Why have MGS prices suddenly dropped?

Many investors have been asking for the reasons behind the sudden drop in prices of Malta Government Stocks over the past 3 weeks. Prices and yields of MGS mirror movements in the benchmark German bund and those of other periphery countries with credit ratings similar to those of Malta (BBB+). Therefore, as a start, it is important for investors to note that this is not solely a Malta development, but the movement in local bonds followed the trend across the eurozone bond markets.

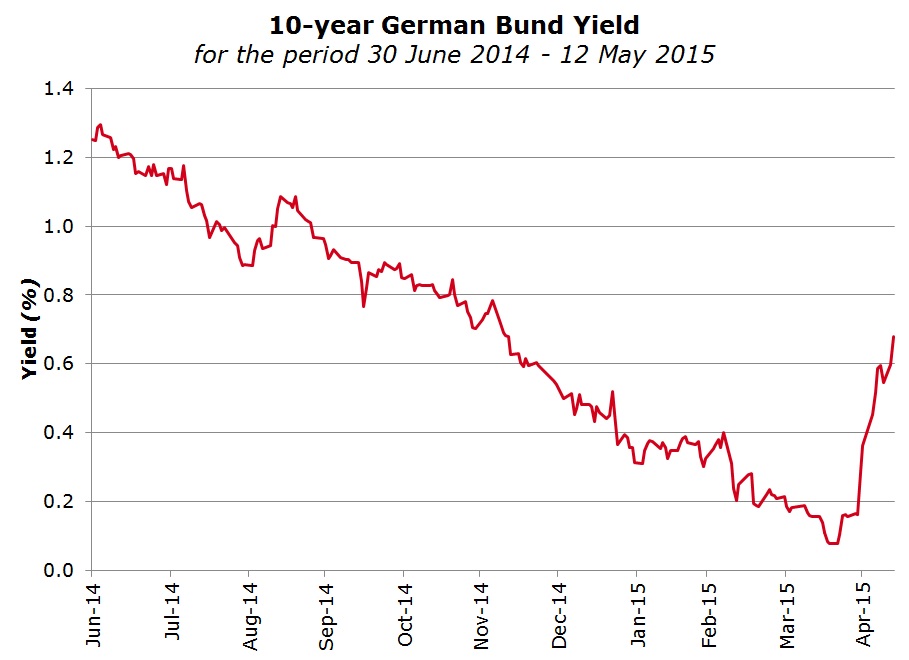

Until mid-April, bond yields had dropped unrelentlessly (bond prices soared) with the benchmark German 10-year bund-yield reaching a low of 0.05% on 17 April as the President of the European Central Bank Mr Mario Draghi reiterated his commitment to purchase €60 billion of eurozone bonds each month until September 2016 via the quantitative easing (QE) programme regardless of the initial signs of favourable economic indicators.

The general consensus among most market analysts was that it was only a question of time until yields on the 10-year German bund would break through the negative barrier and also approach the -0.2% level which is the limit imposed by the ECB for purchases under its QE programme. By mid-April, yields of German bonds up to the nine-year maturity point, were trading at negative nominal interest rates — in other words, investors were willing to pay to lend money to the German government.

However, the relentless fall in yields came to a sudden halt after data revealed stronger eurozone economic figures, improved credit conditions as well as inflationary expectations. Another factor that may have impacted sentiment was a German bond auction for 5-year paper that failed to attract the required amount.

The movement in the price of oil is also another major reason since this is one of the primary factors that impacts inflation expectations. Fuel prices are a key ingredient in the basket of goods and services that is used to measure inflation statistics and the price of oil is a primary determinant of fuel prices. Oil prices may also impact food prices since a higher fuel price increases the cost of transporting goods and vice versa. The price of crude oil recovered strongly from the multi-year lows of a few months ago and reached USD62.58 per barrel triggered by lower output from Libya and a drop in US supply.

Investors would do well to understand that these are truly unprecedented moves since bonds do not normally provide double-digit performances.

