All asset classes perform negatively

The turmoil across international financial markets which started off at the start of the year exacerbated further in the second quarter amid more evident and stronger signs that high inflation is far from a “temporary” or “transitory” phenomenon. Indeed, several indicators have been showing the spread of high inflation across multiple aspects of life, be it in food, energy, commodities, raw materials, machinery/equipment, shipments, and also wages.

This unexpected shock was first a reflection of the after-effects of the COVID-19 pandemic as the world economy went through a prolonged and unprecedented period of disruption. In hindsight, the massive interventions by governments and major central banks to safeguard livelihoods and shore up economies during the pandemic also had the undesired effects of contributing to significant imbalances which exerted additional burden on the factors of production and supply chains. More recently, the war in Ukraine has not only been a huge tragedy from a human aspect, but also a cause for deep political divisions with enormous economic costs for all parties concerned.

The quick transition to the current high inflationary environment has also been immensely underestimated by economic policymakers and central banks alike after several years of low or well-controlled inflation. In fact, in Europe and Japan, a recurring theme only a few years ago was the peril of subdued inflation which sometimes even verged on the brink of deflation reflecting structurally weak economic activity.

The impact of the high inflation figures across international financial markets over the past six months has been material. Understandably, fixed income securities were at the forefront of the fallout as yields spiked reflecting the decisive actions taken on board by the US Federal Reserve. In aggregate, the US central bank hiked its target range for interest rates by 150 basis points. Furthermore, from 1 June 2022, the Federal Reserve started reducing its significant holdings of Treasury, agency, and mortgage-backed securities. This quantitative tightening process is expected to intensify further in the coming months along with additional interest rate increases to above the 3% level.

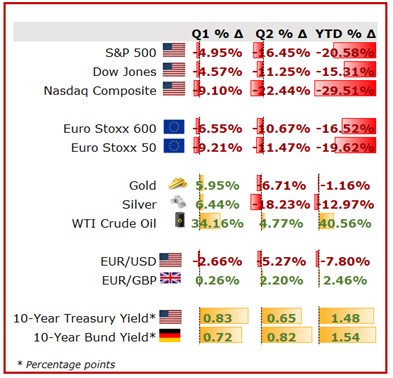

In Europe, although the European Central Bank’s response to high inflation has so far been relatively muted, prices of bonds still tumbled amid spiralling yields. In fact, the 10-year German Bund yield touch a multi-year high of almost 2% in mid-June 2022 compared to a level of minus 0.18% at the end of 2021. This naturally also had a knock-on effect on the prices of Malta Government Stocks as already articulated in our previous articles. Indeed, various MGS’s posted sharp double-digit declines, with the 2% MGS 2051 plunging by 27 percentage points to 76.14% from 103.49% at the end of 2021. Overall, the RF MGS Index shed 12.8% in the first half of 2022 with the decline intensifying in Q2 2022 (-7.8%) following a decline in the index of 5.4% in Q1 2022. In contrast, the RF Malta Corporate Bond Index eased by 1.3% in the first six months of the year. This drop is minimal when compared to the performance of other international frontier and high yield corporate bond markets.

Across international equity markets, all major indices in the US as well as Europe suffered double-digit declines in Q2 2022 except for the UK FTSE 100 (-4.6%) and the Spanish IBEX 35 (-4.1%). In particular, the tech-heavy Nasdaq Composite shed 22.4% in Q2 2022 whilst the S&P 500 and the Dow Jones Industrial Average slid by 16.5% and 11.3% respectively. Both the S&P 500 (-20.6%) and the Nasdaq Composite (-29.5%) ended H1 2022 in bear territory whilst the Euro Stoxx 50 (-19.6%) and the German DAX 30 (19.5%) only just avoided entering bear market. Meanwhile, Maltese equities proved to be somewhat resilient to the ongoing market turmoil across continued very weak activity. Although the MSE Equity Price Index slipped by 7.2% in H1 2022, it recorded a minor uplift of 1.1% in Q2 largely on the back of the strong rebound in the share price of Bank of Valletta plc following the €182.5 million settlement agreement in respect of the Deiulemar litigation.

Elsewhere, contrasting developments also took place in the prices of the main commodities such as gold (which is widely regarded as one of the safest havens), silver and oil. Although the prices of gold and silver drifted by a minimal 1.2% and 3% in H1 2022, it is pertinent to point out that gold declined by 6.7% in Q2 whilst silver tumbled by 18.2% during the same period. On the other hand, the price of oil advanced by over 40% in H1 2022 but most of this upsurge (+33%) took place in Q1 2022.

The downturn across all asset classes in recent months is another timely reminder of the importance for investors to maintain long term objectives when building investment portfolios. Although many market commentators and analysts expect the coming months to continue to be highly uncertain and turbulent, on the other hand history has repeatedly showed that whilst timing the market is virtually impossible, it is during such volatile times that the best opportunities emerge.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.