Double-digit returns from PG plc since IPO

Two weeks’ ago I published an article stating that shareholders of GO plc generated an average annual return of just over 8% from holding their shares since the company’s Initial Public Offering in June 1998. Although shareholders may expect to generate higher returns from investing in shares, this return nonetheless justifies an allocation to equities in investment portfolios for all categories of investors. Incidentally, a few days ago, a financial journalist stated that since the mid 1980’s the total returns across the DAX index in Germany also averaged 8% per annum.

Across the various equities in Malta, there are some companies that generated superior returns to those of GO plc while others unfortunately have fared much worse and are actually in negative territory since their IPO.

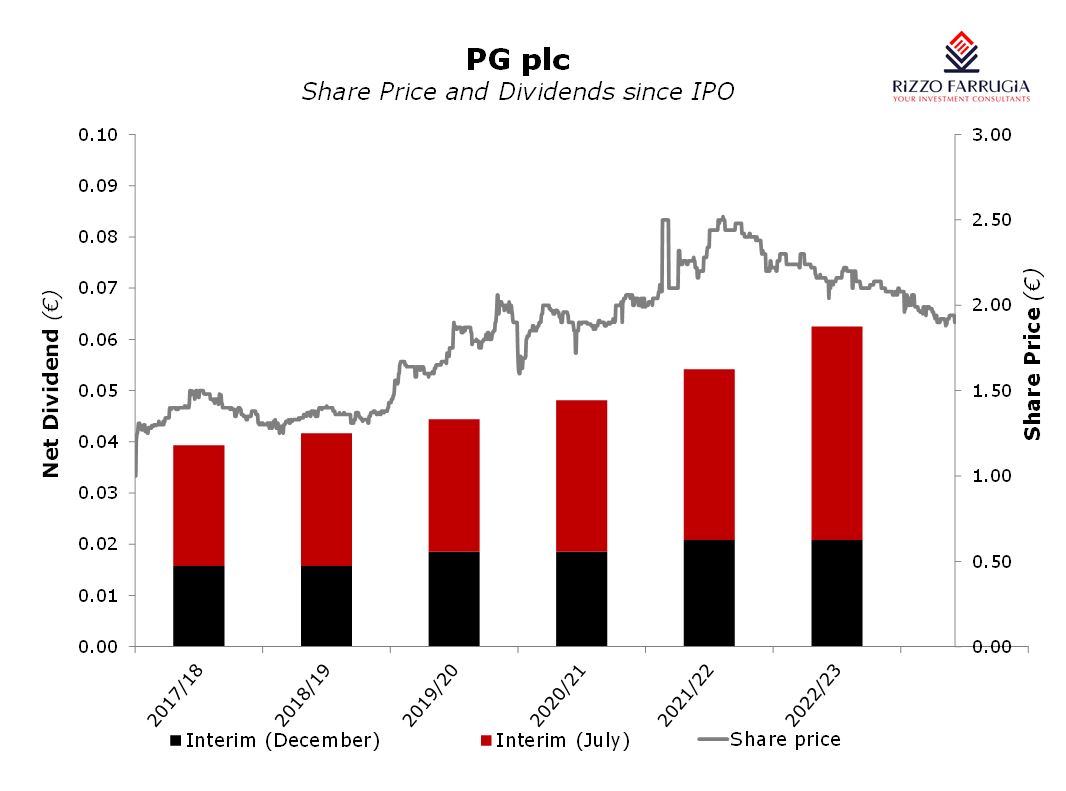

One of the most recent success stories for Maltese investors was the IPO of PG plc in the first half of 2017. The share offering was priced at €1.00 per share and since then, the company consistently distributed semi-annual dividends to shareholders even during the course of the pandemic. In total, dividends of €0.29 per share (inclusive of the dividend paid this week) would have been distributed to shareholders who have held their shares since the IPO that took place 6 years ago equating to a dividend return of 29%. Moreover, the share price has since jumped by 90% despite retreating from its all-time high of €2.52 in October 2021. As such, this equates to a total return of 119% which is equivalent to an average annual return of 20% per annum.

The growth in the company’s share price since the IPO mainly reflects the strong upturn in the profitability over the years with a return on equity consistently above 20% per annum. The company’s financial year-end is 30 April and the IPO took place towards the end of the 2016/17 financial year. At the time, total revenue amounted to €91.7 million, operating profit was of €11.4 million and profit after tax of €7.4 million.

PG’s core business is the operation of the PAVI & PAMA supermarkets coupled with the leases of retail and commercial outlets within the PAVI Shopping Complex and PAMA Shopping Village. Revenues from the supermarkets and associated retail operations consistently generated over 80% of revenues in each of the past few years. Meanwhile, PG plc is also the franchisee of Zara® and Zara Home® outlets across Malta.

Since the company has not yet published its annual financial results for the latest financial year which ended on 30 April 2023, the results of the previous financial year to 30 April 2022 will be used as a reference point for the purposes of today’s article. During the 2021/22 financial year, total revenue amounted to a record level of €147 million, operating profit was of €18.1 million and profit after tax was also at a record level of €12 million.

During the 5-year period between 2017 and 2022, total revenues jumped by 60%, operating profit by 59% and profit after tax by 62%. This is precisely the trajectory in performance that shareholders hope for when taking a minority stake in a company. This trend is almost certainly going to repeat itself in the last financial year which came to an end in April 2023 as the company reported a 14% growth in revenue during the first half of the financial year to October 2022 to over €80 million.

The strong financial performance enabled the company to not only increase its dividend distribution almost on an annual basis but also retained sufficient cash flow for further investment purposes as well as to repay its bank borrowings. In fact, it is remarkable that over the most recent years, the company managed to end up with no debt debt as it reported in October 2022 that its cash holdings exceeded the level of bank borrowings. This provides the company with a sizeable capacity to pursue other investments in the future.

In the meantime, since the IPO, the major investment undertaken by the company was in the sizeable extension and refurbishment of the Zara and Zara Home flagship store in Tower Road Sliema that took place in the 2018/19 financial year.

More recently, PG acquired a site Qormi, in close proximity of the PAVI Shopping Complex for €7 million with the initial intention to relocate the warehousing and storage facility from the ex-pasta factory site which was also acquired after the IPO.

Moreover, the company also signed an agreement for a 50-year concession over a parcel of land adjacent to the PAMA shopping complex. Subject to planning permission, it will enable the company to extend its retail space and parking facilities.

In recent years, the local equity market has been through one of the most challenging periods ever since the domestic capital market commenced operations in 1992. Investor sentiment was heavily impacted by the severe setbacks that occurred in quick succession recently, namely the political crisis, the COVID-19 pandemic, the cancellation of dividends by a number of companies, Malta’s greylisting between June 2021 and June 2022 and the Ukraine war. The consistent performance and dividend distributions by PG plc and the overall returns to PG’s shareholders since the IPO is a success story that often goes unnoticed. Hopefully, the strong post-COVID recovery currently taking place across the tourism and leisure sectors together with the bumper results anticipated from the banks will continue to help improve investor sentiment across the investing community

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.