Banks’ Business Model Sustainability

The announcement by HSBC Bank Malta plc issued two weeks’ ago regarding the closure of a number of branches and the intention to launch a new voluntary retirement scheme caused quite an uproar across the media.

HSBC Malta’s CEO Mr Andrew Beane was interviewed by various sections of the press immediately following the announcement and he was very clear that these actions were necessary as part of a change in the bank’s business model. Mr Beane explained that it was purely a local strategic decision. This therefore implies that it is not based on the news across the international media earlier that week in which it was indicated that HSBC Holdings plans to reduce its global workforce by circa 10,000 employees.

Mr Beane also explained that the plan for HSBC Malta is to increase its focus on digital banking services and to modernise its branch network in response to the increased digital usage by its customer base.

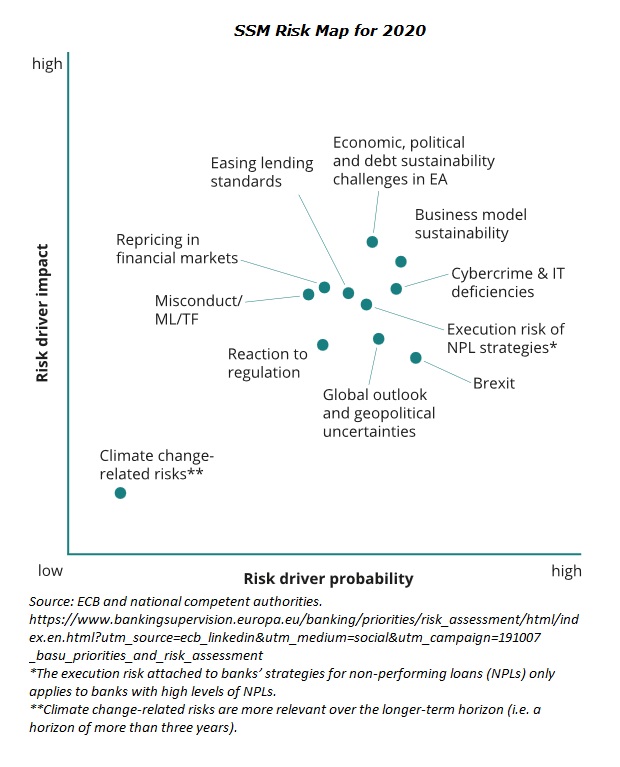

Incidentally, a few days before the HSBC Malta announcement, the European Central Bank (ECB) published its Single Supervisory Mechanism (SSM) risk map for 2020. The SSM risk map which is published annually shows the key risk drivers affecting the euro area banking system over a two to three-year horizon along the dimensions of probability and impact. The report published by the ECB clearly indicates that the “Risk Map highlights only the key risk drivers and does not provide an exhaustive list of all risks faced by supervised banks”.

Compared to the risk assessments of previous years, one can note that a ‘new’ risk was included at the top right of the heatmap (high impact – high probability) called ‘business model sustainability’.

The report states that “Compared with last year, risks related to euro area economic conditions have increased. The economic cycle is maturing and the global outlook has deteriorated, partly on account of prolonged uncertainties such as the rising threat of protectionism. This, together with the prolonged period of low interest rates that is expected to continue, adds to concerns about the subdued profitability of euro area banks and the sustainability of their business models. More intense scrutiny of money laundering cases also increases the risk of losses owing to misconduct”.

The report further explains that business model sustainability is an area of focus as significant institutions (SIs) in the euro area continue to struggle with low profitability. While a bank’s ability to generate income is hampered by the prolonged low interest rate environment, concurrently “expenses have remained stable on aggregate, as cost-saving efforts have been partly offset by factors such as rising salaries, the need for IT investments and improvements in risk management”.

The ECB report also states that “over half of banks currently generate a return on equity (ROE) which is below their estimated cost of equity. As a result, the market valuation of most listed euro area SIs remains low and price-to-book ratios have, on average, remained below one since the financial crisis”.

