Bond focus: Property Development Companies

In last week’s article, I wrote about the hospitality sector with specific emphasis on the extent of leverage of the six hotel companies whose bonds are listed on the Regulated Main Market of the Malta Stock Exchange.

Property development companies generally have higher leverage ratios than companies in other sectors since they take on debt to finance their development pipeline and seek to pay it down once the property/ies are sold upon completion. Moreover, the financial performance of property development companies is generally very volatile from one year to the next since the recognition of revenue is dependent on the timing of the final deed of sale of any properties. As such, one can often observe that a company of this nature registers a very high revenue and profit figure in one year when a large amount of units are delivered to their owners, followed by weaker performances in future years until a subsequent phase of the development is completed. The interest cover is therefore not a reliable financial metric to gauge the strength and creditworthiness of such companies.

As such, for property development companies, the extent of leverage by comparing the overall debt taken on, compared to the level of equity, should be given added importance to other financial metrics like the interest cover since the gearing ratio could indicate the ability of a company to withstand a period of weakening sales or to take on added leverage should the property sector experience excess supply. This takes on even more importance in current circumstances as the pandemic undoubtedly resulted in a period of slow sales.

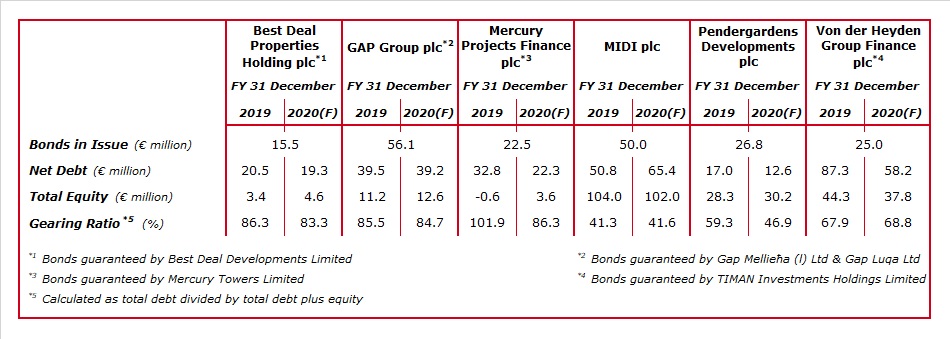

Among the various companies whose bonds are listed on the Regulated Main Market of the Malta Stock Exchange, one can identify the following six companies which are mainly focused on property development activities namely, MIDI plc, Pendergardens Developments plc, GAP Group plc, Best Deal Properties Holding plc, Von der Heyden Group Finance plc and Mercury Projects Finance plc.

MIDI plc was the first among these six companies to utilise the bond market in early 2009. Following the bond issue, the company had then conducted an equity IPO in 2010 and subsequently refinanced the original bonds through an issuance of new bonds in 2016. The company has the lowest level of gearing among the six property development companies with an estimated 41.6% as at the end of 2020 comprising total debt of €72.6 million and equity of €102 million. Naturally, this is expected to increase once additional funding will be taken to develop the long-awaited Manoel Island project assuming planning approval is obtained in due course. Although the emphyteutical deed signed with the Government of Malta specified that “the entire development shall be substantially completed by 31 March 2023”, during the recent Annual General Meeting held remotely, the company clarified in response to a question sent by shareholders that “the deadline to substantially complete the development by March 2023 is subject to extension, in terms of the provisions of the Emphyteutical Deed and “discussions have commenced with Government to extend this deadline”.

Pendergardens Developments plc had launched two secured bonds in 2014 totalling €42 million with redemption dates of 31 May 2020 and 31 July 2022. In fact, the €15 million 5.5% bonds were duly redeemed on 31 May 2020. As a result of the repayment of the €15 million in bonds, the gearing ratio is anticipated to decline to 46.9% at the end of 2020. The company is projecting to have a reserve fund of €11.6 million by the end of 2020. Apart from a few residential units and car spaces which are still available for sale, the company holds a number of commercial properties (offices and retail areas) valued at over €30 million, some of which are leased and generating rental income.

In September 2016, GAP Group plc issued a €40 million bond offering a coupon of 4.25% maturing in 2023. GAP Group plc has a number of property development projects located in various towns and villages and the bonds are secured by hypothecs over various pieces of property and land. Meanwhile, in March 2019, the company issued another bond maturing in 2022 with an interest rate of 3.65% mainly in order to encourage holders of the 4.25% bonds to exchange their bonds into the new offering. Just over €20 million were exchanged and while the original bond of 4.25% was reduced to €20 million, a total of €40 million was issued through the new bond at 3.65%. Since then, the company repurchased a number of its bonds on the secondary market totalling over €3.7 million.

The latest Financial Analysis Summary indicates that the company had a sinking fund totalling €21.3 million as at 30 June 2020. Incidentally, last week, GAP Group plc announced that it submitted an application to the Listing Authority of the Malta Financial Services Authority requesting the admissibility to listing of €21 million 3.70% secured bonds maturing between 2023 and 2025. Subject to the attainment of the necessary regulatory approval, the new bonds will be offered for subscription to existing GAP Group bondholders (namely holders of the €36.7 million 3.65% secured bonds 2022, and holders of the €19.4 million 4.25% secured bonds 2023) as well as the general public. Once the prospectus is published, it would be interesting to understand the rationale for such a new issue and whether this is due to a new property development project or whether the company suffered a delay in construction and/or a slowdown in sales of existing units due to COVID-19 and the company envisages that it requires further time to sell all its stock and repay bondholders.

Best Deal Properties Holding plc also repurchased a number of its bonds in recent months. In fact, from the original amount issued of €16 million in December 2018, the outstanding amount has been reduced to €15.5 million. The company has an equity base of only €4.6 million (estimate as at 31 December 2020) which translates into a high gearing ratio of 83.3%. The company has two of its major development projects in Zabbar and Mellieha due for completion during the second half of 2023 and these are expected to generate combined revenues of circa €48 million.

Von der Heyden Group Finance plc launched a bond issue in January 2017. This special purpose vehicle is the finance arm of the Von der Heyden Group which in turn has interests in various property projects located in several countries. The bonds are guaranteed by Timan Investments Ltd. The Group’s largest investment was in a sizeable property development project in Munich, Germany which was sold in December 2019. In fact, cash and cash equivalents are expected to rise to €25.1 million as at the end of 2020 (€6.3 million as at 31 December 2019) following the sale of the ‘Blue Tower’ within the Bavaria Towers development. The Group’s net debt will still amount to €58.2 million at the end of 2020 which also comprises a significant amount of lease liabilities. The Group is now conducting another major investment in Poznan, Poland due for completion in 2023 comprising a sizeable commercial offering.

Mercury Projects Finance plc issued two bonds totalling €22.5 million in March 2019. The bonds are guaranteed by Mercury Towers Ltd which in turn is carrying out a large mixed-use development in St. Julian’s comprising a high-rise with 279 apartments, a boutique hotel, retail and commercial activity, as well as an underlying car park. The Group reported that 86% of the units are either sold or subject to a promise of sale agreement. Permit applications have been lodged with respect to the second phase of this mixed-use development comprising a further 9-storey block consisting of a re-design of the hotel which will now include 130 rooms, further commercial spaces and other units which will be sold to third parties. The financing for this second phase is still under consideration.

In the months ahead it would be interesting to review announcements by these six companies to gauge the impact of the COVID-19 pandemic on the property development sector. It is of utmost importance that the large majority of promise of sale agreements are translated into final deeds of sales to enable these issuers to repay bondholders in due course.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.