MIA reports double-digit profitability growth

Last week as the share prices of Bank of Valletta plc and HSBC Bank Malta plc hit their highest levels in over 5-years after both banks reported record profits for the first half of 2024, the reporting season continued in Malta with the publication of results by some other companies including Malta International Airport plc.

Given the correlation between passenger traffic and the company’s financial performance together with MIA’s consistent communications strategy, the double-digit growth in profits should not have surprised any investors or market participants who devote time to follow the company’s numerous announcements.

In fact, MIA publishes its traffic results on a monthly basis and apart from the obligatory semi-annual financial results, the airport operator is one of the few companies in Malta that also publishes its Q1 and Q3 financial results in May and November respectively. The company also publishes its traffic and financial forecasts at the start of each year and provides additional updates during the year when circumstances indicate major changes from prior guidance.

In line with the regular communications by the company, in early July 2024, the company had published its June traffic results showing that passenger movements in the first half of this year surged by 18.4% to 4.07 million. From this announcement, one could very easily conclude that the company would have reported double-digit growth in revenue and profits when the financial statements were issued last week.

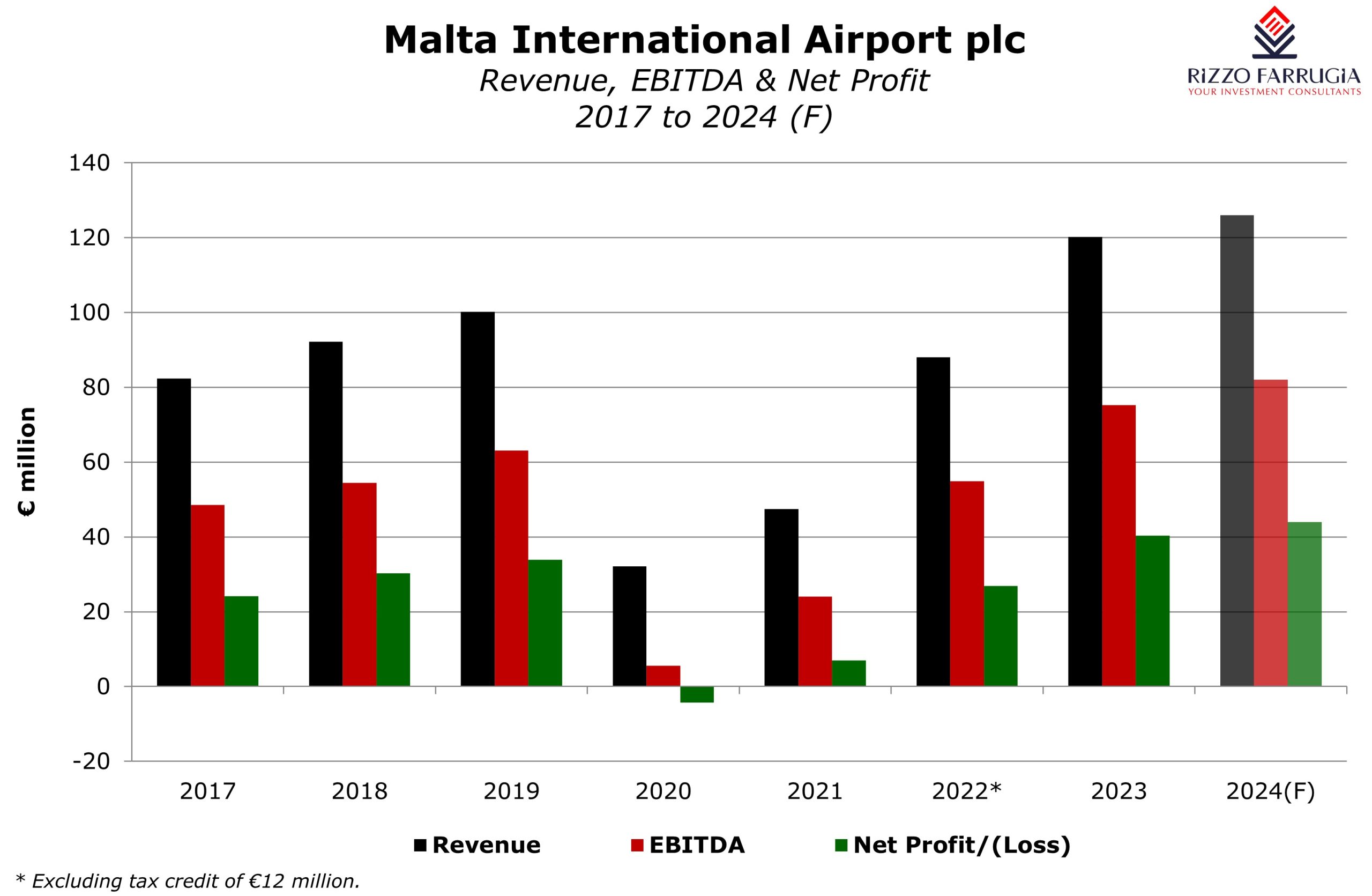

Moreover, on 14 May when MIA published its Q1 financial figures showing the surge in the financial performance at the start of 2024, the company also updated the traffic and financial forecasts for 2024 that were originally published on 11 January. In May, MIA disclosed that passenger movements were expected to amount to 8.45 million (8.3% above last year’s record level of passenger movements of 7.8 million) which would lead to revenue of €132 million (9.8% above the actual revenue of €120.25 million in 2023), EBITDA of €82 million (9.0% above the actual EBITDA of €75.22 million in 2023) and a net profit of €44 million (9.2% above the actual net profit of €40.3 million in 2023).

The June 2024 financial statements published last week should therefore be viewed in the context of the ample information within the public domain.

During the first half of 2024, MIA’s revenues reached a record level of €64.4 million, which is 20% higher than the previous record of €53.6 million generated in the same period in 2023 and 48.8% of the total revenue projected for the current financial year to 31 December 2024. Likewise, EBITDA amounted to €41 million, which is 22.4% higher than the record level of €33.5 million generated in the first six months of 2023 and exactly 50% of the projected EBITDA for FY 2024. Moreover, the company reported a record interim net profit of €22.1 million which is 26% above last year’s previous record of €17.6 million and also exactly 50% of the projected net profit for FY 2024.

The interim financial statements are therefore very much in line with the projections for the year although the seasonality factor is an important aspect when analysing the interim financial statements of MIA. In fact, historically, the company always generated higher revenue and profits during the second half of the year as a result of the elevated passenger movements during the summer months. The busiest months for the airport operator have always been July and August accounting for between 22% and 24% of annual passenger movements.

As such, while the company merely indicated that they are optimistic that for the rest of 2024 and they are “confident” that they will achieve the traffic and financial targets published in May, this will become more evident in the next few weeks once MIA publishes its July and August traffic results. Double-digit growth in these two all-important months as already experienced throughout the course of this year could enable the company to exceed its targets for the year.

