Initial impact of Transformation Programme

The interim financial statements of Bank of Valletta plc that were published last Wednesday 31 July were highly anticipated by observers of the Maltese capital market following the series of negative developments in recent months related to the cyber-attack, the loss of the bank’s last remaining USD correspondent banking relationship and the letter sent by the regulators to BOV which was leaked to the media and published on 30 June.

BOV announced that during the first six months of 2019, it generated an ‘operating profit before litigation provision’ of €45.1 million representing a considerable decline of 46% compared to the figure of €84.2 million in the first half of 2018. While the total income generated by the bank was largely unchanged at just over €127 million, the financial performance of the bank was negatively impacted by a substantial rise in costs as well as the significant loan impairment reversals of €20.2 million recognised in the first half of 2018 which were not repeated in the past six months.

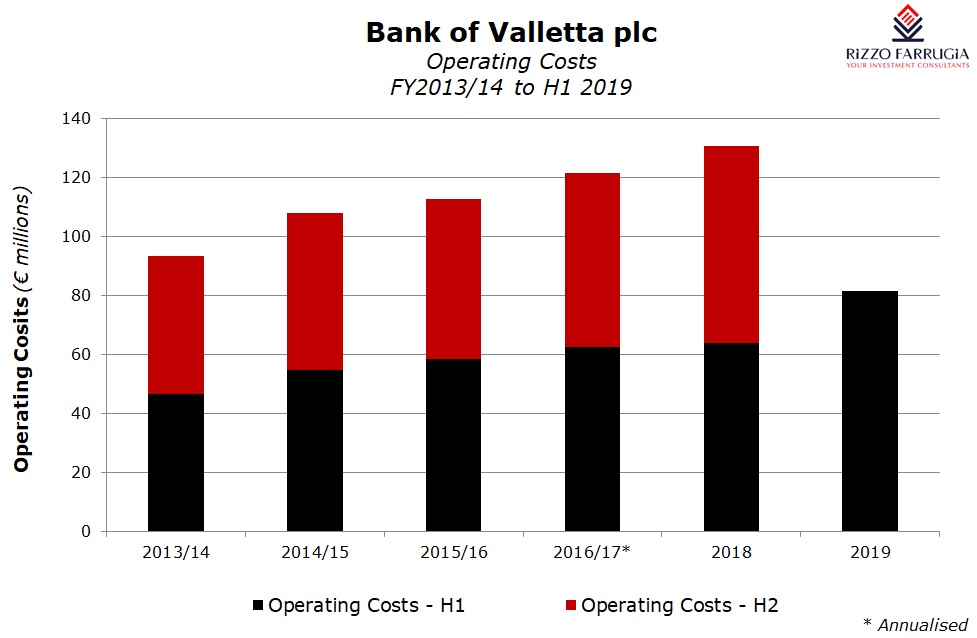

The operating costs incurred by BOV during the first half of 2019 climbed by 27.4% (or €17.5 million) to €81.5 million largely reflecting higher employee costs (+8.7% to €35.6 million) as well as a significant increase in ‘General administrative expenses’ to €39.8 million compared to €26.3 million in the first six months of 2018. The interim financial statements published last week indicate that the substantial jump in administrative expenses include the initial costs related to the implementation of the bank’s ‘Transformation Programme’ (partly reflecting the engagement of two global consultancy firms) as well as work related to the upcoming replacement of the bank’s core IT system.

The surge in costs is one of the key highlights of last week’s announcement and an item which had been repeatedly mentioned by BOV’s CEO Mr Mario Mallia during a meeting with financial analysts on 5 July which was convened following the leaked letter to the media a few days earlier. During this meeting, the CEO had responded to a question and referred to the costs of the ‘Transformation Programme’ as ‘enormous’. In fact, the CEO had also mentioned that BOV cannot continue to generate a double-digit return on equity due to the significant upward pressures on costs from the ‘Transformation Programme’, the weaker income generation arising from the de-risking strategy as well as the low interest rate environment coupled with the need to grow the bank’s equity base. Mr Mallia repeated these circumstances to the media last week by stating that the “days of super profits are over”.

