All asset classes perform strongly

In last week’s article, I provided information on the performance of the Maltese equity market during the first six months of 2019. Notwithstanding the decline in the share prices of the two large banks which greatly impacted the performance of the overall benchmark index, the MSE Equity Price Index advanced by 6.6% during the past six months as various equities posted some strong double-digit gains.

The Malta Government Stock market also performed positively during the first half of 2019 as most of the long-term bonds rallied. In fact, the RF MGS Index added 4.31% in the first six months of this year, representing the sharpest uplift in H1 since the start of the compilation of the index at the end 2008. On the other hand, the RF Malta Corporate Bond Index eased by 0.21% during the first half of 2019, thus resulting in overall wider credit spreads between local corporate bonds and the corresponding benchmark MGS.

The Maltese equity and sovereign bond markets were not the only capital markets to perform positively during the first six months of 2019. On the contrary, it has been an extraordinary period for all asset classes over the past 6 months with strong gains across international equity markets, bond markets, oil as well as commodities in general.

It is rather unusual for all asset classes to perform positively during the same period since rising bond prices (resulting in lower yields) are usually seen as a signal of an eventual economic slowdown. Bonds are normally considered as a safe haven in times of economic turmoil while shares usually produce superior returns over bonds when the economic performance improves.

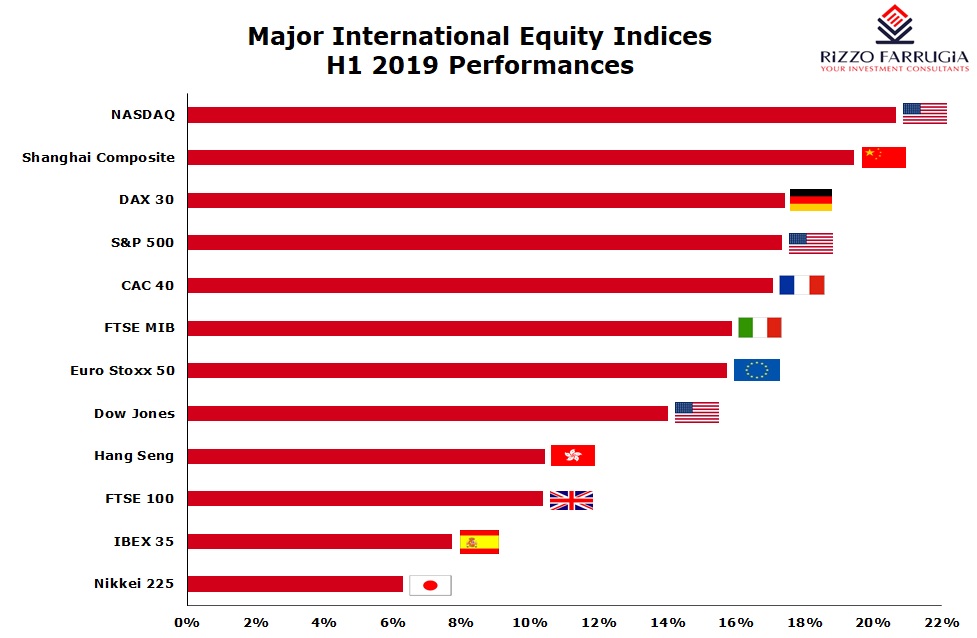

Most of the major international equity markets registered superior performances to the 6.6% rise in the Maltese equity market. The S&P 500 in the US rallied by 17.3% since the start of the year marking the benchmark’s strongest first-half performance since 1997. Also in the US, the Dow Jones Industrial Average index advanced by 14% (on the back of the 7.2% surge in June which was the sharpest rally in June since 1938) while Nasdaq registered a superior performance with a rise of 20.7%.

Across Europe, the German DAX and the French CAC 40 both registered gains of just over 17%, the Italian FTSE MIB added 15.9% while Spain’s IBEX was the under-performer with a rise of only 7.7%. Meanwhile, despite the protracted political uncertainty related to Brexit, the UK’s FTSE 100 still advanced by 10.4%.

