Bond Issuer Rankings – Part 2

In last week’s article I published the rankings of the bond issuers on the Regulated Main Market that feature in the top positions and also the weaker positions from an interest coverage ratio perspective.

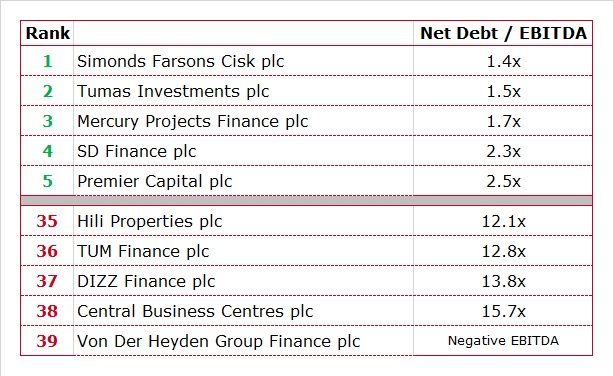

I concluded the article by stating that the combination of the results of the rankings of the interest coverage ratio and the net debt to EBITDA multiple should provide a good basis for the investing public to assess the overall strength of bond issuers.

The net debt to EBITDA multiple is one of the ratios that is most commonly used to measure the level of indebtedness or gearing of a company. Another ratio is the net debt to equity multiple showing the amount of borrowings of a company compared to the level of shareholders’ funds (comprising share capital, retained earnings and other reserves).

Many of the companies ranking as the most creditworthy from an interest coverage perspective also feature in the top positions of the net debt to EBITDA table. Basically, Simonds Farsons Cisk plc, Tumas Investments plc, SD Finance plc and Premier Capital plc all have net debt to EBITDA multiples below three times. It would therefore be reasonable to conclude that as a result of the high interest coverage coupled with the very low net debt to EBITDA multiples, these four issuers stand out as being the most creditworthy among the various bond issuers across the Regulated Main Market.

In order for readers to understand the concept of the net debt to EBITDA multiple, the figure for Simonds Farsons Cisk plc of 1.4 times indicates that given the forecasted EBITDA of €23.6 million which the company estimates it will generate during the current financial year to 31 January 2020, it can repay its total net debt of €33.1 million in almost one and a half years. This is extremely comforting for the company’s bondholders and also its bankers.

Likewise, the guarantor of the bonds issued by Tumas Investments plc (namely Spinola Development Company Limited) is estimated to generate an EBITDA of €32.1 million during 2019 while the overall net debt of the company is expected to amount to €46.8 million. However, it is worth pointing out that the projected EBITDA for this year comprises an amount of €16.6 million from the hospitality division but also €12.6 million from property development activities following the recognition of the second tranche of revenue pertaining to the transfer of the ownership title of the tower adjacent to the Portomaso Business Tower in 2018. The revenue and profitability from property development activities fluctuates widely from one year to the next given the limited amount of property available for sale.

Possibly, the most surprising company on the list is the third position which is occupied by the new issuer Mercury Projects Finance plc. Here again, one needs to highlight the fact that this is a pure property development company and that its financial performances from one year to the next are significantly impacted by the recognition of any property sales. In fact, the guarantor Mercury Towers Ltd is projecting that during the current financial year to 31 December 2019 its revenue will jump to €26 million and EBITDA will amount to €8 million as a result of the sale of airspace pertaining to the apartment units that are already subject to a promise of sale agreement.

The financial statements as at March 2019 of SD Holdings Ltd (as guarantor to the bonds issued by SD Finance plc) indicate that the overall net debt of the company of just over €62 million can be repaid in just over two years given the EBITDA of €26.4 million.

Likewise, Premier Capital plc is estimated to have an overall net debt of €145.1 million at the end of 2019 (including the €65 million bonds due to mature in November 2026 and lease liabilities of €76.5 million) while EBITDA is expected to amount to €57.1 million resulting in a net debt to EBITDA multiple of 2.5 times. Premier Capital was one of the issuers mostly impacted by the new financial reporting standard on lease accounting (IFRS 16). In fact, the net debt to EBITDA multiple for 2018 was 1.5 times. Premier is one of the only companies to have also published its 2020 financial projections and based on the expectation that EBITDA will rise by a further 11.5% next year to €63.7 million, coupled with a reduction in net debt to €127.6 million, the net debt to EBITDA multiple is expected to strengthen further to 2 times.

