Bond focus: Manufacturing Companies

Over the past few weeks I published a series of articles on a number of companies whose bonds are listed on the Regulated Main Market of the Malta Stock Exchange. The articles provided a brief overview of the recent financial performance and forecasts of the various companies and were split according to the business sector in which they operate for investors to obtain a better understanding of how their portfolio may be exposed to certain sectors.

Hal Mann Vella Group plc and Bortex Group Finance plc can be categorised within the manufacturing sector although both companies have branched out into property development and also the hospitality industry which helped improve their financial performance more recently.

Hal Mann Vella Group plc had issued a €30 million bond in October 2014 which is due to mature in 2024. Originally, the Group was predominantly involved in the manufacturing of tiles and pre-cast elements, importation of marble, granite and natural stone. However, over more recent years, it also diversified into property development and into the leasing of its properties within the hospitality industry.

The Hal Mann Vella Group managed to drastically improve its financial performance in recent years following a revamp of its product offerings and the factory renovations undertaken in 2016 which comprised the acquisition of modern machinery and equipment. This enabled it to achieve improved factory optimisation through the overall reorganisation of the Lija factory as well as the leasing of the Hal Far factory. The overall improvement also occurred as a result of the strong momentum across the local economy. In fact, revenue from the main business segment, namely ‘manufacturing, products & contracting services’, improved from €17 million in 2017 to €19.1 million in 2019 helping overall EBITDA to reach over €5 million in each of the last two financial years. However, as a result of COVID-19, revenue from the manufacturing, products and contracting services segment is projected to decline by €5 million in 2020 to €14.1 million as the company reported that various medium to large scale third-party property development projects have slowed down or been put on hold.

Despite the sharp reduction in revenue from the core business, the Group still expects to generate an EBITDA of €5.2 million in 2020 largely on account of the improved contribution from property development activities as a result of the sale of a number of apartments held by the Group in Mgarr and Zebbiegh. Moreover, the Group is also benefiting from a stable rental income stream following the completion of the E-Pantar building in 2017 which was leased to Transport Malta. However, the leasing out to third parties of both the 66-room Mavina Hotel and the 26-room Huli Hotel for a period of 10 years and the sub-lease of a boutique hotel in Valletta known as Merchant Suites ought to have been impacted by the pandemic as well as . In the event that the property market is not unduly impacted for a long time by COVID-19, the property development segment could remain an important contributor given the projects scheduled for completion next year comprising 4 semi-detached villas in Kappara and 17 apartments in Mosta.

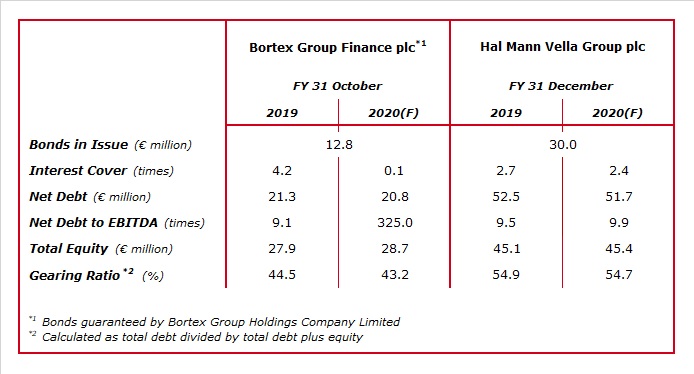

When reviewing the credit metrics of the Hal Mann Vella Group, it is worth noting that the interest cover is expected to remain above 2 times during 2020 helped by the improved contribution from property development activities. The gearing ratio is expected to remain largely unchanged at just under 55% but the net debt to EBITDA multiple is expected to remain elevated at over 9 times.

Bondholders should however be comforted by the security features attached to the bonds with a portfolio of properties having a carrying value of €51.7 million as at 31 December 2019. Bondholders have a first-ranking special hypothec over the Hal Mann factory, the showroom and adjacent land (measuring 22,300 sqm), the E-Pantar building and 50% of the Navi building (a warehouse complex) which is owned by the guarantor Sudvel Ltd and leased to third parties.

Elsewhere, Bortex Group Finance plc is a fully owned subsidiary of Bortex Group Holdings Company Limited which is the guarantor of the €12.75 million bonds issued in 2017. The Group has been principally engaged in the manufacturing and retailing of garments both locally and internationally for a long number of years and more recently also diversified into property development and hotel operations. The properties within the hospitality division are the newly-refurbished “Hotel 1926” in Sliema and the Palazzo Jean Parisot Suites in Valletta.

The most recent property development project of Bortex is the construction of the “TEN” building in Sliema comprising 18 residential apartments, 2 penthouses, 58 car spaces and commercial space at ground floor level. The company reported that works were completed in Q1 2020 and as at June 2020, 7 apartments and 10 car spaces were sold while a further 8 apartments and 17 car spaces are subject to ‘promise of sale’ agreements.

The financial performance of the core business of Bortex, namely manufacturing and retail operations, suffered in recent years as the loss in revenue from private label was not fully compensated by the increase in sales from the international roll-out of the Group’s own Gagliardi brand.

COVID-19 had an immediate impact on the apparel segment as the Group reported that its retail and manufacturing revenues came to an almost complete halt following the closure of all retail outlets in Malta and overseas, together with the factory in Tunisia. During the financial year ended 31 October 2020, the Group was expecting a drop in retail sales of approximately 46% and a decline in manufacturing sales of 21% from pre-COVID budgets. Overall revenue from the apparel segment is expected to have amounted to €14.3 million representing a decline of 18.6% when compared to FY19.

The interest coverage ratio of Bortex Group was showing an improving trend over the years as it rose from 2.9 times in FY2017 to 3.9 times in FY2018 and 4.2 times in FY2019. In view of the very low level of EBITDA which is expected to have been generated during the financial year which ended on 31 October 2020, the interest cover is expected to be marginally above zero. However, this does not take into consideration the profit of €3.4 million from the property development division reflecting the realisation of the final deed of sales of the units within the “TEN” project.

The net debt to EBITDA multiple is not a good indicator for Bortex in 2020 due to the huge impact from COVID-19 and also due to the fact that the recognition of profit from property sales takes place below the ‘EBITDA’ line item. The net debt to EBITDA however in FY2019 stood at just over 9 times. This should improve in due course as the apparel segment recovers from the pandemic and as the contribution from the Hotel 1926 regains the levels seen shortly after the recent opening of this property. In fact, the Group had projected a net debt to EBITDA multiple of 3.8 times for FY2019 but this was not achieved as a result of the weaker-than-expected performance from the core business and also due to the fact that the entire room stock of Hotel 1926 become available later than anticipated during the financial year.

In order to mitigate the deficiencies in the cash flow projections brought about by the impact of COVID-19, Bortex reported that it was granted a moratorium on the payment of interest and principal of its existing bank loans and the company also applied for financing under the MDB Guarantee scheme. Moreover, the Group decided to further delay the planned redevelopment of its Mosta outlet.

Both Hal Mann Vella Group and Bortex Group are understandably facing a difficult operating environment in their respective core business operations. As such, the property development projects being undertaken by the two companies could remain important contributors to both companies until such time as the performance of their core businesses resumes an upward trend and the hospitality industry starts to recover slowly.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.