Among the 30 companies comprising the Dow Jones Industrial Average index, Microsoft (+33%), VISA Inc (+32%) and American Express (+31%) were the strongest performers while Walgreens Boots Alliance Inc. shed 19% during the first half of 2019. Across the Nasdaq-100 index, the e-commerce company MercadoLibre Inc saw its share price rally by 109% followed by Advanced Micro Devices Inc at +65% while Tesla was the worst performer with a decline of 33%. The FANG tech stocks were back in favour again following the sharp downturn during the last quarter of 2018. The share price of Facebook surged by 44%, Netflix soared more than 38% and Amazon climbed by 27%.

The vegan company Beyond Meat launched its Initial Public Offering in May and within the space of a few weeks the share price multiplied by over 500%.

The share price performance of some Greek banks was among the most surprising developments of the first half of 2019. Greece’s largest lender Piraeus Bank saw a share price rally of 250% and the smaller outfit Attica Bank registered a gain of 343%. These extraordinary performances helped to rank Athens among Europe’s strongest performers this year.

Few investors or financial analysts would have predicted such a strong start to the year for global equity markets following the sharp downturn experienced during the last quarter of 2018 brought about by the prospect of a trade war between the two largest economies – namely the US and China – as well as the drive by the US Federal Reserve to continue raising interest rates.

So what brought about such a sudden change in sentiment? One of the main factors that contributed to this was the change in direction by the US Federal Reserve which now seems to be inclined to cut interest rates for the first time in several years after a series of interest rate hikes that began towards the end of 2015.

At the start of 2019, the consensus view was that the Federal Reserve would raise rates twice by the end of the year but the forecast quickly changed. After the March meeting of the Federal Reserve, it was expected that no rate hikes would take place after all, but then there was a complete reversal with interest rates cuts now being forecast in the months ahead after the Fed signalled in June that it was ready to “act as appropriate” to sustain the current economic expansion. Some indicators point to as many as three interest rate cuts by the Federal Reserve (including a 50-basis point reduction at the end of July) although the strong employment figures published last Friday may change this aggressive reversal. The sudden change in policy of the Federal Reserve sent the yield on the 10-year US Treasury notes down to 2.00% at the end of June (the lowest level since November 2016) from 2.69% at the end of 2018.

Another factor for the improved sentiment towards international equities was the announcement of monetary and fiscal stimulus measures in China to support the slowing economy. Nonetheless, the world’s second largest economy is still growing at a pace of more than 6% which is indeed considerable especially when compared to the much lower growth rates in other important regions across the world. In fact, a 6% growth in China’s economy is equivalent to the value of the entire Australian economy.

Other major central banks also reversed course during the first six months of 2019, with the European Central Bank now also considering restarting measures to stimulate the eurozone economy. Sovereign yields across the eurozone declined rapidly following these latest indications, with the benchmark 10-year and 20-year German bunds dropping to -0.33% and 0.05% respectively from 0.25% and 0.63% at the end of 2018. Meanwhile, the yields on French and Swedish government bonds also fell below zero in June for the first time on record.

The indication by the Federal Reserve of a possible decline in interest rates also impacted the commodities market. Gold jumped by more than 8% in June (its biggest monthly rise in three years) following the announcement of the Federal Reserve’s willingness to support the US economic expansion, and also due to heightened geopolitical tension in the Middle East. The price of gold climbed above USD1,400 an ounce for the first time since September 2013.

Moreover, the price of oil recovered by almost 25% in H1 2019 despite wide bouts of volatility from one month to the next. In fact, the price of Brent had regained the USD75 level in the second half of April before entering bear territory and moving to just below USD60 in early June. The rebound until the end of the month was truly remarkable as the price went up again by 12% to just over USD66.

The wide volatility across the equity markets over the past nine months caught many investors by surprise. Those investors who generally take a very short-term view and seek to speculate on short-term price movements would have exited many of their positions during the downturn in October which carried on until the end of 2018. However, such investors always run the risk of bad timing as opposed to medium to long-term investors who are usually rewarded for their patience. In fact, the volatility in recent months led to many financial commentators to reiterating once again that when “the herd is panicking, it is usually a great time to enter the market".

The performance during the second half of the year will be very much dependent on actions by the major central banks, geopolitical issues such as those taking shape in the Middle East, as well as any developments with respect to the trade talks between the US and China.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.