Indeed, BOV’s annualised return on equity during the first half of 2019 is of 7.5%. Although this is much lower than the returns generated by BOV in recent years, it is important to note that the average return on equity of European banks monitored by the European Banking Authority is less than 7%.

Shortly before BOV published its interim financial statements on Wednesday afternoon, the international credit rating agency S&P issued an updated report on BOV. The agency downgraded the bank’s long-term rating from ‘BBB‘ with a negative outlook to ‘BBB-‘ with a stable outlook. The bank’s short-term rating was also revised downwards from ‘A-2’ to ‘A-3’.

Given recent developments and the importance of such rating actions, it is essential to highlight the main observations by such a prominent international rating agency. S&P questioned the effectiveness of the bank’s IT and compliance monitoring tools following the cyber-attack earlier this year.

The rating agency also referred to the stand taken by the European Central Bank and the Malta Financial Services Authority (MFSA) for BOV to strengthen its internal controls and risk oversight. S&P opined that it will take time for BOV to implement these changes and transform the bank’s risk governance before yielding any significant results. S&P also acknowledged the fact that the bank is addressing the issues related to the recent operational risk events and the outcome of regulatory investigations. Unfortunately, however, S&P also expressed its doubts on the bank’s ability to adequately manage the complexities of its operations and the negative impact that this could have on profitability as well as overall capital levels.

S&P also highlighted that the expected significant increase in expenses will place downward pressure on profitability as well as internal capital generation measures while some of the pending litigation cases may require further provisions.

With respect to the planned issuance of €150 million Additional Tier 1 capital in the second half of 2019, the rating agency questioned the actual timing due to the delay that has already occurred in this respect. BOV’s CEO, however, seemed very confident during last week’s analyst meeting that the entire amount of €150 million will be successfully issued by the end of 2019 as a private placement with a number of investors, and in fact ruled out the possibility that another rights issue will be necessary.

Although the stable outlook provided by S&P does not indicate a further change in the rating of the bank in the near term, the report also explains possible scenarios that may lead the agency to either adopt a further downgrade or carry out a rating upgrade.

S&P explained that a further downgrade could materialise if it believes that BOV were failing to deliver on measures to improve its internal controls and offset further provisions arising from the pending litigations.

S&P indicated that a rating upgrade is unlikely at this stage since it will take time for the bank’s actions on its internal controls and operational risk management to prove their effectiveness. Moreover, the rating agency believes that the litigation cases could last several years before concluding. On the other hand, however, S&P stated that the successful issuance of Additional Tier 1 (a ‘bail-inable’ instrument) would be considered as a positive development by the rating agency.

In last week’s announcement related to the interim financial statements, BOV made reference to its aim of “widening its pool of overseas correspondent banks, especially with respect to US Dollar clearing”, following the termination of its current correspondent arrangement on 14 December 2019. While the bank declared that it “is at an advanced stage of replacing its current USD correspondent”, Mr Mallia reported to the press and also to financial analysts shortly after the publication of the results that the bank secured the services of the Austrian Raiffeisen Bank as a new correspondent bank.

BOV’s share price has been among the most negative performers on the MSE over the past 18 months when the news of the Deiulemar litigation resurfaced in the first half of 2018. The share price has tumbled by 36% since then, dropping to its lowest level in almost 10 years with the market capitalisation shrinking to €630 million from around the €950 million level at the start of 2018. Given the huge number of shareholders in the bank, this is likely to be affecting investor sentiment across the local equity market although it is interesting to note that notwithstanding this unfortunate situation, a number of other equities have performed very strongly indicating that the investing public is becoming increasingly attentive to company-specific developments.

BOV had suspended its dividend distribution last year amid the uncertainties related to the litigation cases and the need to enhance its capital levels. As was widely anticipated, the bank did not declare an interim dividend last week but claimed that the decision with respect to a final cash dividend will be revisited at the end of 2019 in line with developments taking place in the second half of the year. BOV’s numerous shareholders will therefore anxiously await upcoming developments in order to gauge whether dividends can be reinstated for the 2019 financial year and if so, whether the extent of such a distribution of future dividends will be conditioned by new regulations such as the Minimum Required Eligible Liabilities (MREL).

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.