Be greedy when others are fearful

The title of this week’s article is a famous quote from the legendary investor Warren Buffett which in my view is very topical given the current unprecedented circumstances.

Among his many principles behind his long-term investing strategy is to act cautiously in terms of stock market euphoria and to invest wisely when there is maximum pessimism and stock markets are falling. In fact, he lived by the notion to ‘be greedy when others are fearful and fearful when others are greedy’. At the time of the global financial crisis in 2008, Warren Buffett had invested heavily in several well-known companies (including Goldman Sachs and Dow Chemical) and over the years generated sizeable returns for Berkshire Hathaway shareholders.

Warren Buffett has been regularly criticised in recent years for holding a large pile of idle cash as he was searching for what he called an ‘elephant-sized’ acquisition. As at the end of December 2019, the financial statements indicated that his investment vehicle Berkshire Hathaway held a balance of USD128 billion in cash and short-term US Treasury Bills.

In his letters to shareholders and other media interviews over recent years, Warren Buffett repeatedly indicated that stock market valuations were too high and prohibited him from utilising the cash in the most effective way for shareholders. In the circumstances, he also resorted to an increasing amount of share buybacks of Berkshire Hathaway.

His last letter to shareholders was published on 22 February, three weeks before the World Health Organisation (WHO) declared the outbreak of the COVID-19 a pandemic. However, at the time, he stated that “anything can happen to stock prices tomorrow” and “occasionally, there will be major drops in the market, perhaps of 50% magnitude or even greater”. Despite this, he argued that the combination of positive economic growth over the long-term and the impact of compound interest “will make equities the much better long-term choice for the individual who does not use borrowed money and who can control his or her emotions”.

There have been numerous articles and newsletters published locally as well as internationally estimating the potential economic implications of the current pandemic and the possible shape of the recovery of economies and specific sectors.

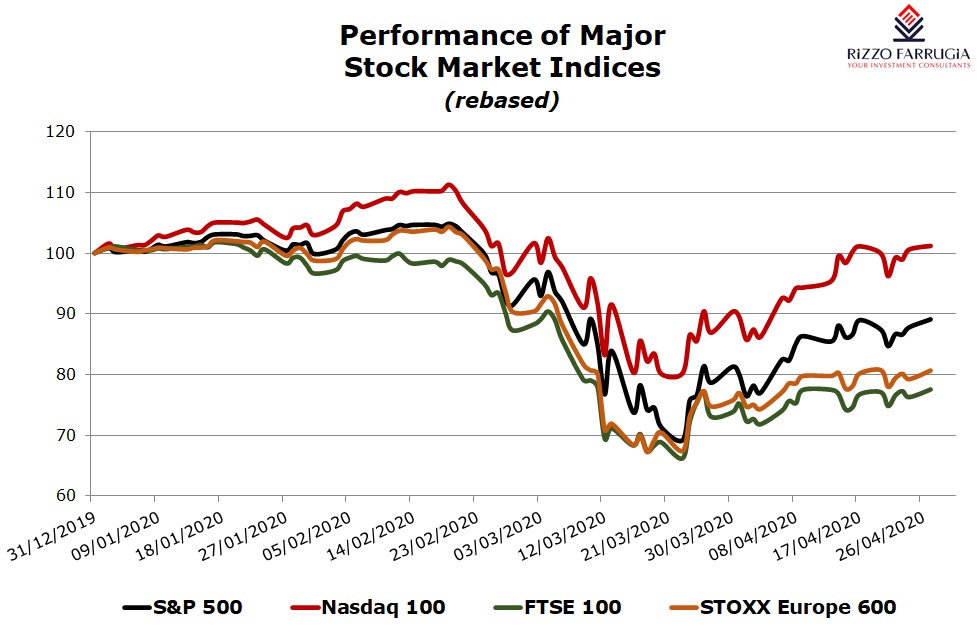

In the midst of the significant volatility that engulfed all equity markets in recent weeks, many seasoned investors would have been on the look-out for opportunities to acquire shares at what they believe to have been discounted prices caused by possibly undue pessimism on the future outlook.

Several media outlets gave prominence to the sizeable investments conducted by the sovereign wealth fund of Saudi Arabia. The USD320 billion Public Investment Fund of Saudi Arabia reportedly made a series of big investments over the past few weeks amongst which in the largest cruise operator Carnival and in some of the major oil groups such as Royal Dutch Shell, Total, Repsol, Equinor and Eni. At the time of the global financial crisis in 2008, the sovereign wealth funds of Qatar and Abu Dhabi had invested large sums in Barclays, Credit Suisse, Volkswagen, Porsche and Daimler.

It is very normal for investors to get carried away by the higher degree of negativity and assume that this subdued sentiment and uncertainty will remain unchanged into the future. However, the reality is that the peak of the growth of the virus in many parts of the world (at least of what they call the ‘first wave’) is now behind us. All economies around the world will very gradually start recovering once quarantine measures begin to be eased and this is an important factor for capital markets.

While it is easy to understand that some sectors such as transport, hospitality, entertainment and retail will be the hardest hit as a result of the economic lockdown in most parts of the world and some form of social distancing would still need to be observed until the medical field provides a vaccine, other sectors may prove to be more resilient and actually emerge as the COVID-19 ‘winners’.

Not many investors would have seen the performance of the share price of Amazon.com Inc over recent weeks. From a pre-virus high of just under USD2,200 in February 2020, the share price tanked together with the rest of the market to a low of just above USD1,600 (representing a decline of 27%) within a few weeks before staging a spectacular 48% rally to over USD2,400 within a month. While it is impossible to mention many companies due to space restrictions, another remarkable performance was that of PayPal Holdings Inc whose share price had reached a high of USD124 before plummeting by 39% as market sentiment deteriorated, but has since jumped by 46% to USD120.

In the Financial Times, there was recent mention of other COVID-19 ‘winners’ as the share prices of some software companies not only proved more resilient than the overall market, but in several cases rose to new record levels. The article quoted a former executive of a large software company who indicated that the resilience reflects “a fundamental change in the importance of software, making it more central to how businesses are run and the way workers do their jobs”. Share prices of cloud computing companies also rallied in recent weeks together with those companies which provide the technologies geared towards helping business operate virtually such as the electronic agreement company DocuSign, the identity management company Okta and the cyber security company Fortinet.

Another interesting example is that of Etsy – the online platform for buying special handcrafted goods. The company initially experienced a decrease in demand as consumers cut back on discretionary spending due to the coronavirus outbreak with the share price slumping to a near two-year low amid the wider stock market crash in March. However, after the company urged their sellers to start producing face masks made from fabrics which were recommended by the Centers for Disease Control and Prevention in the US as a good additional precaution against coronavirus, the site could hardly cope with all the traffic and the share price more than doubled in just over a month from its two-year low to a near all-time high.

Even share prices of companies within certain sectors that may continue to suffer in the near term experienced a remarkable rally from their lows a few weeks ago. One such example is BMW AG whose share price rallied by 37% from its recent low. Despite this recovery, it is still substantially below its pre-virus level.

While it is still very uncertain how long restrictive measures will need to remain in place around the world in order to ensure that health systems can cope with a possible second wave of the virus, it is often argued that recessions are the best times for investors as markets tend to overreact bringing about good long-term buying opportunities. Another legendary investor Benjamin Graham had once stated “abnormally good or abnormally bad conditions do not last forever”. This is another important lesson to keep in mind in the uncertain times we are all going through.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.