RS2 Software discloses important strategic initiatives

RS2 Software plc was one of the companies that published its 2018 financial statements last week shortly before the deadline on 30 April.

The financial statements reveal that RS2 generated earnings before interest, tax, depreciation and amortisation (EBITDA) of €7.85 million (2017: €2.9 million) and pre-tax profits of €6.56 million (2017: €1.23 million). However, these figures need to be seen in the context of the adoption of new international financial reporting standards which hugely impact the financial results. In fact, reported revenues grew by 44% following the reversal of €5.6 million from the equity reserves of the company in relation to a term licence contract with an option to convert to perpetuity. Consequently, the Directors Report provided some additional details of the adjusted financial performance when excluding any impact from the international financial reporting standards. The company on a ‘stand-alone’ basis registered revenues of €16 million (2017: €14.8 million) and a profit before tax of €3.1 million (2017: €1.8 million) while the managed services arm of the group, RS2 Smart Processing Ltd, which is principally engaged in the processing of payment transactions with the use of BankWORKS®, recorded revenues of €3.8 million (2017: €2.9 million) and a profit before tax of €0.6 million (2017: €0.1 million).

Moreover, upon consolidation of all of the group’s activities including the subsidiary in the US and other cost centres such as the office in the Philippines, the overall group generated revenues of €19.3 million (2017: €17.4 million) after excluding any implications of the financial reporting standards and registered a profit before tax of €0.9 million (2017: €1.2 million).

During a meeting held with financial analysts on 30 April, RS2’s CEO Mr Radi El Haj claimed that 2018 was “a very good year in terms of client additions”. He also explained that despite the difficulty in interpreting the financial statements due to the implementation of the new international financial reporting standards, overall revenue growth of 11% was a positive development largely on account of the significant increase in maintenance fees after one of the new client additions started paying annual maintenance fees during the 2018 financial year.

Mr El Haj also commented that the new business strategy implemented some years ago which involves a focus on managed services as opposed to licence sales, is gathering momentum with some very large customers being attracted to the BankWORKS® platform. In fact, he highlighted that the implementation of new client additions and other important projects are expected to translate into a significantly improved financial performance in 2020/21. The CEO added that licence sales will only be considered in specific cases primarily in the Asia Pacific region. RS2’s CEO admitted that the company intentionally declined 3 potentially lucrative licence sales in the US and Europe during 2018 since it is the company’s firm belief that it is more advantageous in the long-term to roll-out its managed services business in these geographical territories. On the other hand, RS2 is in contract negotiations with three potential licensing customers in the Asia Pacific region, principally banks in the Philippines.

Given the strategy in recent years on building the managed services part of the business and the need for additional clients in this area to build up the required scale for the company to start generating healthy returns again for its shareholders, the focus must be on the potential success of the company’s international expansion efforts and how quickly RS2 can monetise these new contracts rather than on the historic financial performance.

In the 2018 Annual Report published last week, a number of important strategic initiatives and milestones were mentioned which could be helpful in assisting investors to understand the potential scale of operations in the years ahead.

In his statement to shareholders, the CEO claimed that RS2 “continues to attract significant attention in the market, particularly due to the flexibility, performance, modularity and the deployment of a single platform globally, which is being recognized by large acquirers in the market wishing to service their merchants worldwide using RS2 as their global partner”.

Mr El Haj also added that “managed services remains a thriving business with continuous increases in processing volumes, resulting in a profit for RS2’s subsidiary company RS2 Smart Processing Ltd. As an integral part of the strategic plan for RS2, RS2 Smart Processing is constantly increasing its portfolio adding large businesses to the platform. These new clients will contribute to substantial volumes of transactions which are expected to exceed the 1 billion mark by 2021”.

The CEO also announced in the 2018 Annual Report that given RS2’s strong positioning in the market, it is now able to start “a new business pillar namely the acquiring of direct merchants…. which will provide the group with a significant revenue stream by getting a percentage of the transaction value and charging a merchant service charge in addition to other ancillary services”. In fact, RS2 revealed that the group is in the process of applying with the German regulator BaFin for a financial institution license in Germany to be in a position to start its new acquiring services. During last week’s meeting, the CEO explained that this would be particularly attractive for US merchants and the aim is to obtain this licence by the first half of 2020.

