GO aiming to become ‘the enabler of the Digital Era’

GO plc held a meeting with financial analysts last week during which the recently appointed CEO Mr Nikhil Patil provided a review of the group’s strategy. Mr Patil is not a newcomer to GO or to the local economy since he had been one of the key persons involved in the acquisition of Maltacom plc by Emirates International Telecommunications in 2006. Mr Patil also served as a director of GO between February 2012 and September 2016 and following the spin-off of Malta Properties Company plc in October 2015, he was appointed as CEO of the newly listed company until he was asked to return to GO in an executive role earlier this year.

The last time GO plc had convened a meeting with the financial community was several years ago so this was an important meeting for financial analysts to get updated on the new strategy being adopted.

The CEO explained that the group’s mission is to “deliver an unmatched multiplay experience and be the enabler of the digital era”. Mr Patil explained that the group aims to achieve its overall mission by focusing on a number of strategic priorities both in Malta as well as in Cyprus, where GO has a 51% equity stake in Cablenet.

Malta’s telecoms market is widely considered to be mature and therefore with limited potential for sizeable customer growth. One of GO’s main aims is therefore to protect its market share across the different segments, namely fixed and mobile telephony, broadband, and PayTV. Mr Patil explained that in order to maintain a high level of customer retention, the key focus is to provide a positive customer experience during the term of a customer’s contract period to increase the chances of maintaining a customer’s loyalty upon renewal.

Meanwhile, with an increased usage rate of digital services within each household for various devices connected to the internet, GO aims to be the company of choice for customers requiring data connections.

Within the business segment, GO aims to become an ICT specialist. Following the acquisition of the BMIT group several years ago, GO already has a significant market share in data centre services mainly for the igaming community but also for a growing list of other local and international companies. It is investing in a new sizeable data centre operation and recently completed the entire acquisition of Kinetix which is vital to enable the group to offer a complete ICT solution to many businesses operating in Malta.

While these initiatives should help the group achieve modest improvements in revenue in Malta, the more meaningful opportunities for profitablility growth could arise from cost reduction measures mainly via an increased focus on automation as well as through modernization of the telecom networks.

The CEO also spoke at length about the Cypriot market and confirmed that Cablenet should continue to grow its broadband customer base in the months and years ahead due to its superior offering compared to its competitors. Mr Patil expects Cablenet to achieve a total of 65,000 broadband connections by the end of the year and this is targeted to reach 73,000 by the end of 2019. Mr Patil explained that by the end of next year, the group will have an equivalent amount of broadband customers in Malta and Cyprus.

The main aim in Cyprus is to accelerate customer growth and apart from the broadband sector, the company is also targeting the mobile market in competition with the other three existing operators. Cablenet is currently achieving an EBITDA of between €13 million and €14 million annually and given the fact that no tax is currently being paid due to historic losses incurred by the company in its initial years of operations, there is a significant amount of free cash flow being generated.

The meeting was also addressed by the CFO Mr Reuben Zammit who gave an overview of some key financials during the first half of 2018.

GO reported a 4.1% increase in revenues during the first half of 2018 to €84.3 million with growth in revenue both in Malta and also in Cyprus. In fact, the CFO indicated that revenue in Malta amounted to €68 million (representing an increase of 3.6%) and the Cypriot subsidiary generated revenue of €16.3 million (representing a growth of 5.8%). Meanwhile, the cost base edged 2.9% higher to €68.3 million leading to an operating profit of €16 million which is almost 10% higher than the €14.6 million figure reported in the previous comparable period. Excluding depreciation and amortisation charges, EBITDA remained broadly unchanged at nearly €33 million with the EBITDA margin deteriorating slightly to 39% from 40.2% in the first six months of 2017.

Net finance costs continued to decline and amounted to €0.72 million helping the pre-tax profit to rise by over 13% to €15.3 million.

Mr Zammit also highlighted that although there was a slight decline in cash generation, the net cash from operations of €24.8 million during the first six months still represents a strong cash flow. The CFO also provided some key figures within the statement of financial position with total assets of €244.1 million and net debt of €61.5 million. Although this represents a slight increase in debt, the net debt to EBITDA multiple remained below 2 times.

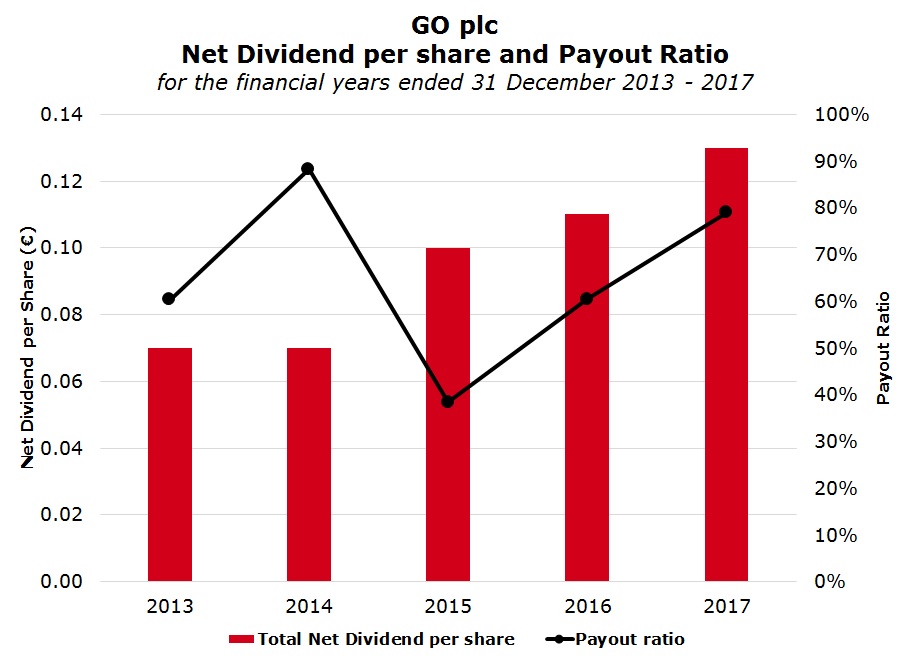

The CEO made reference to the strength of the balance sheet when commenting about the company’s dividend policy. Mr Patil explained that although there is no stated policy on the specific dividend payout ratio, the trend in recent years is a clear indication of the company’s intentions. In May 2018, the company paid a net dividend of €0.13 per share, representing a 18.2% increase over the previous year. This represents a net dividend yield of 3.9% based on the share price of €3.32 on 3 September.

GO does not pay semi-annual dividends and the recent announcement on 10 August again stated that the extent of a dividend distribution for 2018 will be decided on the basis of the full-year results which are normally announced in early March. In recent years, GO increased its dividend payment strongly. In fact, this rose from €0.07 per share in respect of the 2013 financial year to €0.13 in respect of the 2017 financial year. The consistent cash flow generation and the balance sheet dynamics should support a continued strong dividend payout stream also in future years.

During the company’s Annual General Meeting in May 2018, the CEO had stated that the directors are always looking at ways of creating shareholder value. Mr Patil repeated this again during last week’s meeting and also mentioned that any money which cannot be employed profitably should be given back to shareholders.

GO’s new management team would do well to improve its investor relations efforts by organising such analyst meetings more frequently in the future to disclose the progress being achieved in the company’s strategic objectives.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.