MIA issues strong guidance for 2022

Malta International Airport plc was one of the companies that published its interim financial statements last week during the start of the interim reporting season. While it was easily anticipated that the company would report a strong improvement in its financial performance (pre-tax profit of €16.7 million compared to a loss of €3.9 million in H1 2021) given the encouraging recovery in passenger figures especially between April and June as previously reported in its monthly traffic updates, the main highlight was the resumption of financial guidance to the market.

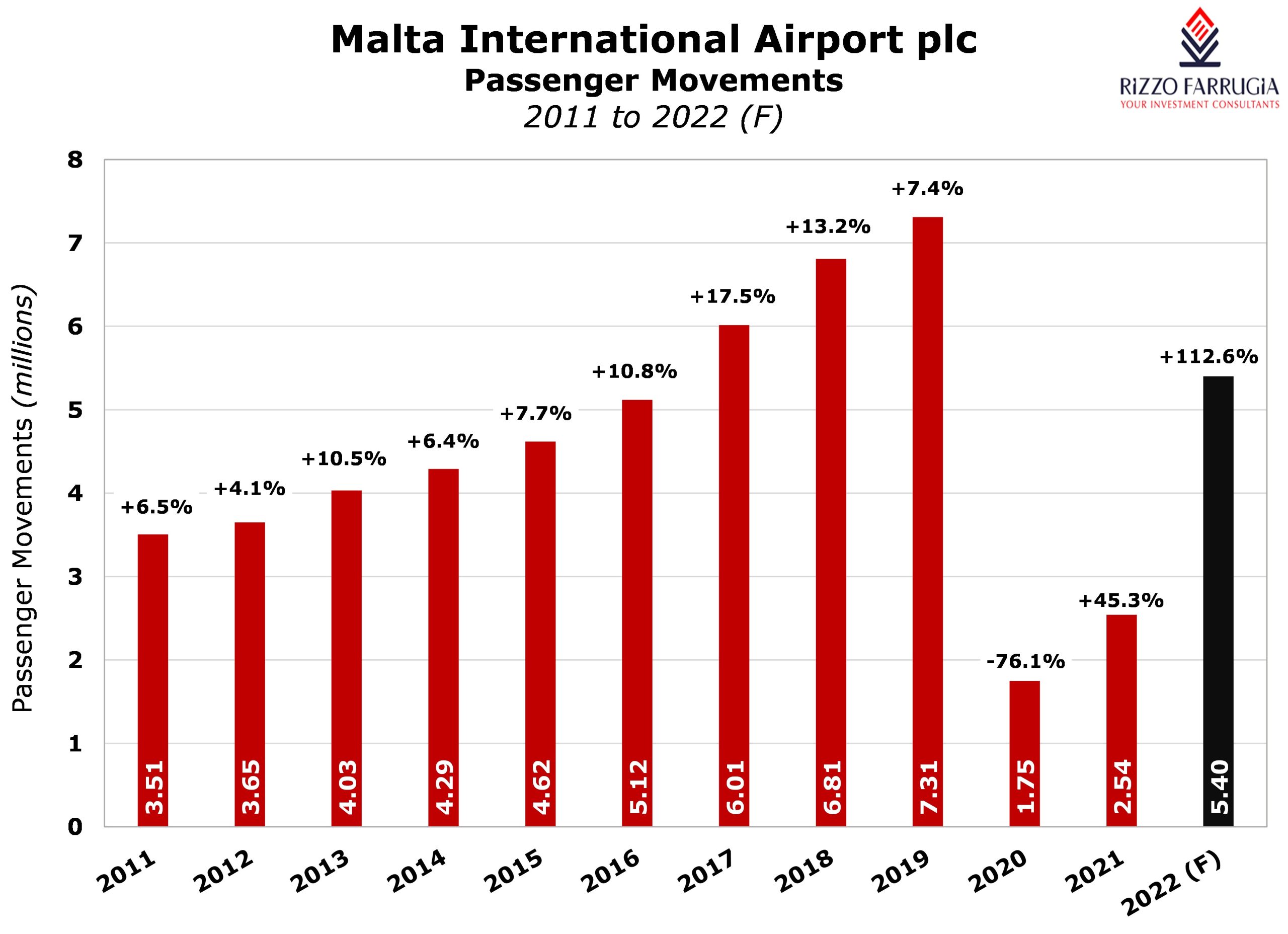

The airport operator announced that given the evident recovery in air travel in recent months with passenger movements amounting to 2.35 million during the first six months of 2022, the company expects total passenger movements for 2022 to exceed 5.4 million.