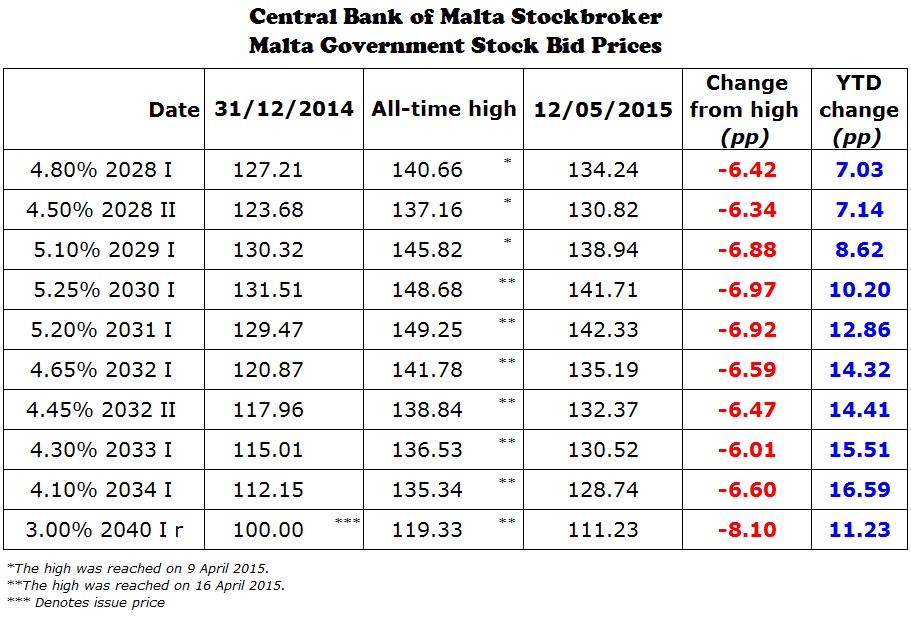

Eurozone yields rebounded strongly since mid-April and traded up to a 5-month high of 0.796% last Thursday afternoon thereby unwinding the movement in yields since the initial announcement of the QE programme by the ECB President in January. This led to a sharp correction in bond prices with the prices of long-term MGS’s (those maturing between 2028 and 2040) dropping between 600 bp and 800 bp from their record levels of 16 April.

While many Maltese investors may be shocked at the strong decline in prices over the past 10 days, the downturn in Malta was less severe than that evidenced in some of the periphery countries such as Italy and Spain.

Investors must not only look at the movements in such short periods of time. In fact, when analysed over a slightly longer horizon, the recent sell-off only represents a partial reversal of the rally since the end of 2014. In fact, despite the 5% to 7% decline in long-term MGSs, prices are still circa 7% to 16% above the year-end level. Investors would do well to understand that these are truly unprecedented moves since bonds do not normally provide double-digit performances.

Following the extraordinary positive performances across global bond markets in recent years, many well-known international investors have been warning that the end of the bond market rally which has been ongoing for a large part of the past 35 years is slowly nearing its end. Only recently, the world-renowned former Pimco bond fund manager Bill Gross, stated that the 10-year German bund was “the short of a lifetime” and he declared that it was only a matter of time before prices tumbled. The legendary investor Warren Buffett agreed with this statement and similarly warned that bonds were “very overvalued”.

Following the strong recovery, Eurozone yields eased at the end of last week to below the 0.55% level again leading to a partial recovery in prices but yields resumed their upward trend in the first part of this week. After the recent volatility, many investors are naturally keen to know whether yields will drop back towards the record low levels seen until mid-April or whether yields will continue to rise and therefore lead to further price declines in the weeks and months ahead.

Although this is very difficult to predict from one week to the next, it is very much dependent on economic data flowing out of the eurozone as well as developments regarding Greece. Economic data for the first quarter of the year is expected to indicate better-than-expected growth for the eurozone on the back of stronger external demand, a weaker exchange rate and the lower oil price. This should push yields higher and weaken bond prices further. Similarly, positive news about Greece should also lead to declines in bond prices.

However, views on upcoming movements in the eurozone bond markets are generally mixed. An international journal recently quoted an HSBC analyst who believes that there is still the potential for bond yields to drop back to the low levels in the near-term as the ECB continues its large-scale buying programme thereby driving prices higher. On the other hand, a fixed income research analyst at the Swiss bank Julius Baer believes that a continued sell-off is in store as he was quoted last week that “yields are still below their fair value in the euro area”. Likewise, Barclays bank compared the recent moves in the eurozone bond market to developments in Japan in 2003 when yields rose by over 110 basis points in only 6 months after dropping to unprecedented lows on fears of deflation. Moreover, Mohamed El-Erian, the former partner of Bill Gross at Pimco (one of the world's largest bond investors), stated in the Financial Times last weekend that in his view, German bund yields will remain low in historical terms, but not as “ridiculously” low as that seen until mid-April. He described the recent events as a correction after yields converged excessively, including those for peripheral European bonds.

The sharp decline in MGS prices over recent weeks is a stark reminder to many local investors, especially to those who have the large percentage of their overall investment portfolios invested in MGSs. Investors had failed to come to terms with the fact that following the extraordinary rally in prices over recent years, prices of the long-term MGS were susceptible to wide bouts of volatility. Although it is very difficult to time market movements from one week to the next, it would be irrational for investors to believe that the historically positive performance can be repeated year after year. Any further improvement in economic conditions in the eurozone and an uptick in inflation will undoubtedly lead to another increase in yields and a further fall in long-term bond prices from current levels. Although yields and official interest rates are unlikely to reach pre-2008 crisis levels over the next couple of years, yields have fallen so low that an upturn in yields even towards a level which would still be far off the pre-crisis levels would still represent a significant price correction from current levels. Local investors need to understand this reality in the bond market to ensure that they are not caught by surprise once again.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.