The interim reporting season

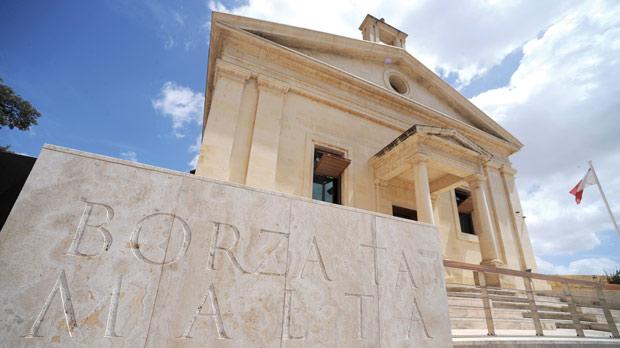

Most companies that have their equity listed on the Malta Stock Exchange have a December year-end and in accordance with the Listing Rules, their interim financial statements for the six-month period to 30 June must be published by 31 August.

The interim reporting season has therefore come to an end three weeks ago. It is not my intention to review the financial results of all the companies whose equity is listed on the Malta Stock Exchange. Instead, I believe it would be worth looking at some of the most significant share price movements and shifts in investor sentiment towards a number of local companies following the publication of their respective interim results.

Few market followers may have noted that the share price of RS2 Software plc has been the worst performer in recent months and has declined by 21.9% since 30 June. The equity is therefore in ‘correction’ territory having declined by more than 20% since its recent high. Although it is debatable whether a single factor has led to this correction, I believe it is fair to assume that the decline in profits registered during the first half of the year would have negatively impacted sentiment towards the equity.

Although revenue was stable at just over €11 million and includes the licence agreement of €1.5 million signed with a German client in the first half of the year, pre-tax profits declined by 47.9% to €3.4 million. The decline in profits was due to: (i) the unfavourable impact of foreign exchange movements, mainly GBP, as a sizeable part of their income is generated in GBP; and (ii) higher costs arising from the new offices in Philippines and Denver (US) together with a larger staff complement and an increased spend on marketing initiatives as the company is gearing up for its strong business pipeline.

However, the half-year financial report published by RS2 made several references to “strong business pipeline”, “significant potential for growth” and results “on track for the full year”. The CEO of RS2 held a meeting with financial analysts shortly after the publication of the results and mainly focused on the upcoming business pipeline. Mr Radi El Haj stated that various contract negotiations are at an advanced stage and should be concluded by the end of 2016 in both the licensing area as well as the processing business. The CEO also indicated that a number of the new clients being onboarded emanate from the US as well as Asia Pacific. This would represent a breakthrough for the company in these new geographical markets.

Another equity which ranks among the worst performers during the third quarter of the year is Medserv plc whose share price has declined by 13.4% since 30 June. Shortly before the publication of the June 2016 interim financial statements, Medserv announced that with respect to the contract awarded to its subsidiary company in Portugal earlier this year, due to unforeseen circumstances, ENI has been prevented from carrying out exploration activities as planned. Medserv had clarified that despite this delay, it continues to operate the base in Portugal and provide related services to ENI. The income that was envisaged to be generated from this exploration activity was an important part of the financial projections for 2016 and was thus a disappointing revelation which must have dented investor sentiment. Moreover, similarly to RS2, the financial performance during the first half of the year would have disappointed many investors as EBITDA dropped to €3.35 million compared to €6.56 million during the first six months of 2015 while pre-tax profits amounted to a mere €0.28 million which is substantially lower than the €4.5 million figure registered in the first six months of 2015.

The major delays were due to less rigs available for exploratory drilling offshore Libya, the lack of offshore activity in Cyprus and the delays in Portugal. The financials in the first half of 2016 were also impacted by two significant non-cash items amounting to €860,000 materialising from the METS acquisition. Medserv also convened a meeting for financial analysts to discuss the factors which impacted the performance during the first half of the year and to provide an update on its business development initiatives. Among the various areas being targeted, Medserv’s Chairman Mr Anthony Diacono made specific reference to the imminent adjudication of the tender submitted by Medserv and other service providers for works in Trinidad & Tobago as well as an upcoming tender to service international oil companies in Egypt. While news on the Trinidad tender is imminent, further progress on possible work in Egypt and other territories is expected in the months ahead. The Chairman of Medserv also remarked that the business that did not materialise during the first half of 2016 is not lost business but business that is merely postponed until 2017 and future years.

While RS2 and Medserv would have disappointed various investors leading to a downturn in their share prices, the financial performance of GO plc, on the other hand, was a positive one. The news of the improved profitability helped GO’s equity recover by more than 10% during the past three months thereby partially recouping from the setback in the share price following the revelation of the voluntary bid by Tunisie Telecom at a significant discount to the prevailing market price at the time.

The interim financial statements of GO plc included the consolidated figures of Cablenet in Cyprus following the increase in GO’s shareholding to a majority stake as from 1 January 2016. In fact, the six-month results of the GO Group were positively impacted by a €6.1 million gain arising from the acquisition of the majority stake in Cablenet. This pushed up the pre-tax profit figure by 31.3% to €17.1 million. Meanwhile, the EBITDA of the GO Group including Cablenet (of which GO only owns 51%) improved to €29.9 million during H1 2016 from €25.1 million during the first six months of 2015.

Following the takeover by Tunisie Telecom who now holds 65% of the share capital of GO plc, it would be beneficial for the market to understand how the new majority shareholder intends to pursue its strategy going forward. In recent press releases, Tunisie Telecom had indicated that the rationale for the acquisition of GO was to create a leading trans-Mediterranean telecoms platform spanning North Africa to Malta, Cyprus and Greece.

Overall, following the mixed signals from the interim reporting season, the market’s attention will now turn to ad hoc announcements from various companies especially RS2 and Medserv as they both prepare to onboard new clients in various new geographical areas and await the adjudication of important international tenders.

While the timing of such announcements will vary depending on contract confirmations, the next important event on the investor calendar would be in mid-November for those companies that have continued to publish updates to the market which under previous Listing Rules were referred to as Interim Directors Statements.

In May 2016, a number of companies had disclosed important information to the market via such updates including details on some key performance indicators. This was a welcome initiative which would hopefully repeat itself in the weeks ahead with companies providing information on their financial performance during the third quarter of the year and their expectations for the full-year.

The interim reporting season is an important period in the investor calendar not only for equity issuers but also for bond issuers. Following the recent article on Hal Mann Vella Group plc, further information on the performance achieved by a number of other bond issuers will be revealed in the weeks ahead in order to assist several investors who may not fully comprehend the details within financial statements.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.