Currency movements during COVID-19

In last week’s article I wrote about the strong performance of the major international equity indices during the second quarter of the year following the sharp and abrupt decline experienced between mid-February and 23 March.

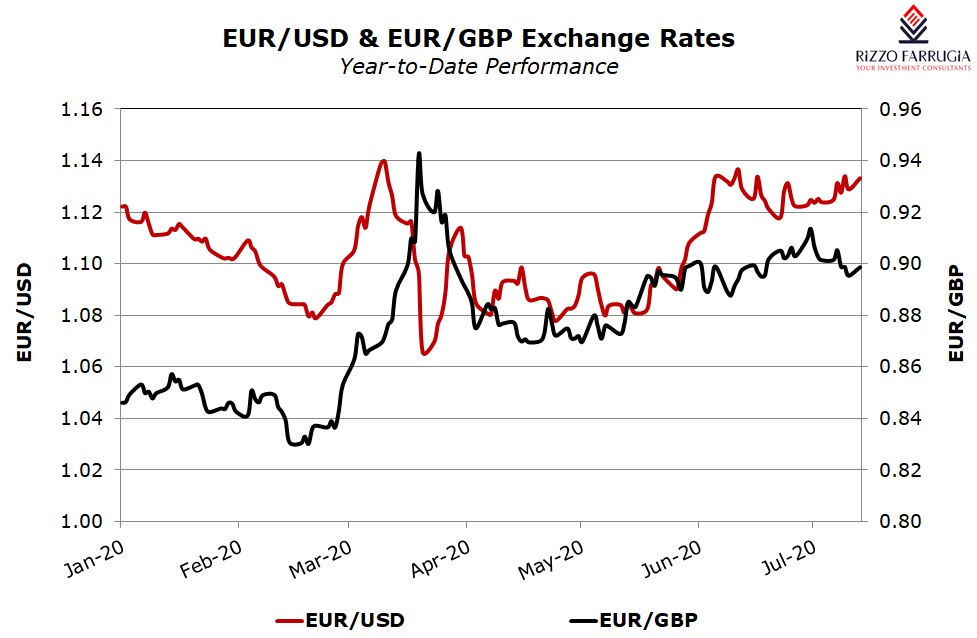

Today’s article provides an analysis of currency movements over recent months. The value of a currency is always quoted in terms of how much it translates in another currency. Therefore, movements in exchange rates are a reflection of the strength or weakness in one currency relative to another. The two main currencies on the radar screens of local investors are undoubtedly the US Dollar and the Pound Sterling. The value of the EUR against both the USD and the GBP are therefore the two currencies which are most regularly monitored since movements in these two currencies impinge on the overall performance of investment portfolios.

Exchange rates are impacted by a multitude of factors such as the state of the economy and government finances, political developments as well as interest rate and inflation expectations.

As a result of the significant shock to global economies resulting from the COVID-19 pandemic, all major central banks announced unprecedented measures to stimulate economic activity which led to a high degree of volatility in exchange rates.

In early March, the Federal Reserve surprised financial markets when it announced an emergency rate cut by slashing its benchmark interest rate by 50 basis points to between 1% and 1.25%. Only a few days later, the Federal Reserve announced yet another cut by bringing interest rates close to zero and launched a USD700 billion quantitative easing programme.

The European Central Bank launched a €750 billion pandemic emergency purchase programme (PEPP) on 18 March and in early June, it announced a larger than expected increase in the amount of asset purchases of €600 billion compared to an estimated rise of €500 billion. The ECB’s PEPP was therefore expanded to €1.35 trillion, and the central bank also indicated last month that it is extending the horizon for net purchases to at least the end of June 2021 and reinvesting the maturing principal payments from securities bought under the PEPP until at least the end of 2022.

On its part, the Bank of England (BOE) slashed interest rates twice in March to a record low of 0.1%. Furthermore, on 18 June, the Bank of England decided to continue with its existing GBP200 billion bond-buying programme targeting UK government bonds and non-financial investment-grade corporate bonds, whilst also increasing the level of purchases of UK government bonds by an additional GBP100 billion to a total stock of asset purchases of GBP745 billion amid subdued inflation forecasts.