The ECB projects that bank profitability levels will slowly recover as from 2021. “However, there are significant downside risks associated with such a scenario: the macro-financial environment has worsened in the period since these projections were prepared, and banks may have not fully incorporated the effects of competition into their estimates, in particular in those segments where many banks expect to grow”.

The report also explains that “while digitalisation can improve cost-efficiency in the medium term and enable banks to offer new products and services, it challenges banks to rethink their business models and strategies. It also requires banks to make short-term investments in order to adjust the way they operate and interact with clients.

In conclusion, the ECB states that “banks need to continue to adjust their business models to bring them onto a sustainable footing, and the risks of falling short of sustainable profitability remain significant”.

In the light of what was stated by the ECB regarding the risks to the sustainability of a bank’s business model, one could possibly now appreciate further the background to the recent announcement by HSBC Malta. In fact, in one of the interviews given to the media, HSBC Malta’s CEO explained that the board’s responsibility is to adopt the right business model to ensure “the bank’s success in the long-term”. He also mentioned that with the renewed action by the ECB to reduce interest rates further into negative territory which are being borne by the shareholders, the bank needs to manage its costs more effectively. Mr Beane also confirmed that the bank has no intention to impose negative interest rates on its personal customers. HSBC Malta however had already introduced a ‘high balance’ fee for its corporate customers in order to partially offset the negative impact from the current interest rate environment.

At the beginning of last month, I had written an article on the recent performance of the six core domestic banks in Malta namely APS Bank plc, Bank of Valletta plc, BNF Bank plc, HSBC Bank Malta plc, Lombard Bank Malta plc and MeDirect Bank (Malta) plc. Although the table published with that article portrayed only the figures and KPI’s for the last annual financial year, when looking at a longer-term trend it was evident how all banks naturally generated a lower return on equity compared to that several years ago as a result of the ongoing very challenging environment for banks due to the ever-increasing regulation and the unfavourable interest rate scenario. Moreover, the cost to income ratios for most of the banks also increased considerably both as a result of the pressure on core income streams and the investments required to adhere to additional regulatory measures including money laundering and terrorist financing (ML/TF) apart from cybercrime and IT risk controls.

One of the priorities for banks across the eurozone is therefore to identify means to reduce the cost to income ratio to ensure that their business model remains sustainable in the long-term as a result of the ‘low for longer’ negative interest rate environment which threatens the traditional intermediation model of financial institutions (paying savers for their deposits and charging borrowers a bit more for taking their payment risk).

Last week, the international credit rating agency FitchRatings announced that it revised Bank of Valletta's outlook to ‘negative’ from ‘stable’ but it confirmed the bank's Long-Term Issuer Default Rating (IDR) at 'BBB’. In its summary of its rating action, the agency noted that “Ongoing risk and IT strengthening measures at the bank will result in a period of weaker profitability…… and medium-term recovery can be challenging in a low-interest rate environment”. This is also in line with the findings highlighted by the ECB report.

Moreover, the day after the report by FitchRatings, in an article published in the local media BOV’s CEO Mario Mallia explained in great detail the rationale behind BOV’s de-risking strategy which is seeking to address both financial and reputational risks as well as the measures being taken. He stated that “BOV is returning to its roots, shedding peripheral high-risk business that developed over the years to focus on its core competence of plain, vanilla banking”. The CEO also rightly indicated that “the BOV of the future will be a smaller but a more robust, lower risk and stable institution for the benefit of all its stakeholders”. Mr Mallia concluded by stating that “In a future article I will delve deeper into BOV’s strategy for the future, including the review of its network of distribution channels”.

BOV shareholders and the market in general therefore await this future media intervention to understand the extent of the ‘review of the bank’s distribution channels’. Incidentally, in my article last week which was published on the same day as that of the CEO of BOV, I explained once again the importance of investor relations. In my view, any decisions already taken by BOV should be immediately communicated via a Company Announcement on the MSE as is required by the Listing Rules and investors must not wait to hear about strategic decisions via a future media article.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.