Banks price to book multiple

While investors’ attention over the past ten days may have been mainly focused on the flash crash that sent international equity markets into a tailspin during the first few days of August, a less notable but interesting development took place across the Maltese capital market that warrants due coverage for the readers of my weekly column.

As indicated in the introduction to last week’s article, the share prices of Bank of Valletta plc and HSBC Bank Malta plc recently hit their highest levels in over 5-years in response to the better-than-expected interim financial results published during the last few days of July.

Over recent months, I published a series of articles regarding the state of the Maltese equity market and various initiatives that should be considered to enhance liquidity and investor participation. Although the levels of liquidity are still well-below that experienced during the pre-COVID times, the fact that the share prices of the two largest retail banks in Malta are at their highest since 2019 indicates that the market is indeed becoming more responsive to financial results and market developments.

In fact, it may be worth highlighting that the share prices of both banks are showing double-digit gains again this year with HSBC at +28% and BOV at +15.5% following the remarkable turnaround in 2023. Last year, the share price of HSBC rallied by 80% and BOV’s share price climbed by 75%. The recovery in both equities since the multi-year lows during the COVID years is also noteworthy with HSBC up by 134% from a low of €0.70 at the end of 2020 and in a similar vein, BOV up by 116% from a low of €0.76 in April 2022.

Although the trend and the extent of the upturn is indeed similar for both banks over recent years reflecting the sharp turnaround in profitability as the European Central Bank hiked interest rates between mid-2022 and Q3 2023, the fact that both share prices are identical at €1.64 per share (as at last Friday 9 August), is a mere coincidence.

The market cap of BOV is over €950 million while that of HSBC Malta is of €590 million reflecting the different profitability levels of both banks arising from BOV’s much larger market share in both deposits and loans. BOV’s deposit base of €12.2 billion is twice the size of HSBC at €6.1 billion and likewise, BOV’s loan book €6.5 billion is more than twice the size of HSBC at €2.98 billion.

Rather than looking at share prices in absolute terms, one needs to refer to pricing multiples when analysing companies within the same sector. International financial analysts and stockmarket commentators regularly quote various multiples when commenting on stockmarket trends.

I had mentioned the use of pricing multiples in an article in early May by making reference to two of the most commonly-used multiples across capital markets – the price to earnings multiple and the price to book multiple.

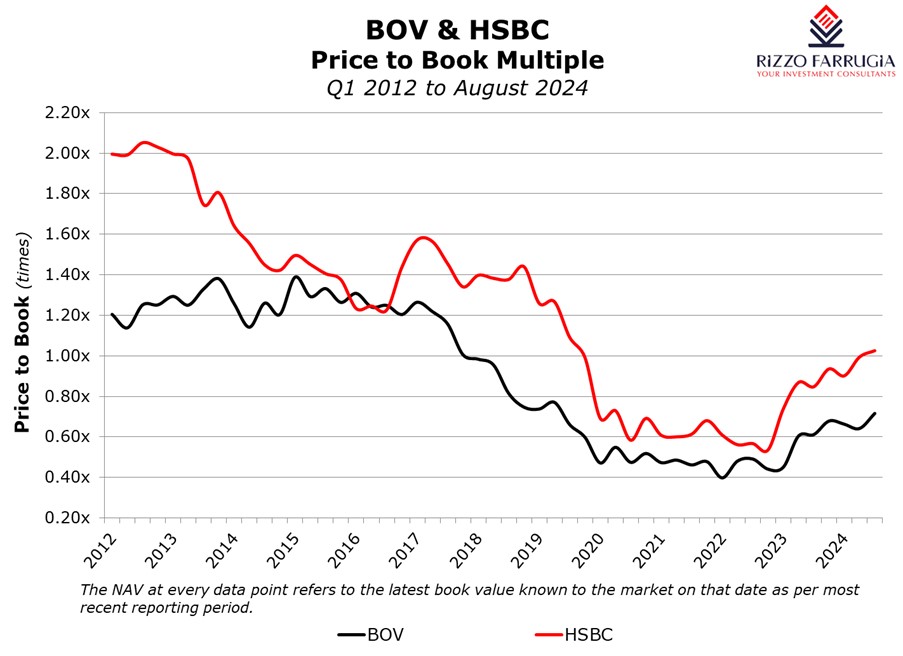

I had also remarked that an interesting analysis was the change in the price to book multiples of the two largest retail banks in Malta over the years. Essentially, while a price to book ratio of above 1 (implying a share price above the book value) was very common until 2017, this ratio dropped significantly during the historically low interest rate environment when the return on equity (ROE) of both banks fell below the 10% level similar to the trend experienced across the eurozone banking sector.

However, following the jump in profitability of several financial institutions as a result of the abrupt change in the interest rate environment in 2023, the share prices of most banks started to recover strongly with many banks in Europe now trading close to or above their book value, implying a price to book multiple of close to 1 or above 1.

In fact, the interesting aspect locally is that the price to book multiple of HSBC Malta is now slight above 1 with a share price of €1.64 and a book value of €1.598 per share as at 30 June 2024. On the other hand, although BOV’s share price has also been moving higher, the shares are still trading at a discount of circa 30% to the book value per share.

BOV’s latest financial statements as at 30 June 2024 indicate a book value per share of €2.289 compared to a share price of €1.64.

I recently came across a newsletter published by a renowned international fund manager on the concept of the price to book multiple in the banking sector. I am replicating parts of this below since it provides a clear understanding of the use of pricing multiples.

Banks are relatively straightforward to value, and a well-performing bank can also be a very good long-term investment. In looking at a bank’s balance sheet, one sees that it consists almost entirely of financial items. A bank has no factories, no production lines, no large inventories, no big capital expenditures, no large research and development expenditures, and so on. A bank’s profits are almost purely credited to its equity. This means they can grow rapidly at high ROE’s. The long-term return to an investor in bank shares (when reinvesting dividends) is approximately equal to the bank’s long-term average ROE while holding constant the price to book multiple.

Both BOV and HSBC are reporting much healthier ROE’s following the change in the interest rate environment. During the first half of 2024, HSBC Malta’s annualised ROE was of 18.3% while BOV's annualised ROE was equally strong at 15.5%.

As I explained in my article in May, generally, when banks generate a higher return on equity compared to their cost of equity, their shares should trade at a premium to their book value per share. On the other hand, when banks generate lower returns, the share price should trade at a discount to their book value per share.

Several international financial analysts often cite a general rule of thumb that the price to book multiple should exceed 1 once a bank’s ROE exceeds 10%.

Although the ROE’s of both HSBC and BOV are dependent on the interest rate environment, the sensitivity of their profitability levels to changes in interest rates has reduced over recent years following certain changes made to the composition of their balance sheet. This was particularly evident for BOV as cash and short-term funds decreased to €1.2 billion as at 30 June 2024 from over €5.2 billion in 2021 with these funds redeployed into longer-term interest-earning assets.

Given the current discrepancy in the price to book multiples of both banks (which was the case for most of the past decade), it would be interesting to gauge whether such a valuation gap will be maintained in the future as well or whether this will converge over time. Within this context, it is also instrumental to see how the growth in the book value of BOV could change once the bank implements any initiatives to optimise shareholder value including the possibility of a share buyback programme.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.