Bond focus: Maritime Industry

In recent weeks I delved into those issuers whose bonds are listed on the Regulated Main Market of the Malta Stock Exchange operating in the hospitality industry, the property development sector and also those within the commercial property sector. It is evident that the various issuers from these sectors represent a large portion of the overall bond market and as such, given the challenges posed by COVID-19, it is important for investors to closely monitor developments across these sectors.

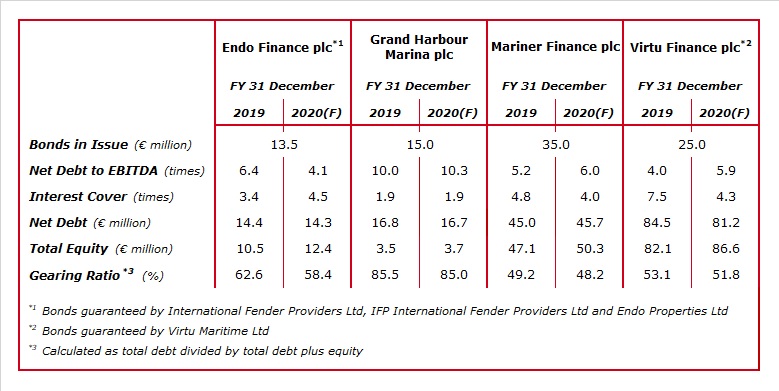

Meanwhile, the maritime sector has been growing in importance over the years and currently there are four issuers with total bond issuance of €88.5 million namely Endo Finance plc, Grand Harbour Marina plc, Mariner Finance plc and Virtu Finance plc. Most of the issuers operating within the maritime sector do not seem to be impacted in such a negative manner as those in hospitality, property development and commercial property. Nonetheless, it is still important for investors to monitor the credit metrics of these companies to gauge their overall creditworthiness. Since in most cases the level of EBITDA generation will be relatively strong, the net debt to EBITDA multiple remains an appropriate ratio to gauge a company’s ability in repaying its borrowings over the years.

Endo Finance plc issued a €13.5 million bond in Q1 2019. Endo Finance is the financing arm of Endo Ventures Limited – the parent company of the Endo Group. Through its various subsidiaries, the Endo Group is in the business of chartering commercial vessels, providing ship-to-ship services, ship management services and also property leasing. There are three guarantors to the bonds in issue (namely International Fender Providers Ltd, IFP International Fender Providers Ltd and Endo Properties Ltd) which are all subsidiaries of the parent company Endo Ventures Ltd. During 2020, revenues are expected to increase by 74.3% to €9.67 million, mainly reflecting a full year’s contribution from the Endo Breeze vessel which was acquired in May 2019, a one-off surge in revenue from IFP Malta and the acquisition of another vessel, Endo Sirocco, which was concluded in September. EBITDA is expected to amount to €3.47 million representing a 55.3% increase over the 2019 comparable figure of €2.23 million. Meanwhile, net profit is expected to contract by almost half to €1.39 million (2019: €2.25 million) given that the 2019 figure was boosted by the €2.24 million gain from the revaluation of investment property. The gearing ratio is anticipated to decrease to 58.4% while the interest cover is expected to improve to 4.5 times compared to 3.4 times in 2019. Net debt to EBITDA is anticipated to improve to 4.1 times. However, the 2020 forecasts do not take into consideration any further issuance of bonds. The company had announced on 16 July that it submitted an application to the Listing Authority requesting the admissibility to listing of €28 million bonds carrying an interest rate of 5.125%. However, no further announcements related to this planned issuance have taken place since then. Meanwhile, on 15 October the company published the Q3 financial performance of Endo Ventures Ltd which is an interesting initiative that should be replicated by all bond and equity issuers to provide regular updates to stakeholders. Between January and September 2020, the Endo Group generated revenues of €7.29 million and an EBITDA of €2.34 million which are well within the forecasts for 2020.