In my article some weeks ago, I highlighted that it was evident from the recent trends as well as from forecasts presented by MIA’s parent company (Vienna International Airport) that passenger movements at MIA would exceed 5 million during 2022. The official guidance provided last week by MIA of an estimate of over 5.4 million passenger movements during 2022 confirmed this. If it were to be achieved, it would be superior to the total traffic handled in 2016 of 5.1 million but inferior to the level of just over 6 million in 2017. The highest level of passenger traffic was registered in 2019 when 7.3 million movements were registered.

MIA also announced some key financial highlights based on the level of passenger movements being forecast for 2022. The airport operator anticipates that it will generate total revenues of over €82 million translating into an EBITDA of over €50 million and a net profit of over €23 million. In order to place these financial highlights in the context of MIA’s performance prior to the pandemic, it is worth comparing them to 2017 when passenger movements amounted to just over 6 million and the record year in 2019 with passenger traffic of 7.3 million. MIA had registered revenues of €82.4 million in 2017 and €100.2 million in 2019, an EBITDA of €48.6 million in 2017 and €63.2 million in 2019 and a net profit of €24.2 million in 2017 and €33.9 million in 2019.

Based on this comparison, it is evident that during 2022 MIA is expecting to generate higher revenues and EBITDA than in 2017 despite the lower amount of passenger movements. In fact, this trend is already evident in the actual financials for the first half of 2022 as the airport operator achieved a record EBITDA margin of 62.4% compared to the previous record of 60.5% in H1 2019, although this level of profitability includes the positive impact of the COVID Wage Supplement which amounted to €1.1 million.

It is worth recalling that in an earlier article of mine on MIA in January 2022, I had stated that a foreign financial analyst reviewing Vienna International Airport had issued a report at the end of 2021 which also included financial forecasts for MIA until 2024. This analyst had predicted MIA’s revenue will amount to €80 million in 2022 rising to €96 million in 2023 and €106 million in 2024. Meanwhile, this same investment house downgraded MIA’s revenue forecasts in May 2022 to €70 million in 2022, €88 million in 2023, €101 million in 2024 and €112 million in 2025.

Based on these latest forecasts, it is being estimated that in 2024 MIA would be surpassing the previous record revenue of €100.2 million in 2019 when passenger volumes amounted to 7.3 million.

The recent downgrades made by this foreign investment house indicates the heightened uncertainty across the travel industry in the first half of the year as well as the quicker-than-expected recovery during the start of the summer season. MIA’s guidance for 2022 of revenue exceeding €82 million is well-above the May 2022 revised forecast as mentioned above, and only marginally above the original forecasts by the foreign analyst late last year. This may have been unimaginable at the start of the year when MIA reported revenue of only €47.4 million during 2021.

Despite the strong financial performance in H1 2022, MIA announced that it will not be distributing an interim dividend to shareholders. The company noted that this decision was taken in the context of the prevailing macroeconomic uncertainties and the challenges within the aviation industry. However, the company also highlighted that this stance will be reviewed at the end of the year when it would be in a better position to assess the situation against the targets established for the year.

Given the very strong financial situation of the company with no borrowings and deposits amounting to €38.4 million as at June 2022 even before the start of the peak summer season which is the most profitable period for MIA, it is hoped that MIA will resume the distribution of dividends to shareholders by declaring an interim dividend during the fourth quarter of the year. Prior to the pandemic, MIA had regularly distributed semi-annual dividends to shareholders ever since its Initial Public Offering in 2002 and it is hoped that this trend will resume in the coming months for the benefit of all investors and overall market sentiment across Malta. MIA shareholders would therefore need to monitor the upcoming monthly traffic results closely as this promises to be a reliable indicator of the company’s ability to achieve its financial targets and thereby ensure that dividend payments are resumed.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.