Following the publication of the interim financial statements last week showing revenues and profits at circa 50% of the financial targets for this year and coupled with historical trends with the financial performance of the company improving during the second half of the year, one can easily assume that this same pattern will reflect itself also in 2024.

As such, one should expect the company to exceed its financial targets published in May and eventually report revenue in excess of €132 million for 2024, EBITDA greater than €82 million and also a net profit above €44 million.

Possibly the only surprise within last week’s announcement was the decision by the Board of Directors of MIA to declare an increased interim dividend. However, while this is indeed positive, the additional net dividend of €0.03 per share declared by the directors is not material enough to really cause any disbelief among the investor community.

Historically, with the exception of the pandemic years between 2020 and 2022, the company always paid an interim dividend of €0.03 per share and the larger proportion came about as a final dividend. In fact, earlier this year, MIA’s Directors had recommended the payment of a 2023 final dividend of €0.12 per share which brought the total dividend for the 2023 financial year to a record level of €0.15 per share.

Whether last week’s decision to increase the interim dividend from €0.03 per share to €0.06 per share is purely a rebalancing exercise between the interim dividend and the final dividend or whether this is a clear indication to accelerate shareholder returns remains to be seen.

On various occasions I had clearly advocated for higher dividends despite the very heavy investment programme being undertaken by the company over the next few years. The absence of any debt, which was confirmed again last week, coupled with the strong cash flow generation should enable the company to accelerate dividend distributions to shareholders. In one of my articles earlier this year, I had also made reference to a similar strategy by MIA’s parent company to distribute higher dividends as it announced an increase in its dividend payout ratio from 60% to 66%.

In 2023, the dividend payout ratio of MIA was at 50%. As such, in addition to the €0.06 per share declared last week and payable in mid-September 2024, given the profits expected during the second half of the year, the company can easily eventually recommend a further final net dividend of €0.14 per share which will still result in a dividend payout ratio of below 60%.

Also worth highlighting for those investors who do not closely follow the regular company announcements and do not attend the Annual General Meeting, is the clear and obvious frustration by the Board of Directors during the shareholders’ meeting on 15 May 2024 of the “disparity between the company's strong financial performance and share price recovery in 2023”. With the share price languishing below the €6.00 level for most of the past 3 years and failing to recover to the pre-COVID record of just below €8.00, during the AGM earlier this year and correctly replicated via a company announcement on the same day, MIA’s CEO Mr Alan Borg declared that the Board of Directors will be making considerations regarding the optimisation of shareholder value over the coming year.

Apart from the monthly passenger traffic announcements which should confirm the strong growth trajectory seen in recent months, the initiatives that may be contemplated by the Directors to optimise shareholder value to achieve a better reflection of the company’s valuation on the secondary market would surely be the more interesting aspects to follow in the months ahead.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.