Grand Harbour Marina plc is expecting revenues to drop by 7.6% to €3.8 million in 2020 largely due to the disruptions brought about by the COVID-19 pandemic and EBITDA is expected to ease by 4.3% to €1.62 million. GHM is anticipating ending the year with a cash balance of €4.19 million and total borrowings are expected to remain virtually unchanged at around €20.9 million when including lease liabilities amounting to €6.17 million. The gearing ratio is anticipated to remain at the 85% level. On the other hand, given the expected drop in EBITDA, the net debt to EBITDA multiple is forecasted to deteriorate slightly to 10.3 times while the interest cover is expected to remain stable at 1.9 times. In the updated Financial Analysis Summary published in mid-August, it was explained that the project related to Phase 1 of the planned reconfiguration of the Vittoriosa Grand Harbour Marina is currently underway but the process of obtaining the necessary permits is taking longer than expected due to matters which are outside the company’s control. Meanwhile, at the time of the publication of the interim financial statements at the end of August the company explained that COVID-19 will continue to impact certain parts of its business, especially superyacht and pontoon visitors in both Malta and Turkey as well as revenues from landside activities in Turkey. However, the company again reaffirmed the position it stated in the announcement of 2 April 2020 that it has sufficient resources to meet all its payment obligations and its ability to redeem in full its current €15 million bond which matures in 2027.

Mariner Finance plc had approached the local capital market for the second time in June 2014 with a €35 million bond issue. The issuer is principally the holding as well as the finance and investment company for its main operating subsidiary SIA Baltic Container Terminal (BCT) which is engaged in the provision of port and related services in the port of Riga, Latvia over which it holds a port concession licence expiring in April 2047. Moreover, Mariner owns and operates a 3,880 sqm commercial and office building in Riga, Latvia which as at 31 December 2019 was valued at €5 million. The issuer reported a consistently strong performance over the years generating an EBITDA of over €8.5 million per annum with an interest cover of well over 4 times. The 2020 projections published in May were based on what the company claims to be a “stressed scenario” showing a decrease of 8.4% in BCT’s revenue to €15.2 million and a 29% drop in rental income to €0.4 million. Mariner is expecting its EBITDA to decline by 11.8% in 2020 to €7.6 million which will weaken the interest cover ratio to 4 times. The gearing ratio is expected to remain virtually unchanged at around 48%. Meanwhile, the net debt to EBITDA is expected to weaken to 6.0 times. The 2020 interim results published on 28 August 2020 indicate a 7.1% drop in total revenues to €8.2 million mainly due to the fact that volumes handled within the BCT terminal declined as a result of the COVID-19 pandemic.

The bonds that had been issued by Virtu Finance plc in late 2017 are guaranteed by Virtu Maritime Limited. In view of the disruptions brought about by the COVID-19 pandemic, revenues during 2020 are anticipated to drop by 28.6% to €31 million in part compensated by the increase in charter income totalling €15 million following the extension of the lease agreement for the HSC Jean de la Valette till the end of 2020. EBITDA is expected to decline to €13.7 million compared to €21.3 million in the 2019 financial year and the guarantor expects to end the 2020 financial year with a cash balance of €11.8 million. Total borrowings (including lease liabilities forecasted at €7.77 million) are expected to remain virtually unchanged at €93 million while net debt is anticipated to drop by 3.9% to €81.2 million. The gearing ratio is anticipated to improve to 51.8% while the net debt to EBITDA multiple is forecasted to deteriorate to 5.9 times compared to 4.0 times for the 2019 financial year. Likewise, the interest cover is expected to drop to 4.3 times compared to 7.5 times in 2019. It will be interesting to monitor how Virtu will fare during the 2021 financial year following the decision to commence a second route to Sicily and deploy the HSC Jean de la Valette between Valletta, Augusta and Catania commencing during the first quarter of 2021. The company had stated in a press release that this new service is being launched in response to requirements of Maltese and Sicilian importers and exporters and would complement the existing Malta-Sicily route (between Valletta and Pozzallo) operated by their newest vessel – HSC Saint John Paul II. Moreover, following a foreign media report published a few weeks ago, it is being rumoured that another competing fast-ferry service may be launched in 2021 operating between Malta and Sicily.

The increased bond issuance by companies within the maritime sector over recent years is a positive development since it provided investors with an opportunity to diversify their bond portfolios away from the concentration towards companies within the hospitality industry, the property development sector and those within the commercial property sector. Hopefully other issuers from within the maritime industry will also seek to utilise the capital market in the future for their financing requirements.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.