the company. The directors expect this positive financial performance to be maintained and in fact they are forecasting that during the current financial year ending 31 December 2018, BMIT is expected to generate an EBITDA of €9.31 million (+8% over 2017) and a net profit of €4.22 million (+11.3% over 2017) on revenues of €21.7 million (+9.9% over 2017).

The explanatory circular also provides projections for the financial years ending 31 December 2019 and 2020. The directors of BMIT are projecting that EBITDA will rise by 9% to €10.1 million in 2019 and by a further 12% to €11.4 million in 2020 as revenues are anticipated to continue growing in the coming years and reach €24.6 million by 2020. The continued growth in revenue and operating profits is based on the current healthy business pipeline and more importantly on the increase in the data centre capacity as a result of the new data centre in Zejtun as from 2020. The growth in revenue in 2020 also reflects the 50 racks (equivalent to half of the additional capacity) being taken up by GO which will also help BMIT to reduce its dependency on the online gaming sector.

BMIT is projecting net profits to surge by 22% in 2019 to €5.15 million but drop by 9.4% to €4.67 million in 2020. The projected drop in profitability in 2020 is largely due to the much higher net finance costs as these are expected to increase to €0.94 million in 2020 from €0.31 million in 2019. This reflects the impact of fresh borrowings amounting to €10 million (from GO plc) related to capital investments in the new data centre located in Zejtun (owned by Malta Properties Company plc) as well as the recognition of charges in relation to committed leases by BMIT in line with the implementation of the new accounting rule IFRS 16.

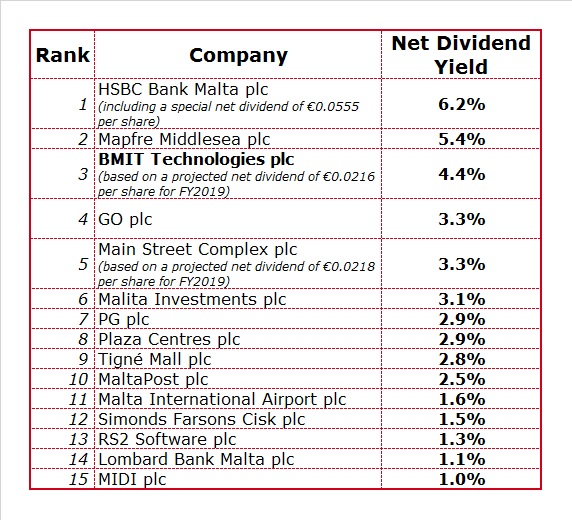

The explanatory circular also discloses the expected dividend policy that will be adopted by BMIT. The intention of the company’s directors is to retain a strong dividend payout ratio similar to the past few years. In fact, the circular notes that BMIT paid its sole shareholder GO a total of €12.3 million in dividends between 2015 and 2017. The future dividend policy described in the explanatory circular states that dividend distributions will be made on an annual basis and they are expected to amount to a maximum of 90% of the company’s free cash flow but not exceeding 95% of distributable profits. This high dividend payout is possible as a result of the low annual requirement for capital expenditure following the upcoming €10 million investment in Zejtun as well as the underleveraged balance sheet. The first dividend for the new shareholders after the IPO in early 2019 will be in or around May 2020 since this will need to be approved by shareholders during the Annual General Meeting in respect of the 2019 financial year. The dividend is projected to amount to €0.0216 per share, representing a net dividend yield of 4.4% based on the IPO price of €0.49 per share. Moreover, BMIT is projecting a net dividend of €0.024 per share for the 2020 financial year. This translates into a yield of 4.9% on the IPO price. The expected dividends for 2019 and 2020 place BMIT among the highest dividend-yielding equities listed on the Malta Stock Exchange

The total issued share capital of BMIT Technologies plc amounts to 203,595,310 shares. In its initial announcement on 3 October, GO had stated that it is seeking to dispose of up to 49% of its shareholding in BMIT and it is seeking to raise up to €49 million. The explanatory circular also indicates that GO will retain a minimum of 51% of BMIT and a maximum stake of 75%. In essence, the IPO is for a minimum of 25% of the total issued share capital (equivalent to circa 50.9 million shares) and up to a maximum of 49% (equivalent to circa 99.8 million shares).

The explanatory circular clearly states that the completion of the proposed IPO is dependent on the satisfaction of a number of conditions, namely (i) approval by GO shareholders during the EGM on 3 December 2018; (ii) regulatory approval for the admission to listing on the Official List of the MSE of the shares of BMIT; (iii) listing of the shares of BMIT; and (iv) a minimum of 25% of the total issued share capital of BMIT Technologies is taken up at the IPO.

BMIT has been attributed a value of just under €100 million. The slideshow explains that the valuation was based primarily on the income approach, whereby projected cash flows from the operations of the BMIT Group were discounted to their present value equivalent using a rate of return that reflects the relative risk of the investment.

Based on the IPO price of €0.49 per share, an estimated net debt of €1.4 million as at 31 December 2019 as well as a projected net profit of €5.2 million in 2019, the valuation gives a forward enterprise value-to-EBITDA multiple of 10 times and a forward price-to-earnings multiple of 19.4 times.

The slideshow also indicates that a selected group of data centre operators listed across US and EU stock markets (namely InterXion, Internap and Equinix) currently trade on an EV/EBITDA multiple of 20 times. BMIT’s IPO was therefore priced at a discount to international peers to reflect some of the risks involved such as the current dependency on gaming customers.

Shareholders of GO should eagerly attend next Monday’s EGM since it is an opportunity for them to seek any clarifications regarding the information published to date.

Meanwhile, assuming the conditions are all satisfied for the IPO to take place, it would be another important milestone for the Maltese equity market since it not only provides investors with another possibility of diversifying their portfolios into the technology sector but it also shows how the larger companies can optimize shareholder returns.

Rizzo, Farrugia & Co. (Stockbrokers) Ltd is acting as Sponsor and Co-Manager to BMIT Technologies plc.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.