Other companies with relatively low net debt to EBITDA multiples forecasted for 2019 which do not feature in the top five positions but are still worth highlighting are Eden Finance plc, AX Investments plc and Virtu Finance plc all at 3.1 times; Corinthia Finance plc at 3.4 times; Gasan Finance Company plc at 3.5 times; Bortex Group Finance plc at 3.8 times and Mediterranean Investments Holding plc at 3.9 times.

Mediterranean Investments Holding plc is one of the three issuers forming part of the Corinthia Group. Mediterranean Investments Holding plc is 50% owned by the parent company of the Corinthia Group, Corinthia Palace Hotel Company Ltd which also acts as the guarantor of the bonds issued by Corinthia Finance plc apart from two of the bonds issued by Mediterranean Investments Holding. Meanwhile, International Hotel Investments plc is 57.8% owned by Corinthia Palace Hotel Company Ltd.

The net debt to EBITDA multiple of Mediterranean Investments Holding should be of particular interest to the investing public since the company has only one operating asset in Libya (namely the ‘Palm City Residences’) and its three bond issues are all due for redemption within the next three years. The projected financial statements for 2019 published in the recent FAS indicates that the overall net debt of the company is estimated to decrease to €81.7 million by the end of 2019 (compared to €94.7 million at the end of 2018). Meanwhile, the company expects to generate an EBITDA of €20.8 million in 2019 representing a significant increase compared to the €11.7 million generated in 2018 as occupancy within the ‘Palm City Residences’ is anticipated to reach 75% by the end of 2019 from 45% at the end of 2018.

Since Corinthia Palace Hotel Company Ltd reports consolidated financial statements including both International Hotel Investments plc and Mediterranean Investments Holding plc, the net debt to EBITDA multiple works out at 3.4 times for 2019 while that of International Hotel Investments plc is of 7.5 times.

DIZZ Finance plc and Central Business Centres plc feature among the lowest rankings from both an interest coverage ratio perspective and also from a net debt to EBITDA multiple. Apart from the €8 million bonds on the Regulated Main Market, the Dizz Group (via its subsidiary D Shopping Malls Finance plc) also borrowed an additional €7.5 million at the end of last year and these bonds were admitted to Prospects MTF.

The 2019 financial forecasts of TUM Finance plc do not provide a good benchmark of the company’s performance and financial standing since in 2020, the company will benefit from the first twelve-month contribution of the company’s two main assets, namely Center Parc (in which the company holds a 75% stake) and the Zentrum Business Centre. The 2020 financial projections should therefore represent a clearer picture of what the financial metrics of TUM Finance plc would be following the issuance of the new bonds and a full-year operation of the two main assets. TUM Finance plc estimated that its EBITDA in 2020 will rise to €2.9 million which would lead to an improvement in the net debt to EBITDA multiple of 6.3 times (when also including shareholders’ loans amounting to €2.65 million) compared to the projected 12.8 times in 2019. Likewise, the interest coverage ratio will improve from 2.1 times in 2019 to 3.6 times in 2020.

The bonds of Von Der Heyden Group Finance plc are guaranteed by the parent company Timan Investments Holding Ltd. Since the guarantor registered a negative EBITDA in 2018 and a similar result is expected in 2019, the net debt to EBITDA multiple as a measure of leverage cannot be computed. Timan Investments is involved in the development of the Bavaria Towers in Munich, Germany, consisting of four high-rise towers with circa 78,000 sqm of total gross rental area. The most recent Financial Analysis Summary of Von der Heyden Group Finance plc dated 28 June 2019 explains that the Blue Tower, one of the commercial towers with circa 24,500 sqm in rental area, has reached an occupancy level of over 95%, with the remaining office space being under option by one of the current tenants. On the other hand, for such property development companies, investors should also analyse the net debt to equity ratio. In the case of Timan Investments, the overall net debt as at the end of 2018 amounted to €49.6 million compared to total equity of €44.9 million.

While the computation of a company’s gearing using either the net debt to EBITDA multiple or the net debt to equity ratio are important metrics to gauge the overall indebtedness of a company, it is unrealistic to expect that companies will ultimately seek to repay all bank borrowings and bonds. An element of debt is always necessary in the long-term financing plans of any company in order to enhance overall shareholder returns.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.