A review of Malta’s economic progress

Earlier this month, the European Commission (EC) published its updated economic forecasts for all eurozone countries covering the three-year period from 2018 to 2020. The data provides interesting findings particularly with respect to Malta as it continues to outperform most of the other euro area countries.

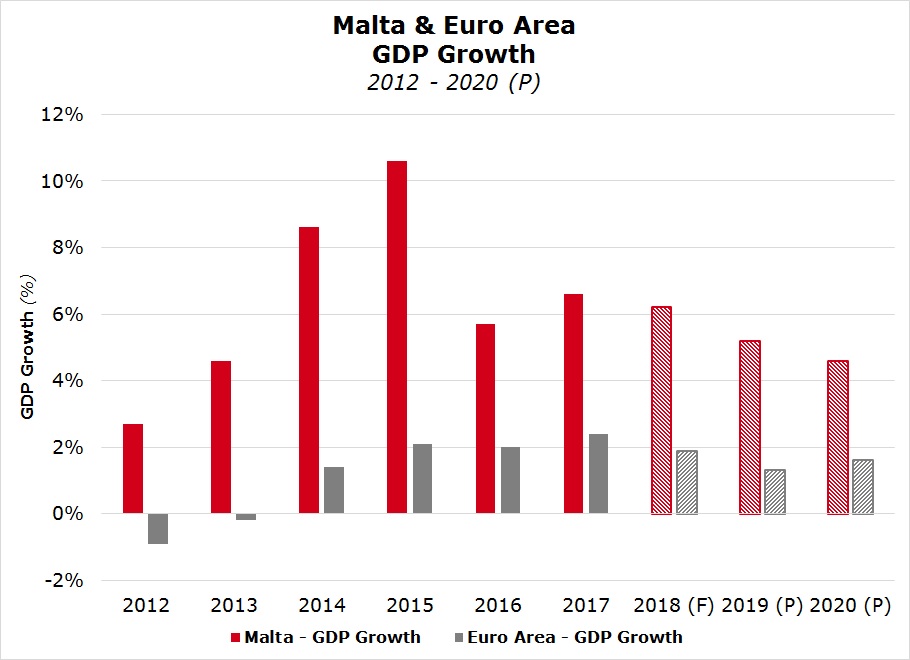

The EC noted that “Malta’s economy maintained a strong growth trajectory in 2018”. In fact, the EC expects Malta’s gross domestic product (GDP), a commonly used measure to value the economic activity within a particular jurisdiction, to have grown by 6.2% in real terms during 2018 compared to 6.6% in the previous year and only second to Ireland’s 6.8%.

The EC’s report further explains that this growth was achieved on the back of an increase in domestic demand which, in turn, was spurred by strong employment growth, increasing disposable income as well as large accumulation of savings in recent years which also contributed to buoyant private consumption. The EC also explains that domestic demand is now Malta’s main driver of economic growth as opposed to net exports in previous years as the latter has been adversely impacted by a weaker external environment which also resulted in a drop in the exports of goods.

Looking ahead, the EC anticipates further growth for Malta both in 2019 and 2020. Malta is projected to register a further 5.2% growth in GDP this year and an additional 4.6% expansion in 2020. Specifically, for 2019, the EC explains that the onset of large-scale projects in the health, tourism and real-estate sectors are expected to boost private investment whilst private consumption is set to remain healthy on the back of higher disposable incomes. It is also noteworthy to highlight that the forecasted GDP growth rates for Malta in 2019 and 2020 are the highest amongst eurozone countries. Moreover, although the EC’s latest projections for Malta indicate that growth for the Maltese economy will somewhat ease from the 6.6% in 2017 and 6.2% in 2018, the latest figures are still better than the previous growth forecasts of 4.9% and 4.4% respectively published by the EC in November 2018.