The EUR vs USD exchange rate exhibited a high degree of volatility in recent months with the US Dollar strengthening markedly towards the third week of March to almost USD1.06 compared to a level of USD1.12 at the start of the year. The volatility was considerable when considering that only two weeks earlier, the euro stood at the USD1.14 level before the US Senate approved a historic USD 2 trillion stimulus package (the largest emergency aid package in the country’s history) on 25 March. The US Dollar weakened again to above the USD1.11 level within a few days and hovered in a relatively tight range until the end of May. The euro rallied once again since the end of May and maintained most of these gains particularly as the market digested the European Commission’s proposal for a €750 billion ‘Next Generation’ recovery fund, financed by mutual debt issuance and delivered in a combination of loans and grants to eurozone members. One of the major factors that was negatively impacting the performance of the EUR was the re-emergence of fears over a break-up of the single currency. On the other hand, however, the EUR was also being supported by the larger-than-expected increase in the ECB’s asset purchase programme by €600 billion in early June. On its part, the US Dollar was impacted by the heightened uncertainty on the US economic outlook due to the wider spread of the pandemic in the country which contrasted with the opening up of many economies across other parts of the world especially in Europe.

The EUR vs GBP was also particularly volatile in recent months. The Pound Sterling strengthened slightly to GBP0.83 towards the third week of February compared to a level of GBP0.845 at the start of the year. However, the EUR rallied significantly also against the Pound Sterling in a short period of time to a level above GBP0.94 by mid-March before easing somewhat towards the GBP0.87 level by mid-April and moving back towards the GBP0.90 in recent weeks. The significant weakness in Sterling during March was attributed to the sharp drop in interest rates by the BOE, the sizeable bond-buying programme as well as the costly relief package by the Government which led to a weakening outlook for the currency. Some analysts also opined that the UK’s exit from the EU from January 2020 made the currency more vulnerable to negative shocks.

The future trajectory of the pandemic and the extent of the economic recovery in various geographic regions are likely to be the determining factors impacting investor sentiment and currency movements in the weeks and months ahead. Moreover, those countries with higher levels of debt and whose governments pursue looser fiscal policy measures to finance the economic recovery may need even larger balance sheet expansions by their respective central banks. This additional liquidity would also likely weigh on the performance of currency markets.

The performance of the euro is undoubtedly linked to the fate of the proposed €750 billion ‘Next Generation’ recovery fund. The proposal still has to be approved by all the 27 EU member states, some of which might also require individual parliamentary approval. The ‘frugal four’ countries (the Netherlands, Austria, Sweden, Denmark) meanwhile recently sent a letter to the European Commission rejecting the proposal of giving ‘grants’ to countries and instead proposed a two-year fund that will issue loans. The approval of the recovery fund is especially important for some of the fiscally-challenged economies such as Italy, Spain and Greece which will see even greater debt and deficit burdens in the coming years due to the devastating impact of the pandemic. Until financial burden-sharing across the EU becomes a permanent concept, there will undoubtedly be periods of increased political risk leading to bouts of EUR weakness. The immediate focus is therefore on the EU’s ‘special summit’ taking place tomorrow as the 27 nations forming the euro are set to discuss the bloc’s 2021-2027 budget and the coronavirus recovery plans.

From a UK perspective, a potential extension of the Brexit transition period would make the UK partially responsible for the upcoming additional payments by the wealthier EU countries to finance the €750 billion ‘Next Generation’ recovery fund. In view of this, the UK government is even less likely to request an extension which many currency specialists believe could lead to further weakness of the Sterling against the euro since it raises the possibility of a hard Brexit. The UK Government’s finances are one of the least healthy among the G10 countries and also mainly dependent on a significant amount of external financing. As at the end of September 2019, the UK government debt to GDP ratio was around 85%. However, in view of the widening deficit which is expected to reach 13% of GDP in 2020, the UK’s debt to GDP ratio has now already exceeded the 100% level. In addition to the challenging circumstances due to the pandemic, the difficulties related to Brexit negotiations are likely to continue to weaken investor sentiment towards the Pound Sterling. Many foreign exchange analysts are therefore indicating that the GBP is increasingly susceptible to further downside risk with a particular bank recently reducing its forecast for Sterling to GBP0.92 against the EUR compared to an earlier forecast of GBP0.87. Meanwhile, another foreign currency analyst opined that without a deal between the EU and the UK governing their future relationship leading to a ‘hard Brexit’, the Pound Sterling could even drop to parity against the euro.

Meanwhile, the future direction of the EUR/USD exchange rate is very much dependent on developments across the EU with a lack of an agreement to the recovery fund likely to push the euro lower. Additionally, although the US Presidential election which is due in November 2020 is normally an important determinant to the future direction of the US Dollar, most currency analysts believe that issues surrounding COVID-19 and the extent of the economic recovery are more likely to dominate movements in the US Dollar rather than the election due to the comfortable lead of Democratic contender Joe Biden which is expected to persist until election day. There will be many important developments taking place in the months ahead in various regions around the world which are likely to lead to continued volatility across currency markets and also across other asset classes.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.