Bond redemptions in 2021

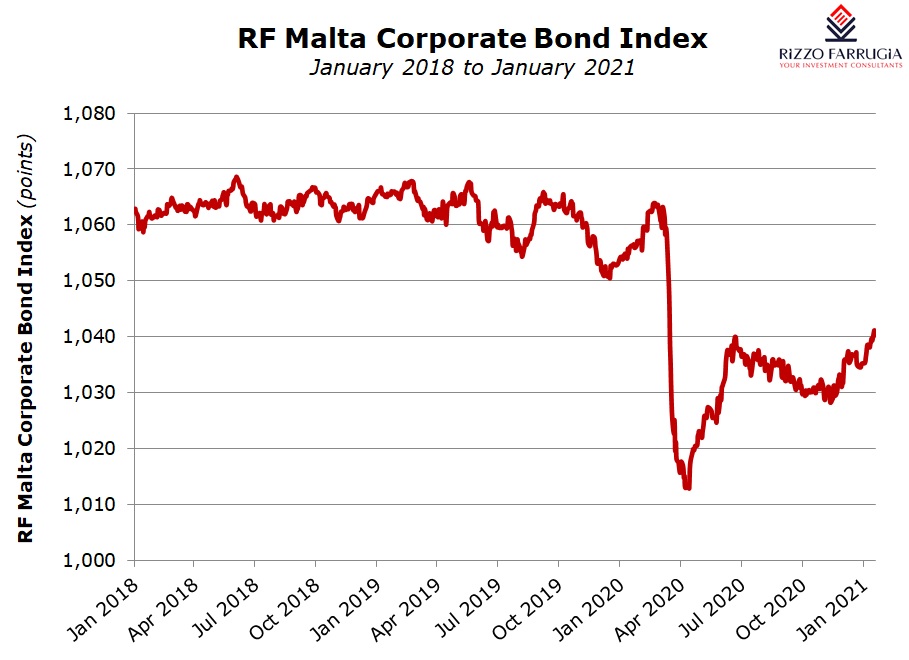

During the course of 2020, Malta’s corporate bond market was naturally severely impacted by the pandemic. As I highlighted in some articles over the past few months, during the start of the pandemic in early March 2020, there were double-digit declines in the prices of various corporate bonds as a result of the understandable huge concern among retail investors about the unprecedented circumstances that were being experienced.

However, following the sharp sell-off, investor sentiment somewhat improved and many corporate bond prices recovered with some bonds also trading back up above their par value during the second half of the year. On the other hand, though, other bonds still remain below their par value with the clear outlier being Melite Finance plc which last traded at 80% due to the huge negative impact on their business in Italy and the bond restructuring plans which were initially outlined in the 2019 Annual Report published on 30 June 2020.

Despite the challenging situation across the bond market due to the pandemic, three new issuers and two existing issuers successfully tapped the market during the second half of the year. The new issuers were Cablenet Communication Systems plc, Shoreline Mall plc and APS Bank plc while Mediterranean Investments Holding plc and GAP Group plc utilised the bond market once again for their financing requirements. Collectively, an amount of €176 million was raised with MIH being a roll-over of an existing bond that was redeemed in 2020.

Meanwhile, bondholders were in receipt of a total of €109.6 million during 2020 from three other redemptions by Bank of Valletta plc, Gasan Finance Company plc and Pendergardens Developments plc. Additionally, Best Deal Properties Holding plc, GAP Group plc, Mediterranean Investments Holding plc, Pendergardens Developments plc and Plaza Centres plc periodically also re-purchased a number of their own bonds from the market which were subsequently cancelled.

Within this context, it is interesting to highlight that four bonds are due for redemption during 2021, namely €10 million of LifeStar Holding plc due on 2 June, €11.95 million of Mediterranean Investments Holding plc due on 22 June, €20 million of International Hotel Investments plc due on 21 December and €3 million of Central Business Centres plc due on 30 December.

LifeStar Holding plc (formerly GlobalCapital plc) had already issued some lengthy announcements in September and October 2020 making reference to the bond redemption due in 2021. In fact, the company had announced a group-wide restructuring plan which had also included the sale of at least 25% of the shares in the life insurance subsidiary as well as an offer to existing shareholders to exchange all of their shares in LifeStar Holding plc for shares in the life insurance subsidiary during Q4 2020. The proceeds from the offer of shares were intended to be used to redeem the €10 million bonds due to mature in June 2021. Subsequent to the initial announcement detailing this restructuring plan, LifeStar Holding had also stated that it separately intends to file an application with the Listing Authority of the MFSA requesting admissibility to listing of €10 million unsecured bonds in order to raise new funds to redeem the outstanding €10 million bonds. Although the company had correctly indicated that “there are material uncertainties on timing and execution” of the overall plans, the market still awaits further details on the planned bond issue as well as the IPO.

The other companies whose bonds are also due to mature during 2021 have not made any reference as yet of their intentions on whether new bonds will be issued to refinance the redeeming bonds or whether capital settlement proceeds will be sent to all bondholders upon maturity. News from each of these companies ought to be expected once the annual financial statements are published in the months ahead.

Although investor sentiment improved in recent months, as evidenced from the recovery in the prices of some bonds and also from the general lack of supply in other bonds, possibly as investors continue to position their portfolios ahead of the end of the pandemic following the COVID-19 vaccines already being rolled out, the corporate bond market is surely not out of the woods as yet. In a series of articles published during the summer in which I provided an analysis of the various bond issuers within the different economic sectors, it was clearly evident that while a handful of companies were limitedly impacted by the pandemic and continued to generate strong cash flows, other companies especially within the hospitality sector, the oil and gas industry as well as some other economic sectors were materially impacted by the very challenging economic conditions. A number of companies within specific sectors were also greatly assisted by government initiatives especially with respect to the wage supplement. Once the wage supplement is tapered off, cash flow pressure on certain companies may intensify further.

The publication of the Financial Analysis Summary by most of the bond issuers in the months ahead will be an important event for investors and financial analysts to gauge the extent of any recovery being anticipated and possibly already being felt by companies, as well as whether additional borrowings are required to sustain their operations before a full-blown recovery takes hold.

In previous years, the Malta Stock Exchange had occasionally published an indicative listing calendar at the start of the year to inform the market on the potential new issuance programme being anticipated. Following the successful new issuance during the second half of 2020 despite the pandemic, it is evident that excess liquidity remains abundant within the financial system (as evidenced by the huge increase in bank deposits throughout 2020). This could be important in the intermediation process to assist companies to expand and develop further. The publication of such a listing calendar should be reconsidered as this would provide important information both to the investing public as well as to upcoming issuers to understand the extent of the funding requirements. In a media article over the weekend, the Chairman of the MSE confirmed that “there is a significant pipeline of new issues”.

2021 should be an important and interesting year for the continued development of the Maltese capital market. On the one hand, investors need to remain vigilant on the financial performance of certain companies as a result of the devastating effect of the pandemic by reviewing the annual financial statements as well as the Financial Analysis Summary of all companies in the months ahead. On the other hand, hopefully, companies from various sectors will use the market to grow their business and enable investors to add new names to their investment portfolios and diversify into other sectors which so far have not been represented across the Maltese corporate bond market.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.