On 17 December 2018, RS2 had issued an Interim Directors Statement in which it claimed that it successfully entered the North American market and among the clients forming part of the pipeline of potential clients, there were Tier-1 financial institutions. In the Annual Report published last week, the CEO expanded further on the developments in the US by stating that “RS2’s USA subsidiary is currently attracting some of the largest US acquirers to on-board as managed services clients”. Mr El Haj argued that “these opportunities will translate to significant revenue over the coming years”. Moreover, the Annual Report states that the group is currently in contract negotiations with 4 customers in the US which are expected to be onboarded in 2019 and is also in very advanced stages of negotiations with another 5 potential customers. In fact, shortly after the publication of the Annual Report, a separate announcement was issued on the Malta Stock Exchange in which RS2 stated that it secured a new major contract with Cross River Bank. Although this may not be a ‘household’ name for many Maltese investors, Cross River is reportedly a leading innovator and a provider of banking services for financial technology companies. In last week’s analyst meeting, Mr El Haj claimed that although this is a smaller bank compared to the Tier-1 financial institutions mentioned previously, Cross River has some huge names as its clients and therefore it is a great partner for RS2.

The 2018 Annual Report also states that RS2 is preparing to launch transaction processing services with its alliance partner for the travel industry during the third quarter of 2019 commencing in Europe and then proceeding to Latin America. This major agreement had first been announced in November 2017 when it was reported that RS2 successfully formed a strategic alliance and a processing services agreement with one of the largest players in the travel and tourism industry in order to deliver global acquiring services to international airlines, travel agents, hotels and car rental firms around the globe.

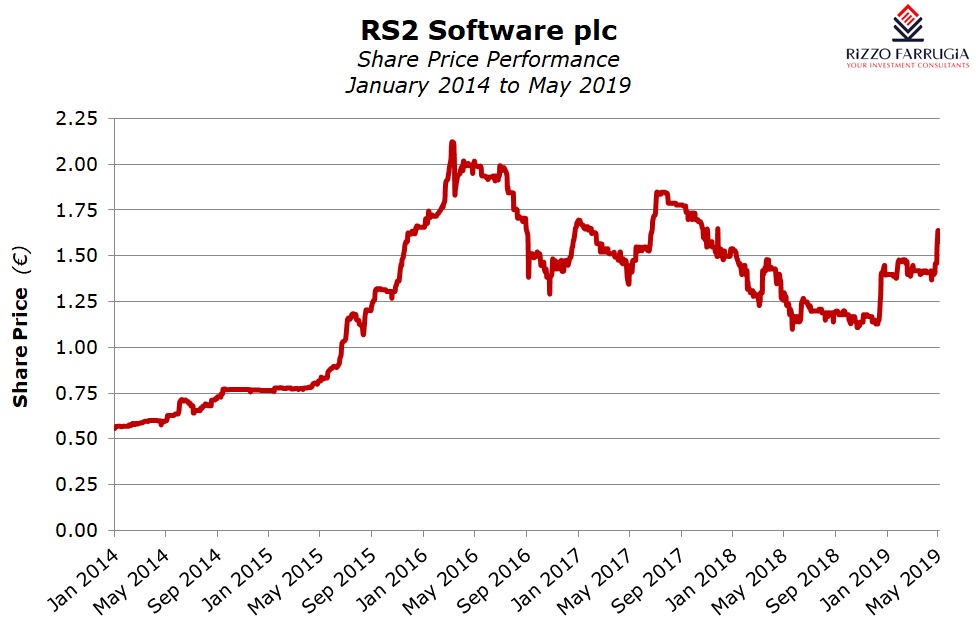

RS2 has been listed on the MSE since 2008 and it has always distributed a dividend to shareholders except in 2012 with respect to the 2011 financial year. Last week, RS2 announced that in view of the various investments required by the company to implement its ambitious expansion strategy, the Board of Directors resolved not to recommend the distribution of a cash dividend. While many Maltese investors focus on dividend returns and may be disappointed at this decision, given RS2’s international expansion strategy, the equity must be viewed as a potential growth play rather than a consistent dividend yielding one. Instead, RS2’s Directors are recommending a 1-for-8 bonus share issue.

The payment processing industry has seen significant M&A activity over recent months involving some of RS2’s own multinational clients. With a concerted move in many countries to shift towards cashless economies and with the increased use of e-commerce, the payment services sector promises to become an even more fundamental pillar of modern economies. RS2 needs to ensure that its technology remains at the forefront of ongoing developments to reap long-term rewards for its numerous shareholders.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.