This contrasts sharply with the projected figures for the whole euro area which have been revised downwards in the latest EC publication. The 19-country currency union is now expected to expand by just 1.3% in 2019 compared to the previous estimate of 1.9% as most of the countries’ projections, excluding Malta, Greece and Slovakia, have been revised lower by the EC. These include significant downward revisions in the growth projections for Germany, Europe’s largest economy, from 1.8% to 1.1%, Italy from 1.2% to 0.2% and the Netherlands from 2.4% to 1.7%. Disruptions in car production, which mainly affects Germany’s economy given that the country is a major automobile exporter, social tensions and political uncertainty, particularly in France and Spain, as well as fiscal policy fragility, with Italy in the limelight in this respect given its aggressive budget measures for 2019, are some of the challenges cited by the EC as the reasons for the aforementioned downward revisions.

Furthermore, the EC noted that the economic slowdown in the eurozone during the second half of 2018 was more pronounced than expected and the downward momentum was also evident during the month of January. The EC also opined that risks in the euro area remain to the downside which could ultimately have a lasting adverse effect throughout the whole year. This view is also shared by the European Central Bank (ECB) as evidenced in the January 2019 ‘Economic Bulletin’. Both institutions have identified the challenges related to global trade (particularly between the US and China), Brexit and volatility across emerging markets as potential pitfalls for the eurozone economy.

Malta has weathered these risks unscathed so far. Moreover, although Malta is expected to continue outperforming its fellow euro nation states, inflation remained within the ECB target of close but below 2% and should remain so at least until 2020. In fact, the EC projections indicate that Malta’s inflation rate reached 1.7% in 2018 (partly due to a technical amendment in the calculation) and is expected to gradually increase to 1.9% by 2020 largely on the back of pressures from continued wage growth. This is truly comforting especially in view of the low interest environment and other expansionary measures being taken by the ECB to support the economies of other European countries which are registering much weaker growth.

Malta has also registered a substantial improvement in its budgetary and debt metrics. In this respect, a country’s economic health is measured by its budgetary deficit or surplus as a percentage of GDP and by the ratio of national debt to GDP. In the case of Malta, the government has returned a budget surplus every year since 2016 and following 32 years of successive annual deficits. In 2016, the surplus stood at 0.9% of GDP, whilst in 2017 this was 3.5%. Additionally, in each of the first three quarters of 2018, Malta registered a budget surplus in excess of 3% which should lead to a surplus for the whole year. As anticipated in the budget speech delivered by the Finance Minister in October 2018, Malta is also expected to continue registering a fiscal surplus in the years ahead at the rate of 1.3% in 2019, 1.5% in 2020 and 1.8% in 2021.

As a result, Malta’s debt levels have stabilised around the €5.7 billion level in recent years as no additional debt was required to finance budget deficits. Coupled with the improvement in GDP, Malta’s debt-to-GDP ratio has fallen from 72% in 2014 to below the 50% mark for the first time since the late 1990s. As at the end of the third quarter of 2018, Eurostat figures show Malta’s debt-to-GDP ratio at 45.9% which ranks as the fifth lowest within the eurozone. Only four other countries within the single currency area have a debt-to-GDP ratio of less than 50% (namely Estonia, Latvia, Lithuania and Luxembourg). The other fourteen countries all have higher ratios including 61% for Germany, 68% for Ireland, 98.3% for Spain, 99.5% for France and more than 100% for Italy, Cyprus, Portugal and Greece.

Malta’s economic progress has also been recognised by the international rating agencies which in recent years have either confirmed Malta’s credit rating or awarded a better rating. Naturally, the international rating agencies also identified a number of challenges, both internal (including those related to the labour market, property, infrastructure and bureaucracy) and external, which the government needs to remain cognisant of and take action where possible.

Therefore, while Malta’s economic progress is commendable and the economic prospects for the smallest eurozone member state are encouraging, Malta must not become complacent and should continue to seek to sustain the more important economic sectors whilst cultivating new sectors. This would enable Malta to achieve a truly diversified economy to strengthen the sustainability of the positive momentum currently being registered. Additionally, in the prevailing buoyant scenario, it must continue to manage its economic resources in a balanced manner to sustain competitiveness and avoid an overshoot of inflation which could ultimately lead to a derailment of the positive economic trends mentioned above.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.